The Thursday Report – 2.25.16 – Is This Your Life or Just a TV Show?

Florida Bar Action Against Lawyer for Alleged Fraudulent Transfer

Florida Statute – Proceedings Supplementary and Contempt Risk

Seminar Spotlight: The Florida Bar 2016 Annual Wealth Protection Seminars, April 14th and 15th in Miami (where it’s hot – like the techniques to be covered!)

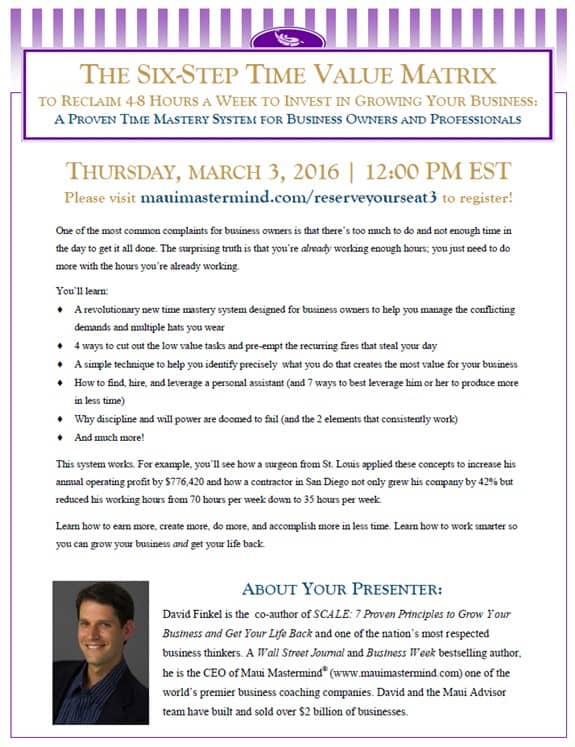

Webinar Spotlight – The Six-Step Time Value Matrix with David Finkel

Richard Connolly’s World – Changes for the 2016 Tax Season

Thoughtful Corner – Controlling Your Facebook Digital Legacy by Jeffrey M. Verdon

Humor! (or Lack Thereof!)

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Stephanie at stephanie@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

Quote of the Week

“The bitterness of poor quality remains long after the sweetness of a low price is forgotten.”

– Benjamin Franklin

Benjamin Franklin was one of the Founding Fathers of the United States. He was a leading author, printer, political theorist, scientist, inventor, and civic activist. Known as “The First American” for his early campaigning for colonial unity, Franklin was also the first US Ambassador to France. He is known for the invention of the lightning rod, bifocals, the Franklin stove, and the establishment of the first national communications network. From 1785 to 1788, he served as the governor of Pennsylvania. He is now honored by having his picture featured on the American $100 bill, which is the perfect gift for your favorite tax lawyer – get a receipt!

Florida Bar Action Against Lawyer for

Alleged Fraudulent Transfer

by Alan Gassman and Dena Daniels

In December 2015, the Florida Supreme Court determined that a lawyer forming a second professional association in an attempt to avoid paying a judgment owed by his first professional association, did not violate Florida’s Rules of Professional Conduct.[1] Initially, the Florida Bar sued the lawyer[2] claiming two separate violations. First, that the new professional association he created was a mere continuation of the prior one and had been formed with the intent to hinder, delay, or defraud another law firm, which the Bar alleged was a violation of Rule 4-8.4, and, second, that the lawyer diverted monies belonging to the first professional association to a bank account owned by the second professional association with the intent to hinder, delay, or defraud the creditor.

Rule 4-8.4(c-d), titled “Misconduct,” states that “a lawyer shall not engage in conduct involving dishonesty, fraud, deceit, or misrepresentation, (d) a lawyer shall not engage in conduct in connection with the practice of law that is prejudicial to the administration of justice.”

The Supreme Court appointed Referee found that the lawyer did not transfer tangible assets or accounts receivable from the first professional association to the second, and that there was no transfer of goodwill to the second professional association. The Referee also found that the lawyer’s long standing practice of paying personal expenses from the business operating account of the professional association “is more than norm for small business than the exception,” and that every year his CPA sorted out personal and business expenses so that “nothing was hidden. Nothing was ‘laundered.’” The court further noted that the Respondent did not commit fraud, deceit, or misrepresentation.

The Referee indicated that the evidence was not clear and convincing such that it could be proven that the lawyer acted in an unlawful or contrary manner to honesty and justice.

It would have been nice if the Referee had further pointed out that even if this lawyer had committed a “fraudulent transfer” to avoid a creditor, this would not be considered as conduct involving dishonesty, fraud, deceit, or misrepresentation. Nor, by our view, would this be considered to be “prejudicial to the administration of justice.” In the US Supreme Court case of Grupo Mexicano v. Alliance Bond Fund[3], it was ruled that it is not illegal or “wrong” for a debtor to take steps to preserve assets that may be legally used. The Supreme Court held that it did not have the authority to grant a preliminary injunction that would hinder individuals being sued by creditors from disposing his or her assets pending adjudication of contract claim of the creditor for damages. In the opinion, the late Justice Antonin Scalia stated that by allowing federal courts to issue such injunctions to creditors “could radically alter the balance between debtors’ and creditors’ rights and might induce creditors to engage in a race to the courthouse…which might prove financially fatal to the struggling debtor.”

This case does point out that the Florida Bar may pursue lawyers who engage in aggressive transfers to avoid creditors and that it is important to confirm that no such transfer involves dishonesty, fraud, deceit, or misrepresentation.

*********************************

[1] When violations of the Florida Rules of Professional Conduct occur, the complaint is first brought before the Florida Bar Committee on Professional Ethics, once a decision is rendered at that level, an appeal to the Florida Supreme Court may be filed. Upon the Florida Supreme Court receiving the case, a “Referee” is assigned to the case to determine the final holding.

[2] The Florida Bar v. Jefferson Riddell, SC 15-1288 (Dec. 18, 2015).

[3] 527 US 308 (1999).

Florida Statute Proceedings Supplementary and Contempt Risk

by Alan Gassman and Lauren Eliopoulos

Many creditor protection techniques rely upon the difficulty that a creditor would have in accessing assets that are easily within reach of a debtor. Two examples of this would be a Delaware bank account held by a Delaware company that is owned by a debtor and an offshore bank account owned by a Nevis LLC that is owned by a debtor.

Some advisors are encouraging their clients to use these choices to protect assets because Delaware, Nevis, and other statutes do not provide a remedy to enable a creditor to require the bank or other financial institution holding the assets to turn them over.

On the other hand, Florida and federal law provide for the possibility of judicial orders that could require a debtor to access and turn the funds or other assets over and to risk being held in jail on contempt of court for failure to do so.

Under Florida law, a judgment creditor can file a Proceeding Supplementary with the court that issues a judgment to request the court’s assistance in the collection process, as further described below.

Proponents of asset protection trusts point out that if the trust is funded before problems arise, then by the language of the trust agreement and the actual nature of the arrangement, the debtor can look the judge in the eye to explain that it is beyond the debtor’s legal and practical ability to access the assets, based upon actions that were taken well before a judgment was ever expected. This seems to us to be a much better position to be in, although establishing an asset protection trust is not inexpensive and takes more time and trouble than simply setting up a Delaware company and Delaware accounts or offshore companies and accounts.

Significantly more detail on the risk of a contempt order is set forth below. We thank Michael Markham, Esquire, of the Johnson Pope law firm for his assistance in preparing this article.

*********

Florida Statute Section 56.29 provides for a “proceeding supplementary” whereby a court that has granted a monetary judgment can take actions to enable the plaintiff/creditor to collect upon the judgment, using normal and appropriate means with respect thereto.

Subsection 9 of the Statute specifically provides that the court “may enter any orders, judgments, or writs required to carry out the purpose of this section…” Subsection 10 of the statute provides that any person failing to obey any order issued under this section “may be held in contempt.”

The Statute also provides that fraudulent transfers may be set aside, so the court, in a proceedings supplementary, has the power to issue judgments and enforce them against not only the defendant who has the judgment against him or her, but also subsequent “fraudulent transferees.”

In the 1970 Third District Court of Appeals case of Swartz v. Lipsky the judge Henry L. Balban, in Dade County, entered an order in a supplementary proceeding under the above statute “holding the defendant in contempt and imposing a 30 day jail penalty, with leave to purge the contempt by payment of the judgment within 14 days.”

The Third DCA concluded that the contempt order was appropriate because subsection (6)(a) of 56.29 “does not operate to exempt fraudulent transfers of personal property which are made more than a year prior to execution.” In the factual situation of the case, the defendant owed the plaintiff $4,800 and had made a fraudulent transfer of $37,000 to her daughter after learning that a lawsuit was being filed against her. After the Circuit Court had originally held the defendant in contempt, the defendant filed for a rehearing where the court held that the fraudulent transfer was legal because it had been made more than a year prior to the judgment. It was then appealed by the plaintiff to the Third DCA. The DCA reversed and remanded the matter back to the Circuit Court Judge.

Contempt or similar equitable remedies may apply in situations where a debtor places monies under an arrangement where non-equitable judicial remedies would not be effective.

For example, Delaware Statute Section 3502 provides that:

(a) All corporations doing business in this State, except as specified in subsections (b) and (c) of this section, are subject to the operations of the attachment laws of this State, as provided in the case of individuals. A corporation shall be liable to be summoned as garnishee.

(b) Banks, trust companies, savings institutions and loan associations, except only as to a wage attachment against the wages of an employee of the bank, trust company, savings institution or loan association, shall not be subject to the operations of the attachment laws of this State.

(c) Insurance companies, except as to moneys due in consequence of the happening of the risk provided for in the policy of insurance or a wage attachment against the wages of an employee of the insurance company, shall not be liable to attachment.

While some have argued that this statute only applies when a bank or trust company itself is being sued by its creditors, other courts have read this statute to preclude allowing a writ of judgment or other order against a bank to require the turnover of assets the bank is holding under an account owned by a debtor. While this statute by its terms only applies to Delaware residents, individuals residing outside of Delaware may establish Delaware corporations that have Delaware offices and own Delaware-based accounts.

If and when a Florida court concludes that the Delaware statutes prevent a court order from being binding against a Delaware bank, it will be within the authority of the Florida court operating under Section 56.29 to exercise equitable powers and order the debtor to turn over ownership and control of the Delaware company that holds the Delaware accounts.

In such event, a judge may conclude that a debtor that does not turn the monies over to the creditor, or is otherwise ordered by the court, can be placed in jail on contempt of court.

Unlike other creditor protection vehicles, that will become protected after the applicable statute of limitations run, even if funded with the intent to hinder or delay creditors, a Delaware bank account, or the ownership of a company in Delaware that owns a Delaware bank account will not be considered an exempt asset under the federal or Florida Statutes, and will therefore not be exempt from creditor claims once the four year limitation period under Florida Statute Section 726.105 has passed.

In addition, a debtor who wants to be able to eventually bankrupt out debt would lose such assets on the filing of a bankruptcy. This will not be the case if the debtor allows the requisite amount of time to run after transferring the asset to a form that is exempt under the creditor protection law.

Also, while the Nevis or other offshore LLC alternative seems to be based upon a political climate and judicial system that will be expected not to change for many years to come. Some speculate that a state like Delaware, which will derive more revenue from Delaware asset protection trusts than simple bank accounts and probably does not want to be known as a creditor protection haven, may be inclined to change its laws on the garnishment of bank accounts if this strategy is used by debtors.

Seminar Spotlight

The Florida Bar 2016 Annual Wealth Protection Seminars,

April 14th and 15th in Miami

(where it’s hot – like the techniques to be covered!)

The Florida Bar 2016 Annual Wealth Protection Seminars will be held on Thursday, April 14th and Friday, April 15th at the Hyatt Regency Downtown Miami, featuring speakers such as Barry Engel and Howard Fisher.

We firmly believe that this will be the best and most focused conference that we have ever had. Each speaker has been given plenty of time to cover much ground, and the interaction between speakers and attendees promises to be more productive and thought-provoking than ever.

The Thursday night “speakers dinner” can be attended by everyone. Please bring a guest to our free interactive evening breakout session on Accelerating Your Practice: Upgrading Clients, Building Passion, and Enjoying What You Do.

A splendid time is guaranteed for all!

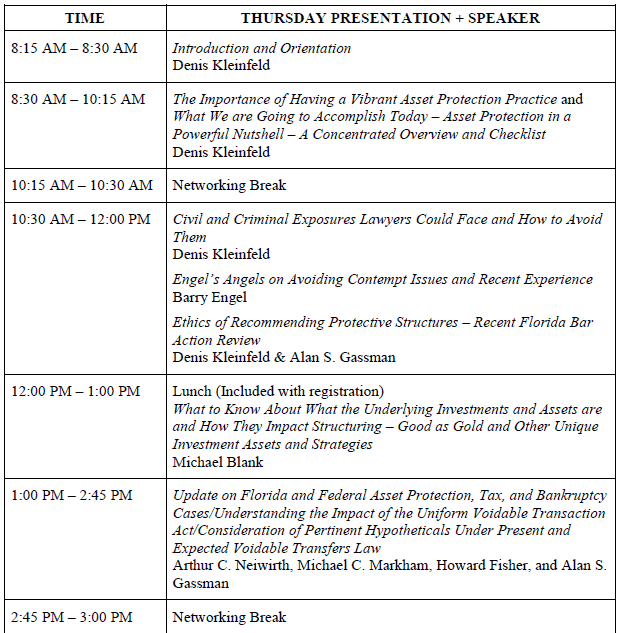

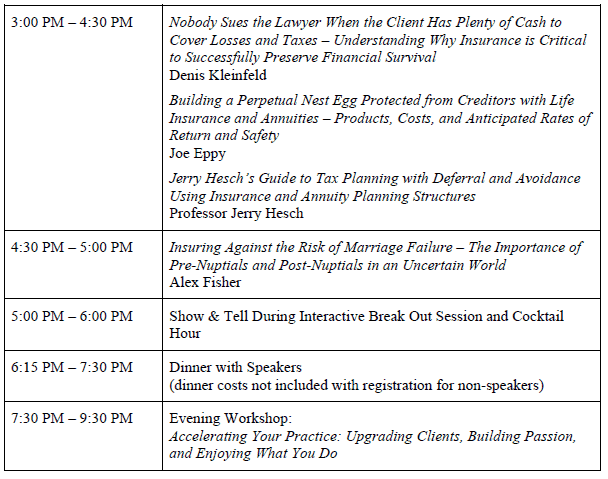

The first program on Thursday is an Intermediate Level Course entitled “Essential Updates and Wealth Protection Building Blocks.” The schedule for this day is as follows:

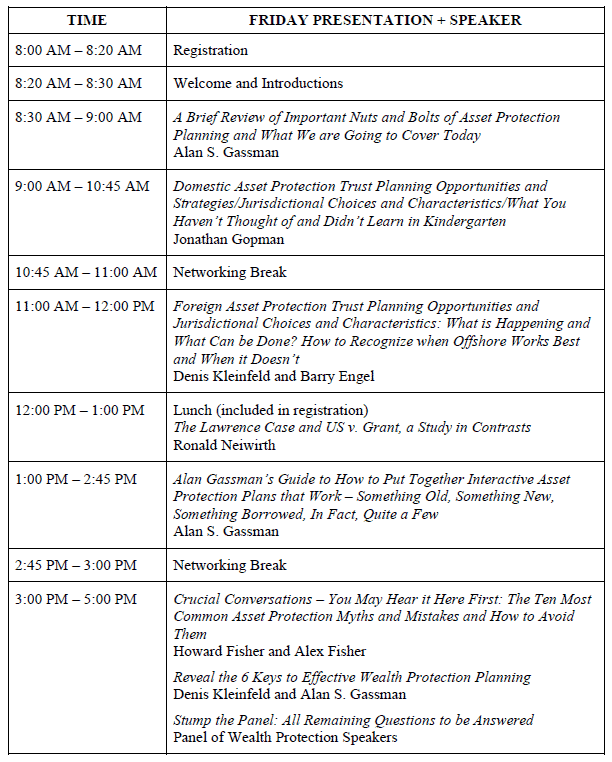

The second program on Friday is an Advanced Level Course entitled “A Deep Dive into Wealth Protection, Tax, and Advanced Planning.” The schedule for this day is as follows:

You can register for this conference by logging on to www.floridabar.org/CLE or by filling out the Florida Bar form, which can be downloaded by clicking here.

Webinar Spotlight:

The Six-Step Time Value Matrix with David Finkel

Please click here to register for this webinar!

Richard Connolly’s World

Changes for the 2016 Tax Season

Insurance advisor Richard Connolly of Ward & Connolly in Columbus, Ohio often shares with us pertinent articles found in well-known publications such as The Wall Street Journal, Barron’s, and The New York Times. Each week, we will feature some of Richard’s recommendations with links to the articles.

This week, the first article of interest is “New Year, New Tax Rules: What You Need to Know” by Laura Saunders. This article was featured in The Wall Street Journal on January 8, 2016.

Richard’s description is as follows:

The good news is that last month, in the nick of time, Congress enacted permanent extensions of several popular provisions, including the American Opportunity tax credit, a higher-education benefit; the IRA charitable transfer provision for people 70.5 years old and older; certain mass-transit benefits; a child tax credit; and the ability to deduct state sales taxes instead of income tax on the federal return.

No longer will people using these benefits have to bite their nails waiting for lawmakers to re-enact them – especially if a provisions has already expired, as happened several times over the past decade.

Other changes to be made aware of and discussed in this article are the Affordable Care Act penalty tax, adjusted tax brackets, adjusted investment brackets, mileage deductions, and increased estate and gift tax levels.

Please click here to read this article in its entirety.

The second article of interest this week is “Did the IRS Hang Up on You? You’re More Likely to Get Through This Year” by Richard Rubin. This article was featured in The Wall Street Journal on January 14, 2016.

Richard’s description is as follows:

The Internal Revenue Service has some good news for taxpayers this year: You might actually be able to get through to someone on the phone.

Thanks to an additional $290 million approved by Congress for taxpayer services, the IRS is hiring up to 1,000 people, Commissioner John Koskinen told reporters Thursday.

Last year, taxpayers trying to reach the IRS on a toll-free line had a 38% chance of reaching a person, after waiting an average of more than 30 minutes, according to the National Taxpayer Advocate’s annual report. More than 8 million calls ended in what’s known as the “courtesy disconnect” – a hang up.

This year, Mr. Koskinen said he hoped about 60% of calls would go through and that wait times would decline to under 20 minutes.

Please click here to read this article in its entirety.

Thoughtful Corner

Controlling Your Facebook Digital Legacy

by Jeffrey M. Verdon, Esquire

Jeffrey Verdon is Managing Partner of Jeffrey M. Verdon Law Group, LLP. He has an LL.M. in Taxation from Boston University and practices law in the areas of taxation and comprehensive estate planning. He specializes in estate, trust and income tax planning, and asset and lifestyle protection planning for high net-worth clients across the US. He is also a highly sought-after speaker in the areas of taxation and estate planning, lecturing aboard cruise ships and at top Investment Conferences internationally.

To see this article in its original form, please click here. Thanks, Jeff, for sharing this Client Alert with Thursday Report readers!

Twelve years ago, Ellen’s mother passed away after 96 wonderful years of life. She was not the wealthiest of persons, but her life was rich with memories of her children growing up, watching them raise their children, and even getting to know her great-grandchildren. This could not have been more evident than when Ellen went to her mother’s fourth floor New York walk-up to clear out her mother’s belongings and was met by countless photos of family spanning the decades – they were hanging on the walls, preserved in photo albums with handwritten stories, and in frames on the bedside tables. The pictures were beautiful to behold and easy to distribute to family or discard, if appropriate. But today, as they say, times are different.

While some of today’s photographs and stories are preserved in tangible form, a great deal are digital and make their homes online – on Facebook, Instagram, and the Cloud – not to mention other digital assets, such as emails, a LinkedIn account, and personal websites, which may leave behind a person’s digital legacy for hundreds of years into the future. Social media is new in the grand scheme of time – and while the Uniform Fiduciary Access to Digital Access Act (UFADAA) was approved on July 16, 2014, states and tech companies have been slow to adopt it. But the reality of an online digital legacy remains, and while legislatures figure out ways to handle the issue, some online forums, such as Facebook, have created their own option as a solution for users with a concern for what will happen to their account after they pass away.

By going to the Facebook drop down tab, selecting Settings, Security, and then Legacy Contact, a Facebook account holder can name a person as their Legacy Contact, thereby giving that person permission and the ability to manage the decedent’s account after the account holder passes away. The Legacy Contact can pin a post to the decedent’s Timeline, thereby, for example, providing information as to memorial service information; accept or deny friend requests, for instance, should a family member request to be a friend after the person passes in order to learn information about memorial proceedings; and can update the decedent’s profile picture.

By logging into the Legacy Contact area of Facebook, an account holder can opt to give permission for their Legacy Contact to download a copy of the account user’s posts, photos, videos, and About Me section, or can choose to instruct Facebook to delete their account after Facebook is notified of the person’s passing. If an account is not set to be deleted, it will be Memorialized, with the word Remembering shown next to the person’s name in the profile. Further details and information can be found on Facebook’s website, and we encourage interested Facebook users to take advantage of the easy-to-use planning opportunity provided by Facebook so as to have a say in their own digital legacy.

Humor! (or Lack Thereof!)

Sign Saying of the Week

*************************************************

IN THE NEWS

by Ron Ross

Jeb Bush quits the 2016 presidential race after receiving only 10% of the Bush family vote. It is believed that George W. Bush accidentally voted for Pat Buchannan, while his newest grandchild, Chad Bush, is not yet 18, and therefore, reportedly unable to vote.

******

Young women all over the country are reportedly falling in love with an old man named Bernie, much to the dismay of their parents. The gentleman in question, Senator Sanders, could not be reached for comment. That is, we did reach him, but he has trouble hearing over these new-fangled phones.

******

The Late Valentine, From Your Husband in Jail

by Ron Ross

You know I’d never leave you.

Lover, I’d never go,

If I wasn’t caught red handed

On that security video.

There’s no one else for me,

And here’s the reason why.

Because you are my loving wife,

They can’t make you testify.

Upcoming Seminars and Webinars

Calendar of Events

LIVE COMPLIMENTARY MAUI MASTERMIND WEBINAR:

Wall Street Journal and Business Week bestselling author David Finkel will present a free, one-hour webinar on the topic of THE SIX-STEP TIME VALUE MATRIX TO RECLAIM 4-8 HOURS A WEEK TO INVEST IN GROWING YOUR BUSINESS.

Date: Thursday, March 3, 2016 | 12:00 PM – 1:00 PM

Location: Online webinar

Additional Information: To register for this presentation, please click here. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE INTERACTIVE LEGAL WEBINAR:

Alan Gassman will present a live, one-hour webinar on the topic of TEN COMMON PORTABILITY MISTAKES AND WHAT YOU NEED TO KNOW TO AVOID THEM.

This webinar is part of InterActive Legal’s Hot Topic Webinars series.

Date: Friday, March 4, 2016 | 1:00 PM EST

Location: Online webinar

Additional Information: To register for this webinar, please click here. For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

PODCAST INTERVEW:

Alan Gassman will be interviewed by Bob Mason on the new TrustHacker podcast channel on the topic of BETTER ENJOYING YOUR TRUST AND ESTATE PRACTICE – DOING WHAT’S BEST FOR YOUR CLIENTS, YOUR TEAM, AND YOUR COMMUNITY.

Bob Mason, J.D., CELA, CAP, is owner of Mason Law, PC of Asheboro, North Carolina, a law firm devoted exclusively to legal issues involving the elderly and the disabled. He is a Board Certified Specialist in Elder Law by the North Carolina State Bar Board of Legal Specialization and a Certified Elder Law Attorney by the National Elder Law Foundation. To listen to past podcasts or to subscribe, please click here.

Date: Monday, March 7, 2016 | 4:00 PM – 4:45 PM

Location: Online

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com or Bob Mason at ram@masonlawpc.com.

**********************************************************

LIVE COMPLIMENTARY MAUI MASTERMIND WEBINAR:

Alan Gassman will present a free, 45-minute webinar on the topic of ASSET PROTECTION BASICS FOR BUSINESS OWNERS.

This webinar will be specially made for and presented in partnership with Maui Mastermind. Clients, advisors, and colleagues of Gassman, Crotty & Denicolo are welcome to attend.

Date: Wednesday, March 16, 2016 | 12:30 PM – 1:30 PM

Location: Online webinar

Additional Information: To register for this presentation, please click here. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE WEBINAR:

Alan Gassman will moderate a Bloomberg BNA Essential Elements webinar with special guest Martin Shenkman on the topic of THE ESSENTIALS OF PLANNING BEFORE AND AFTER THE DEATH OF A CLIENT.

This is a free Essential Elements webinar presented by Bloomberg BNA.

Date: Thursday, March 17, 2016 | 12:30 PM to 1:30 PM

Location: Online webinar

Additional Information: To register for this webinar, please click here. For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE UNIVERSITY OF FLORIDA PRESENTATION:

Saturday, March 19, Alan Gassman will be speaking to Professor Dennis Calfee’s University of Florida Tax LL.M. program on PROFESSIONAL ACCELERATION FOR ESTATE PLANNING LAWYERS.

Alan’s six-hour, interactive workshop will include breakout discussions on goals, time management, enjoyment of what we do, and time-tested tools and techniques for making the best of the opportunity to help others and our communities in a fascinating profession.

We welcome your input, and, if you know any UF law students who would like to attend, please email agassman@gassmanpa.com.

Date: Saturday, March 19, 2016 | 9:00 AM – 3:00 PM

Location: University of Florida | Gainesville, FL

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE MIAMI PRESENTATION:

FLORIDA BAR WEALTH PROTECTION CONFERENCE

The Annual Florida Bar Wealth Protection Conference in Miami on Thursday, April 14th and Friday, April 15th will definitely be our best program ever! You can attend one or both days.

Speakers will include Barry Engel, Howard Fisher, Denis Kleinfeld, Jonathan Gopman, Alan Gassman, and many others! The two-book course materials will be available to all attendees.

A Thursday evening dinner with the speakers and a post-dinner small group discussion and workshop on Practice Acceleration will be available only to those who attend the live sessions.

The official brochure for this program can be viewed by clicking here.

Date: Thursday, April 14th, 2016 and Friday, April 15th, 2016

Location: Hyatt Regency Miami | 400 SE 2nd Avenue, Miami, FL 33131

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE COMPLIMENTARY MAUI MASTERMIND WEBINAR:

Wall Street Journal and Business Week bestselling author David Finkel will present a free, one-hour webinar on the topic of MORE WITH LESS: 5 SIMPLE STEPS TO ENJOY MORE BUSINESS GROWTH AND GREATER PERSONAL FREEDOM BY DOING LESS.

Date: Thursday, April 28, 2016 | 12:00 PM – 1:00 PM

Location: Online webinar

Additional Information: To register for this presentation, please click here. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE NAPLES PRESENTATION:

3RD ANNUAL AVE MARIA SCHOOL OF LAW ESTATE PLANNING CONFERENCE

This one-day conference will take place in Naples, Florida on Friday, May 6, 2016.

On Thursday, May 5, there will be a special dinner with Jonathan Blattmachr. Jonathan will also present at the conference on Friday. Be sure to bring an extra pair of socks because the first pair will get knocked off by Jonathan’s talk!

Alan’s Friday morning presentation will be entitled COFFEE WITH ALAN: AN INTRODUCTION TO SELECT ESTATE PLANNING AND ASSET PROTECTION STRATEGIES. During this session, Alan will offer an overview of the topics that will be presented throughout the Estate Planning Conference. Attendees new to these specific estate planning areas will find the presentation useful and helpful.

Alan will also moderate the Luncheon Speaker Panel with Jonathan Blattmachr, Stacy Eastland, and Lee-ford Tritt. The panel will cover the topic of WHAT WE WISH WE KNEW WHEN WE STARTED PRACTICING LAW – NON-TAX AND PRACTICAL ADVICE FOR ESTATE PLANNERS YOUNG AND OLD.

Date: Friday, May 6, 2016

Location: Ritz Carlton Golf Resort | 2600 Tiburon Drive, Naples, FL, 34109

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE COMPLIMENTARY MAUI MASTERMIND WEBINAR:

Alan Gassman will present a free, 45-minute webinar on the topic of EQUITY STRIPPING AND OTHER ADVANCED ASSET PROTECTION IDEAS.

This webinar will be specially made for and presented in partnership with Maui Mastermind. Clients, advisors, and colleagues of Gassman, Crotty & Denicolo are welcome to attend.

Date: Wednesday, May 11, 2016 | 12:30 PM

Location: Online webinar

Additional Information: To register for this presentation, please click here. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE TAMPA PRESENTATION:

MAUI MASTERMIND ACCREDITED INVESTOR WEALTH WORKSHOP

Maui Mastermind will present their three-day ACCREDITED INVESTOR WEALTH WORKSHOP on July 21st – 23rd.

The first two days of this event will feature three speakers: David Finkel, Kevin Bassett, and Alan Gassman, on a variety of topics including advanced asset protection topics, reducing your tax drag, creating more with less, and how to create and sustain rapid growth of your business or company.

Saturday, July 23rd will feature a bonus add-on to the program entitled SCALE YOUR MEDICAL PRACTICE: PROVEN STRATEGIES TO GROW YOUR PRACTICE, INCREASE YOUR CASH FLOW, AND CREATE MORE PERSONAL FREEDOM. This event will feature David Finkel’s presentation on scaling a medical practice.

Watch this space as more details will be forthcoming!

Date: Thursday, July 21st – Saturday, July 23rd

Location: Tampa Marriott Westshore | 1001 N. Westshore Blvd., Tampa, FL, 33607

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

Notable Events by Others

LIVE TAMPA PRESENTATION:

2016 FLORIDA TAX INSTITUTE

The 2016 Florida Tax Institute, organized by the University of Florida Levin College of Law, will feature top speakers in the United States on tax, business, and estate planning issue. This program is designed to be informative, engaging, and state of the art!

For a full conference agenda, please click here. Up to 24 hours of continuing education legal credit will be available in several states, while Accounting, Certified Financial Planner, Certified Trusts and Financial Advisor, and Enrolled Agents PACE credit will be available nationwide.

Date: Wednesday, March 30, 2016 – Friday, April 1, 2016

Location: Tampa Marriott Waterside | 700 S. Florida Avenue, Tampa, FL 33602

Additional Information: To register for this event, please click here. For more information, please email admin@floridataxinstitute.org.

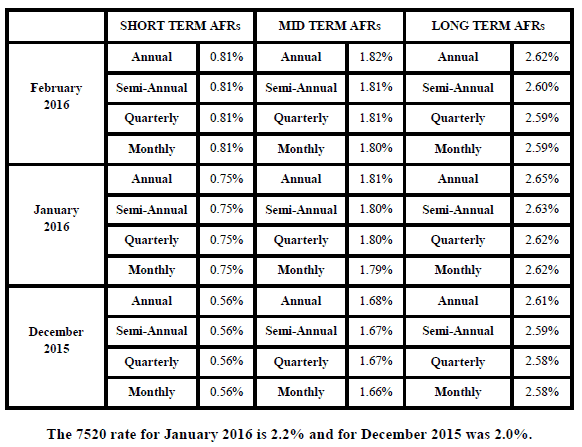

Applicable Federal Rates

Below we have this month, last month’s, and the preceding month’s Applicable Federal Rates, because for a sale you can use the lowest of the 3.