The Thursday Report – 6.18.15 – And Now For Something Completely Thursday

Fraud Alert: Physician Compensation Arrangements May Result in Significant Liability

A Logical Guide to Selecting a Buy-Sell Agreement Arrangement – Traditional Choices are Not Always Best

Tax Court Approves the Mother of All Crummey Trusts with 60 Beneficiaries, Part II

Richard Connolly’s World – Planning for the Future

John Cleese & Eric Idle in Clearwater

Thoughtful Corner – Your Email is Evidence Mail

Humor! (or Lack Thereof!)

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Stephanie at stephanie@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

Fraud Alert: Physician Compensation Arrangements May Result in Significant Liability

The Office of Inspector General (OIG) of the U.S. Department of Health and Human Services conducted a criminal and also civil activities investigation of Medicare and other federal payors, and will often fire a shot over an industry’s bow at the time they begin implementing an initiative of investigation and possible prosecution. We will discuss the below replicated June 9, 2015 fraud alert with veteran healthcare lawyer Lester Perling on a 15 minute free webinar to air on Monday, June 22, 2015 at 5:00 p.m.

The following alert language, reproduced below verbatim, says it all!

Physicians who enter into compensation arrangements such as medical directorships must ensure that those arrangements reflect fair market value for bona fide services the physicians actually provide. Although many compensation arrangements are legitimate, a compensation arrangement may violate the anti-kickback statute if even one purpose of the arrangement is to compensate a physician for his or her past or future referrals of Federal health care program business. OIG encourages physicians to carefully consider the terms and conditions of medical directorships and other compensation arrangements before entering into them.

OIG recently reached settlements with 12 individual physicians who entered into questionable medical directorship and office staff arrangements. OIG alleged that the compensation paid to these physicians under the medical directorship arrangements constituted improper remuneration under the anti-kickback statute for a number of reasons, including that the payments took into account the physicians’ volume or value of referrals and did not reflect fair market value for the services to be performed, and because the physicians did not actually provide the services called for under the agreements.

OIG also alleged that some of the 12 physicians had entered into arrangements under which an affiliated health care entity paid the salaries of the physicians’ front office staff. Because these arrangements relieved the physicians of a financial burden they otherwise would have incurred, OIG alleged that the salaries paid under these arrangements constituted improper remuneration to the physicians. OIG determined that the physicians were an integral part of the scheme and subject to liability under the Civil Monetary Penalties Law.

Those who commit fraud involving Federal health care programs are subject to possible criminal, civil, and administrative sanctions. For more information on physician relationships, see OIG’s “Compliance Program Guidance for Individual and Small Group Physician Practices” available at http://oig.hhs.gov/authorities/docs/physician.pdf and OIG’s “A Roadmap for New Physicians: Avoiding Medicare and Medicaid Fraud and Abuse” available at http://oig.hhs.gov/compliance/physician-education/roadmap_web_version.pdf.

If you have information about physicians or other providers engaging in any of the activities described above, contact the OIG Hotline at https://forms.oig.hhs.gov/hotlineoperations/ or by phone at 1-800-447-8477 (1-800-HHS-TIPS).

For more information on the recent OIG Fraud Alerts, please join Alan Gassman and Lester Perling for a free webinar on the topic. The webinar will be held on Monday, June 22nd at 5:00 PM. Please click here to register.

A Logical Guide to Selecting a Buy-Sell Agreement Arrangement:

Traditional Choices are Not Always Best

by Alan Gassman

The following memorandum offers points to consider when choosing how to best arrange a buy-sell agreement, and summarizes why Cross Purchase and Redemption Agreements are most often, in our opinion, not “the best solution”:

Entity Redemption Arrangements

In an entity redemption arrangement, the company owns the life insurance policy and is the beneficiary thereof. Upon receipt of the life insurance proceeds, the company is to use such proceeds to buy out the deceased owner.

Some questions to consider before choosing an Entity Redemption Arrangement are as follows:

- Will there be enough money to (A) buy out the deceased owner and (B) have the deceased owner released from any and all guarantees and obligations associated with the business?

- If it is not practical to have the deceased owner released for contractual or other reasons, should the part of the life insurance proceeds that would otherwise be kept by the company as key man insurance be escrowed pending satisfaction of all releases that the deceased owner may have responsibility for?

- How can the deceased owner’s family be sure that the monies received from the life insurance policy will actually be used to satisfy contractual buy-out agreements?

- What if the company claims that, for some reason, the agreement is not enforceable or that there are claims against the deceased owner that offset what would be paid to him or her?

- What if the company has a major creditor claim against it (what if the deceased owner died in a car accident that he or she caused while driving a company vehicle, and the company is now being sued by others who died in the accident?)

- What if the company goes into bankruptcy and the family of the deceased owner becomes just another creditor in a bankruptcy proceeding?

- For income tax purposes, the remaining shareholders do not get a stepped-up basis for the stock purchased. The stock simply becomes treasury stock.

Cross-Purchase Agreements

To avoid the above potential problems, consider a cross-purchase agreement.

Each owner may own the policy or policies on the other owners. Thus, the policy proceeds should be protected from creditors of the company.

Additionally, each purchasing shareholder will get a tax basis in the purchased stock equal to the purchase price thereof. However, policy proceeds will not be protected from creditors of the surviving owner who would receive policy proceeds.

Also, contractual disputes could result in the surviving owner using the funds for other purposes while litigating over the obligation to pay and becoming insolvent.

Further, if there are more than two shareholders, then, on the death of one, the policies owned on the others would need to be transferred to rebalance between them, thus causing issues under the transfer for value rules. For example, if there are four equal shareholders, there has to be four policies, each owned one-third each by three shareholders on the fourth, and if one leaves the company, the remaining three policies have to be readjusted as to ownership. Under the transfer for value rules, this could cause the proceeds of a policy to be subject to income tax.

Hybrids of the Above

Consider a Trusteed Corporate or Cross-Purchase Agreement. Under these arrangements, the owner and beneficiary of the policy can be a trust company, a law firm, or another trusted institution as trustee for the benefit of the company in a Trusteed Redemption arrangement, or for the benefit of the other shareholder or shareholders in a Trusteed Cross Purchase arrangement. The trust agreement can require that the policy proceeds be held safely until sale and used solely for redemption or cross-purchase purposes.

This, at least, assures the surviving family that the life insurance proceeds will not be absconded with.

Generally, for tax purposes, the policy needs to be considered as owned and payable to the company in a redemption arrangement or the surviving owner or owners in a cross-purchase agreement. Could a state court or a bankruptcy court override the trust agreement where there are creditors of the entity in a redemption arrangement or creditors of the remaining shareholders in a cross-purchase arrangement?

There would be a purchase price tax basis for the other shareholders if the Trustee appropriately characterized as an agent for the other shareholders.

The Best Solution

Use of a Related Partnership to Facilitate Purchase is the best solution. Because of the above concerns, oftentimes a separate limited partnership or limited liability company is established to own and facilitate the life insurance buy-out arrangement.

This entity will be taxed as a partnership to avoid the transfer for value rules that would otherwise be problematic if there are more than two owners. Shifts of ownership in the policy would apply if there was a redemption arrangement.

The transfer for value rules do not apply when there is a reapportionment of entitlement to the proceeds of life insurance for use in a buy-sell arrangement between partners under a partnership. The partnership may have an additional investment besides the life insurance to help assure that it is recognized as a partnership for federal income tax purposes.

If the separate partnership is purchasing the interest in the entity on behalf of its surviving partners, who are the surviving owners of the operating entity, then a creditor of the company would have no claim against the policy proceeds, and a creditor of an individual “partner” in the partnership entity might have a claim against the member or partnership interest of the individual partner, but this would not permit the creditor to reach into the partnership to have a claim against the policy proceeds if appropriate charging order protection applies.

The redemption arrangement and the separate partnership arrangement described above should avoid this result.

The above strategy was blessed by the IRA in Private Letter Ruling 200747002, which discussed having term insurance held under an LLC taxed as a partnership to facilitate the buy-sell arrangement. Under this Private Letter Ruling, the manager of the LLC was a trust company that was required to use monies contributed to the LLC to purchase and maintain life insurance to fund a separate cross-purchased buy-sell agreement between three related shareholders. It would be possible to have permanent life insurance and to have special allocations of entitlement as to policy values under an LLC/partnership agreement. See The Advanced Planner, Volume 5, Issue #1, May-June 2008 at www.zelllaw.com and the ING publication entitled “Buy-Sell Planning Using Life Insurance/Buy-Sell Arrangements Using a General Partnership.”

Tax Court Approves the Mother of All Crummey Trusts with 60 Beneficiaries, Part II

by Ed Morrow and Alan Gassman

Last week, we featured Part I of a LISI newsletter by Ed Morrow and Alan Gassman regarding the case of Mikel v. Commissioner, which you can view by clicking here. Ed and Alan’s commentary on the case is featured below, and a silly poem about it (The Tax Lawyer on the Roof) can be viewed by clicking here.

COMMENT:

One of the important takeaways from the Mikel decision is: “Don’t forget the basic garden variety Crummey trust and to draft carefully!”

After clearing away the smoke created by the in terrorem clauses and religious arbitration panels, the result remains that the taxpayers were able to transfer illiquid assets into a trust and qualify for $1.44 million of tax-free gifts (this would translate to $1.68 million in 2015 with the exclusion now adjusted to $14,000 per donor per donee). Assuming the taxpayers remain New York residents, these tax-free gifts may save the family not only 40% federal estate tax but also the 16% New York estate tax.

The Crummey power beneficiaries included minors and spouses of family members as well. The IRS conceded more than 40 years ago that minors could have a present interest if there was no impediment to appointment of a guardian to make the withdrawal, in Rev. Rul. 73-405, so this was not an issue. We can also assume that the spouses had not only withdrawal powers but also distribution rights so that they were legitimate beneficiaries of the trust having a business reason to not exercise their withdrawal rights. There was no discussion as to whether such spouses would continue or be removed as beneficiaries of the trust in the event of a divorce (aka “floating spouse provisions”), which might have also been a logical line of IRS attack.

Should practitioners use forfeiture and in terrorem clauses for Crummey trusts? To interpret the above in terrorem clause, the Tax Court resorted to a canon of construction known as noscitur a sociis, a Latin phrase meaning “it is known by its associates.” Any time a court resorts to obscure Latin canons to rule on a case, there is probably an opportunity to draft a clearer trust! Attorneys should draft any such clause to make it crystal clear that any forfeiture and/or in terrorem clause does not apply to impair the withdrawal right.

However, a narrowly crafted in terrorem and forfeiture clause can be acceptable in Crummey trusts so long as the demand right is not impaired. For instance, a practitioner may want any hanging power or other mandatory right aside from a current Crummey power to be eliminated in the event of a creditor attack. While this may cause a minor gift tax event in the event of a hanging power, this may be the lesser of two evils compared to the corpus being seized by a creditor. Forfeiture clauses were recently upheld as protecting a beneficiary’s interest in trust from creditors in the recent federal district court’s reversal of the Castellano bankruptcy court decision which had initially denied protection.

Another potential issue brought up by the case, but only tangentially discussed in the third footnote, is the effect of the trustee’s discretionary ability to exclude beneficiaries from any withdrawal rights that stem from future contributions by the settlors. The IRS and the Tax Court agreed that this provision did not apply to the contributions in 2007 that initially funded the trust, so the issue was not relevant to decide the case. However, practitioners should be extremely careful about using such a clause. Have the Mikels made contributions in 2008-2015 to this trust to which that clause may apply? If so, and the trustee can, in his discretion, exclude beneficiaries from a withdrawal right, there may not be a present interest. Ultimately, it depends on the exact wording of the clause – the entire provision was not included in the case. However, the general idea may be dangerous if not carefully considered.

Such a clause is completely different from giving such a power to the settlors to decide future withdrawal rights via deed of gift, but it could probably be drafted to ensure a present interest. Let’s compare the settlor and trustee Crummey gatekeeper varieties and contrast with a concrete example. Let’s say the Mikels decided to make another $560,000 gift to the trust in 2015. They really don’t want to give sixty beneficiaries the withdrawal right. They only need to do so for twenty ($14,000 x 2 x 20 = $560,000), assuming no other gifts.

Now assume that some of the beneficiaries have creditors, marital strife, financial aid or special needs issues. If the trustee can choose the lucky twenty beneficiaries AFTER the gift is made, whether before notice or not, then no beneficiary has a present interest at the time of gift, the withdrawal right would only vest when the trustee chooses. This may be effective to create a withdrawal right but not to retroactively create a present interest. By contrast, if the trustee chooses beneficiaries eligible for the withdrawal right before or at the time of gift, each Crummey beneficiary’s withdrawal right would exist at the time of gift.

Although there is no case or ruling on this point, practitioners may even want to examine their state decanting statute that might enable the trustee to effectively accomplish the same result as above if not effectively curbed. While most decanting statutes, such as Florida’s or Ohio’s, would prohibit the trustee from eliminating a vested withdrawal right, that is not necessarily true of all decanting statutes. If the trustee can unilaterally revoke the right, the IRS may have a better argument that the power is illusory.

While it is clear that the withdrawal right should commence at the time of gift, attorneys differ on when the withdrawal right should lapse. Should the lapse occur within a reasonable time after the gift, or not until a reasonable time after notice, which may be quite some time later. In the Mikel case, notice was sent four months later. In Turner Est. v. Comr. (T.C. Memo 2011-209 (2011)), the Tax Court found that it is the existence of the legal withdrawal power itself, and not the fact that the beneficiary had notice of it, that permits the power to qualify for the annual exclusion.

The court in Turner also found that the estate need not provide beneficiaries notice of their withdrawal powers; concluding, “the fact that some or even all of the beneficiaries may not have known that they had the right to demand withdrawals from the trust does not affect their legal right to do so.” This same conclusion was echoed in a footnote in the Cristofani case (Estate of Cristofani v. Commissioner, 97 T.C. 74 (1991), and was similar to the rationale in original Crummey case, in which the beneficiaries probably did not have notice.

So why bother with any notice? The Turner opinion is in direct contrast to Rev. Rul. 81-7, 1981-1 C.B. 474, where the IRS opined that a beneficiary must be given notice of any withdrawal right in order for the gift to be considered a present interest.

To follow Rev. Rul. 81-7, therefore, any lapse should be tied to notice. However, this may be overly conservative in light of the case law and could lead to other asset protection concerns – if a beneficiary is sued and attacked by creditors, can he/she adequately prove receipt of prior notices and the subsequent lapses? Similarly, when the beneficiary dies, the uncertain lapse may cause greater estate inclusion. Thus, perhaps the best approach may be to require that the notice be given, but to have the withdrawal power lapse within the earlier of 15 days after notice or a reasonable time after the gift, which may be longer, such as 2-6 months. This would allow a timely notice to accelerate the lapse or provide some protection in the event notice is inadvertently not given. Obviously, this is subject to the necessity of having hanging powers when used as a part of generation skipping trust and associated planning. A period no longer than sixty days from the gift would be recommended if a spouse is a Crummey beneficiary and GST will be allocated to avoid the Estate Tax Inclusion Period (ETIP).[1]

Could this case be the straw that breaks the camel’s back for million-dollar Crummey power trusts? The IRS has disliked the Crummey case and its ever more expansive progeny, such as Cristofani and Kohlsaat, for decades. In the 2015 Greenbook, the Obama Administration has heard their pleas and argued for passage of a new provision that would greatly simplify, but undercut, the use of such provisions.

Under the new proposal, the annual exclusion gift would be expanded and increased to $50,000/yr. – and the “present interest” requirement currently in §2503(b) would be eliminated. This would be a boon to small families, greatly simplifying trust administration and compliance – Crummey powers would no longer be needed. Moreover, disputes as to whether a closely held business constitutes a present interest, as litigated in the Hackl, Fisher, and Price cases, would also go away. To quote the Greenbook, “the cost to taxpayers of complying with the Crummey rules is significant, as is the cost to Internal Revenue Service (IRS) and enforcing the rules.” However, the new and improved annual exclusion would be a total annual cap of $50,000 per donor – not per donee. For a family like the Mikels, this would mean reducing the annual exclusion benefit from $1.68 million per year to only $100,000 per year.

Another reason the Administration may see this case as ammunition for change is the less obvious loophole that Crummey and its progeny create to avoid income taxes. For instance, even if the Mikels had a non-taxable estate, they can transfer $1.68 million (and increasing) in property to trusts, gift tax free, and grant older beneficiaries, or themselves (with limitations of reciprocal trusts, completed gift and other issues), powers that would cause selective estate inclusion upon any beneficiaries’ death up to the maximum amount that would not cause estate taxes. This allows a step-up in basis upon any power holder’s death, including any older power holders, which is not generally hampered by the same issues that may constrain a JEST, Estate, or Community Property Trust.

******************************************

[1] Treas. Reg. § 26.2632-1 (c)(2)(ii)(B).

Richard Connolly’s World

Planning for the Future

Insurance advisor Richard Connolly of Ward & Connolly in Columbus, Ohio often shares with us pertinent articles found in well-known publications such as The Wall Street Journal, Barron’s, and The New York Times. Each week, we will feature some of Richard’s recommendations with a link to the articles.

This week, the first article of interest is “Why Estate Planning for a Distant Future Requires Flexibility” by Anna Prior. This article was featured in The Wall Street Journal on May 4, 2015.

Richard’s description is as follows:

The very wealthy often expect their family fortune to last for generations. The challenge these days, when the pace of change seems to be ramping up, is getting them to plan that far ahead.

Financial advisers and estate planning professionals say many of their clients feel uncertain about the kind of world their heirs will inhabit, what with advances in technology, political and economic upheaval, and even fast-evolving views of what constitutes a family.

These concerns can be addressed by emphasizing flexibility and employing a variety of estate planning techniques to make sure that a multigenerational trust – and a family’s financial legacy – isn’t too rigid, advisers say.

Please click here to read this article in its entirety.

The second article of interest this week is entitled “Tips for the Future Care of Disabled Family Members” by Tara Siegel Bernard. This article was featured in The New York Times on March 27, 2015.

Richard’s description is as follows:

Planning for family members with special needs can be overwhelming, particularly when so many decisions may have lifelong consequences. Beyond figuring out the intricacies of government programs, parents fret over guardianships, how governmental services may erode, and what legal documents they need.

And soon, there will be a new savings account to consider, known as a 529A or ABLE account, which will permit people with disabilities to keep more money in their own names without losing means-tested benefits.

This article provides a few tips for families beginning to plan for individuals with special needs.

Please click here to read this article in its entirety.

John Cleese & Eric Idle in Clearwater

John Cleese and Eric Idle of Monty Python fame are bringing their show to Clearwater! This is a production not to be missed! If you are not familiar with the work of John Cleese and Eric Idle, check out Spamalot and Fawlty Towers.

John Cleese & Eric Idle: Together Again At Last…For the Very First Time will be performed on October 14 and October 15 at Ruth Eckerd Hall. REH’s description of the show is as follows:

In Together Again At Last…For the Very First Time, Cleese and Idle will blend scripted and improvised bits with storytelling, musical numbers, exclusive footage, aquatic juggling, and an extended audience Q&A to craft a unique comedic experience with every performance. No two shows will be quite the same, thus ensuring that every audience feels like they’re seeing the show for the very first time. And now you know why the show is called that, don’t you?

As founding members of Monty Python, Cleese and Idle are unarguably among the godfathers of modern comedy, helping to pioneer an irreverent, absurdist sensibility that is emulated by comics around the world. As individuals, they have written, performed, and produced some of the most beloved and critically-acclaimed shows of all time, including Spamalot, A Fish Called Wanda, Fawlty Towers, and The Rutles.

Tickets to Together Again At Last…For the Very First Time go on sale to the public on Friday, June 19, 2015 at 10:00 AM. Please click here to purchase tickets or for more information about the show.

Thoughtful Corner

Your Email is Evidence Mail

Miami lawyer and law professor Denis Kleinfeld coined the term “evidence mail” to emphasize that emails can and will often reveal problematic messages and communications in litigation.

Even emails that you send your clients will be discoverable if the client forwards them to non-privileged parties or if the client permits the emails to be disclosed. These emails may paint you in a very negative tone from the standpoint of typographical errors, poor grammar, snappiness, or reading something the wrong way.

A client has the right to request their client file, and if you have put something flippant about the client in an email to another team member, will the client see this email, and will it be held against you?

Lawyers and CPAs are covered under the lawyer/client privilege, as are experts who are retained under a “Kovol” confidentiality letter or agreement. Even arm’s-length parties engaged in a transaction or negotiations may enter into a joint defense agreement to enable their communications through lawyers and other professionals to remain confidential under the attorney/client privilege. But what about when a tax lawyer or CPA writes a letter to a financial planner describing what the financial plan is and what possible potential tax issues might arise?

The IRS will certainly want to see any correspondence or emails that express concerns about how a certain transaction or arrangement will be taxed, and if those would be admissible to be seen by an IRS appeals officer or a Court of Claims or a federal district court judge overseeing a tax controversy, major damage may be done to a client’s case.

The law on whether communications with a financial planner will be privileged is a bit murky, and taxpayers have been successful in the past in convincing IRS auditors that such communications are privileged, but the law is not very clear on this, so care needs to be exercised.

On the other hand, how can you appropriately use the team approach and make sure everyone is on the same page if you are not able to write a letter or email confirming what has been discussed in meetings or otherwise?

One way to handle this is to have a meeting, discuss it orally, and then provide a memorandum which reviews what was said after everyone who was at the meeting agrees to as being accurate.

Humor! (or Lack Thereof!)

Sign Saying of the Week

***********************

Marcia Gassman has survived 34 years of marriage to a tax lawyer!

Her advice to other spouses is that in order to survive you must do the following:

Laugh a lot!

Drink a lot!

Become a cartoon character!

The Thursday Report thanks Marcia for her incredible tolerance and for not leaving Alan to become half-owner of the Thursday Report or the owner of an every other Thursday Report. Their inability to divide this asset has kept them together for the last two years.

***********************

IN THE NEWS

by Ron Ross

Avocados Strive for World Domination

aka The Story of Avacad-O

Until recently, scientists were confident that they had confined the avocado to California. In the past few years, however, avocados began appearing in the east, first camouflaged in salads, then in puree form next to the nachos, the salsa, and that dip pretending to be cheese.

It had been assumed that avocado and bacon could not exist in proximity to one another, much like matter and anti-matter, but this combination has now been found in sandwiches around the country, with worrying implications for the future of digestion.

Public Health officials maintain that the fear of avocados is overblown, despite the fact that guacamole, the evil offspring of avocado, looks exactly like the creeping green slime that science fiction movies always warned us about. Further, they say our unreasonable fear reminds them of the hysteria that was associated with the “killer bee” scare of the 1970s. They point out that “killer bees” came from Mexico, the original home of the avocado, and are we prejudiced or something?

These officials insist that everything is fine as long as we completely destroy the black thing inside of the avocado and under no circumstances keep it and allow something to grow out of it.

Upcoming Seminars and Webinars

LIVE WEBINAR:

Lester Perling and Alan Gassman will be presenting a free, live, 15-minutes webinar on THE OIG’S WARNING SHOT ABOUT PHYSICIAN COMPENSATION AND MEDICAL DIRECTORSHIPS.

Date: Monday, June 22, 2015 | 5:00 p.m. (15 minutes)

Location: Online webinar

Additional Information: To register for the webinar, please click here.

********************************************************

LIVE BLOOMBERG BNA WEBINAR:

Alan Gassman, Christopher Denicolo, Jerome Hesch, and Stephen Breitstone will present a Bloomberg BNA Webinar on CREATIVE TAX PLANNING FOR REAL ESTATE TRANSACTIONS AND INVESTORS: A PRACTICAL GUIDE FOR REAL ESTATE AND TAX ADVISORS AND THEIR CLIENTS.

Date: Tuesday, June 23, 2015

Location: Online webinar

Additional Information: To register for this webinar, please click here. For more information, please email agassman@gassmanpa.com.

********************************************************

LIVE WEBINAR:

Alan Gassman and noted trust and estate litigator, LL.M in estate planning, and blog master Juan Antunez, J.D., LL.M. will present a free 30-minute webinar on HOW AND WHEN TO USE ARBITRATION CLAUSES FOR TRUSTS AND WILLS.

Don’t miss Juan’s wonderful blog site entitled Florida Probate & Trust Litigation Blog, which can be accessed by clicking here, and the many very useful articles thereon.

Date: Thursday, June 25, 2015 | 12:30 PM

Location: Online webinar

Additional Information: To register for this webinar, please click here.

**********************************************************

LIVE WEBINAR:

Alan Gassman and Lester Perling will present a live, free, 30-minute webinar on FINANCIAL RELATIONSHIPS WITH PATIENTS, CO-PAYMENTS, GIFTS, AND GRAFT – HOW TO STAY OUT OF TROUBLE UNDER FLORIDA AND FEDERAL LAW.

This is an essential guide for medical practices and those who advise them. There will be two opportunities to attend this presentation.

Date: Tuesday, July 7, 2015 | 12:30 PM – 1:00 PM and 5:00 PM – 5:30 PM

Location: Online webinar

Additional Information: To register for the 12:30 webinar, please click here. To register for the 5:00 webinar, please click here. For additional information, please email Alan Gassman at agassman@gassmanpa.com.

***********************************************

LIVE FLORIDA INSTITUTE OF CPAs (FICPA) WEBINAR:

Alan Gassman will present a webinar on the topic of WHAT FLORIDA CPAS NEED TO KNOW ABOUT ASSET PROTECTION for the Florida Institute of CPAs.

More information about this webinar will be forthcoming. Please stay tuned!

Date: Thursday, July 9, 2015 | 9:30 AM – 10:30 AM

Location: Online webinar

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com. To register, please contact Thelma Givens at givenst@ficpa.org.

**************************************************

LIVE ORLANDO PRESENTATION:

ORLANDO BUSINESS AND PROFESSIONAL PRACTICE OWNER SYMPOSIUM

Alan S. Gassman, business coach and author David Finkel, and others will present a two-day conference for high-net-worth business and professional practice owners sponsored by Maui Mastermind®.

Alan’s topics will include BASIC AND ADVANCED PLANNING TECHNIQUES FOR THE PROTECTION OF WEALTH, THE 10 BIGGEST MISTAKES THAT BUSINESS OWNERS AND PROFESSIONALS MAKE, and ESTATE TAX AVOIDANCE TECHNIQUES FOR BUSINESS OWNERS AND PROFESSIONALS.

Other topics include A Proven Map to Grow Your Business and Get Your Life Back, Building Wealth Outside of Your Company, Tax Reduction Strategies, and Understanding How Investments Work and What They Cost.

Interested individuals can contact agassman@gassmanpa.com or David Finkel at david@mauimastermind.com.

Date: July 30th and 31st, 2015

Location: Hyatt Regency Orlando | 9801 International Drive, Orlando, FL 32819

Additional Information: To register, please click here or email agassman@gassmanpa.com.

********************************************

LIVE WEBINAR:

Alan Gassman and Christopher Denicolo will present a live, free, 30-minute webinar on the topic of CREDITOR PROTECTION PLANNING FOR PHYSICIANS AND MEDICAL PRACTICES. There will be two opportunities to attend this presentation.

Date: Wednesday, August 12, 2015 | 12:30 PM – 1:00 PM and 5:00 PM – 5:30 PM

Location: Online webinar

Additional Information: To register for the 12:30 webinar, please click here. To register for the 5:00 webinar, please click here. For additional information, please email agassman@gassmanpa.com.

**********************************************************

LIVE BRADENTON PRESENTATION:

Alan Gassman will speak at the Coastal Orthopedics Physician Education Seminar on the topics of CREDITOR PROTECTION AND THE 10 BIGGEST MISTAKES DOCTORS CAN MAKE: WHAT THEY DIDN’T TEACH YOU IN MEDICAL SCHOOL.

This 50 minute informative talk with extensive materials will cover essential aspects and trip-ups that doctors often encounter in the area of personal and practice entity asset protection. It will also discuss tax and investment planning, advisor selection, health law, compliance, and other areas of interest for physicians.

Each attendee will receive a complimentary copy of Mr. Gassman’s book, Creditor Protection for Florida Physicians and other valuable materials.

Coastal Orthopedics, Sports Medicine, and Pain Management is a comprehensive orthopedic practice which has been taking care of patients in Manatee and Sarasota Counties for 40 years. They have sub-specialized, fellowship-trained physicians as well as in-house diagnostics, therapy, and an outpatient surgery center to provide comprehensive, efficient orthopedic care.

Date: Thursday, August 13, 2015 | 6:00 PM

Location: Coastal Orthopedics and Sports Medicine | 6015 Pointe West Boulevard, Bradenton, FL, 34209

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE WEBINAR:

Alan Gassman and Lester Perling will present a live, free, 30-minute webinar on the topic of MEDICAL LAW UPDATE – FEDERAL AND FLORIDA DEVELOPMENTS THAT MEDICAL PRACTICES AND ADVISORS NEED TO BE AWARE OF. There will be two opportunities to attend this presentation.

Date: Tuesday, August 18, 2015 | 12:30 PM – 1:00 PM and 5:00 PM – 5:30 PM

Location: Live webinar

Additional Information: To register for the 12:30 webinar, please click here. To register for the 5:00 webinar, please click here. For more information, please email Alan Gassman at agassman@gassmanpa.com.

***********************************************************

LIVE AVE MARIA SCHOOL OF LAW PROFESSIONAL ACCELERATION WORKSHOP:

Alan Gassman will present a full day workshop for third year law students, alumni, and professionals at Ave Maria School of Law. This program is designed for individuals who wish to enhance their practice and personal lives.

Cost of attendance is $35.00. If you are a student or alumni of Ave Maria School of Law, the cost of attendance is $20.00.

Delicious lunch, snacks and amazing conversations included!

Date: Saturday, August 22, 2015 | 9:00 AM – 5:00 PM

Alan Gassman’s Professional Acceleration Workshop was a fast-paced, information-packed, and highly instructional event. Through interactive discussions of time-tested professional and personal growth strategies ranging from goal setting and problem solving to office efficiency and effective team building, Alan provides a thoughtful and measured approach to becoming a highly effective professional. I left the workshop feeling invigorated and excited to implement the insights into my practice management and continued self-study. The course materials and Alan’s compilation of trusted additional resources will be an invaluable resource for years to come. Thank you for the opportunity to participate.

Christina Rankin, J.D., LL.M. (Taxation)

Trust and Estates Lawyer with Over 10 Years of Experience

Law Offices of Richard D. Green, J.D., LL.M.

Course materials are available on Amazon.com for $1.99 and can be found by clicking here.

Location: Thomas Moore Commons, Ave Maria School of Law, 1025 Commons Circle, Naples, FL 34119

Additional Information: To download the official invitation to this event, please click here. To RSVP and for more information, please contact Donna Heiser at dheiser@avemarialaw.edu or via phone at 239-687-5405 or Alan Gassman at agassman@gassmanpa.com or via phone at 727-442-1200.

****************************************************

LIVE SARASOTA PRESENTATION:

Alan Gassman will speak at the Southwest Florida Estate Planning Council meeting on September 8th on the topic of EVERYTHING YOU ALWAYS WANTED TO KNOW ABOUT CREDITOR PROTECTION AND DIDN’T EVEN THINK TO ASK.

Date: Tuesday, September 8, 2015 | 3:30 PM – 5:30 PM with dinner to follow

Location: Sarasota, Florida

Additional Information: For additional information, please email Alan Gassman at agassman@gassmanpa.com.

********************************************************

LIVE WEBINAR:

Molly Carey Smith and Alan Gassman will present a free webinar on the topic of THE 10 BIGGEST MISTAKES THAT SUCCESSFUL PARENTS (AND GRANDPARENTS) MAKE WITH RESPECT TO COLLEGE AND RELATED DECISIONS FOR HIGH SCHOOL STUDENTS.

Date: Saturday, September 12, 2015 | 9:30 AM

Location: Online Webinar

Additional Information: To register for this webinar, please click here. For more information, please email Alan Gassman at agassman@gassmanpa.com.

*****************************************************

LIVE FORT LAUDERDALE PRESENTATION:

Ken Crotty will be presenting a 1-hour talk on PLANNING FOR THE SALE OF A PROFESSIONAL PRACTICE – TAX, LIABILITY, NON-COMPETITION COVENANT, AND PRACTICAL PLANNING at the Florida Institute of CPAs Annual Accounting Show.

Date: Friday, September 18, 2015 | 3:30 PM – 4:20 PM

Location: Broward County Convention Center | 1950 Eisenhower Blvd, Fort Lauderdale, FL 33316

Additional Information: For additional information, please email Ken Crotty at ken@gassmanpa.com or CPE Conference Manager Diane K. Major at majord@ficpa.org.

*************************************************

LIVE WEBINAR:

Molly Carey Smith and Alan Gassman will present a free webinar on the topic of FAILURE TO LAUNCH: 20-SOMETHINGS WITHOUT A SOLID CAREER PATH – WHAT PARENTS (AND OTHERS) NEED TO KNOW.

Date: Saturday, October 3, 2015 | 9:30 AM

Location: Online webinar

Additional Information: Please click here to register for this webinar. For more information, please email Alan Gassman at agassman@gassmanpa.com.

****************************************************

LIVE WEBINAR:

Alan Gassman, Ken Crotty, and Christopher Denicolo will present a webinar on the topic of WHAT EVERY NEW JERSEY ATTORNEY SHOULD KNOW ABOUT FLORIDA ESTATE PLANNING. This webinar will qualify for 2 New Jersey CLE credits.

Most advisors with Florida clients are unaware of the unique rules and planning considerations that affect Florida estate, tax, and business planning. Unlike some other states, Florida’s laws regarding limited liability companies, powers of attorney, taxation, homestead, creditor exemptions, trusts and estates, and documentary stamp taxes are not simply versions of a Uniform Act. They have been crafted by the Florida legislature to apply to various specific issues in an often counterintuitive manner.

This presentation will the following objectives:

- Unique aspects of the Florida Trust and Probate Codes

- Creditor protection considerations and Florida’s statutory creditor exemptions

- The Florida Power of Attorney Act

- Traps and tricks associated with Florida’s Homestead Law and Elective Share

- Documentary stamp taxes, sales taxes, rent taxes, property taxes, and how to avoid them

- Business and tax law anomalies and planning opportunities

Date: Thursday, October 8, 2015 | 12:00 PM – 1:40 PM

Location: Online Webinar

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com or Eileen O’Connor at eoconnor@njsba.com.

********************************************************

LIVE SARASOTA PRESENTATION:

2015 MOTE VASCULAR SURGERY FELLOWS – FACTS OF LIFE TALK SEMINAR FOR FIRST YEAR SURGEONS

Alan Gassman will be speaking on the topic of ESTATE, MEDICAL PRACTICE, RETIREMENT, TAX, INSURANCE, AND BUY/SELL PLANNING – THE EARLIER YOU START, THE SOONER YOU WILL BE SECURE.

Date: Saturday, October 24th, 2015

Location: To Be Determined

Additional Information: Please contact Alan Gassman at agassman@gassmanpa.com for more information.

Notable Seminars by Others

(These conferences are so good that we were not invited to speak!)

LIVE ORLANDO PRESENTATION:

50TH ANNUAL HECKERLING INSTITUTE ON ESTATE PLANNING

Date: January 11 – January 15, 2016

Location: To be announced

Additional Information: Information on the 50th Annual Heckerling Institute on Estate Planning will be available on August 1, 2015. To learn about past Heckerling programs, please visit http://www.law.miami.edu/heckerling/.

*******************************************************

LIVE ST. PETERSBURG PRESENTATION:

ALL CHILDREN’S HOSPITAL FOUNDATION 18TH ANNUAL ESTATE, TAX, LEGAL & FINANCIAL PLANNING SEMINAR

We are pleased to announce that Jonathan Blatttmachr, Howard Zaritsky, Lee-Ford Tritt, Lauren Detzel, Michael Markham, and others will be speaking at the 2016 All Children’s Hospital Estate, Tax, Legal & Financial Planning Seminar.

Lauren Detzel will be speaking on Family Law and Tax Planning for Divorce, while Michael Markham will be speaking on Bankruptcy and Creditor Protection/Fraudulent Transfer in Context with Estate Planning.

We thank Lydia Bailey and Lori Johnson for their incredible dedication (and patience with certain members of the Board of Advisors.) All Children’s Hospital is affiliated with Johns Hopkins, which is not affiliated with Anthony Hopkins.

Please provide us with your input for other topics for this year and next! Watch this space for more speaker and topic announcements.

Date: Wednesday, February 10, 2016

Location: Live Event at the All Children’s Hospital St. Petersburg Campus; Live webcasts in Tampa, Fort Myers, Belleair, New Port Richey, Lakeland, and Sarasota

Additional Information: Please contact Lydia Bennett Bailey at lydia.bailey@allkids.org for more information.

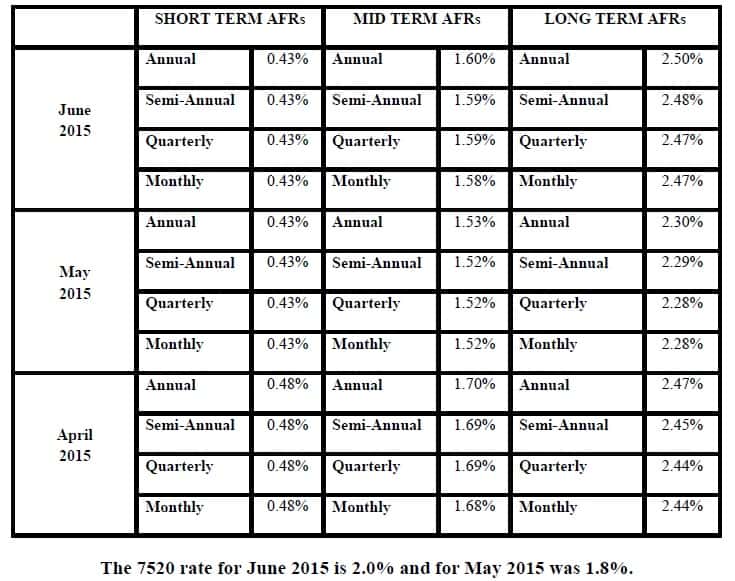

Applicable Federal Rates

Below we have this month, last month’s, and the preceding month’s Applicable Federal Rates, because for a sale you can use the lowest of the 3.