The Thursday Report – 12.3.15 – Just Another Tequila Thursday

Class II Gun Law Trivia

Succession Planning Requires Teamwork by Jeffrey M. Verdon, Esquire

What if You Forgot to Put Something in an Agreement that was Obviously Needed?

Richard Connolly’s World – Tax Changes You Should Be Aware Of

Thoughtful Corner – Top 25 Holiday Gift List by Linda Chamberlain

Humor! (or Lack Thereof!)

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Stephanie at stephanie@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

Quote of the Week

“We make a living by what we get; we make a life by what we give.”

– Winston Churchill

Winston Churchill was the Prime Minister of the United Kingdom from 1940 to 1945 and again from 1951 to 1955. He was also an officer in the British Army and a recipient of the Nobel Prize in Literature. Churchill was also awarded an honorary United States citizenship in 1963 and was the first person to receive such designation.

Anyone who did his best work in bed and in the bathtub and loved papers neatly bound by a hole in the top left corner and special binding clips would have been a great lawyer, let alone one of the most amazing leaders of the 20th century. If you have never taken the tour of 10 East Downing Street to see the small quarters that Churchill and his team lead the second strongest nation in Western Europe from in its worst modern times, you should consider making that trip. It is inspiring to see how so few led so many in such difficult circumstances, with limited technology but unlimited faith, dedication, and political prowess. It’s no wonder that Churchill has been considered one of the great leaders of all time by other such great leaders like Roosevelt and the editors of the Thursday Report.

Hoping that today and tomorrow, you make a life by what you give,

and get as a natural byproduct thereof.

Class II Gun Law Trivia

by Alan Gassman

This year, the Thursday Report has reported on a number of items concerning guns, gun trusts, and Title II firearms. To see some of our previous coverage, click here, here, here, or here. More regulations and requirements concerning Title II firearms are as follows:

Issues with Individual Ownership – Additional Requirements for Individual Owners

In addition to registering and paying the $200 tax, individuals must submit additional information to the Bureau of Alcohol so that they may conduct an extensive background check. Unlike a business entity or trust, individuals must provide photographs, a fingerprint card, and a certificate of approval from their chief law enforcement officer (“CLEO”). The certificate signed by the CLEO must state “that the certifying official is satisfied that the fingerprints and photograph accompanying the application are those of the applicant and that the certifying official has no information indicating that the receipt or possession of the firearm would place the transferee in violation of State or local law or that the transferee will use the firearm for other than lawful purposes.”

This extra requirement for the certification makes many CLEOs wary of signing the form. Many are concerned with the possible legal liability if one of these National Firearms Act items is used to hurt someone. This causes some CLEOs to not sign simply out of fear of litigation if the worst should happen.

The chief law enforcement officer can be the Chief of Police for the applicant’s city or town of residence, the Sherriff for the applicant’s county of residence, the head of the State Police for the applicant’s state of residence, a state or local district attorney or prosecutor with jurisdiction over the applicant’s residence, or another person whose certification is acceptable to the Director of the Bureau of Alcohol, Tobacco, and Firearms and Explosives.

If someone has been delegated to sign on behalf of a chief law enforcement officer, this fact must be made clear on the form by printing the CLEO’s name and title, followed by the word “by” and the full signature and title of the delegated person. The certification must be created within a year of the receipt of the form by the Bureau of Alcohol.

Oftentimes, affluent individuals report and act as if they reside in a low tax state, such as Florida or Texas, when they actually may be found by taxing authorities to reside in a higher tax state, such as New York or Massachusetts. The Bureau of Alcohol has prosecuted individuals who claim to reside in one location and actually are found to be residents of another location under 26 U.S.C. Section 5861(1), stating it is a submission of false information to the federal government.

Co-Owners

A Title II firearm owner is the only person authorized to have use and access to the firearm, and those with roommates, spouses, or periodic guests run the risk of committing a felony if they permit constructive access to the weapons to those people. Co-ownership of a Title II firearm by two or more “individuals” is not permitted. However, with a gun trust or business entity, trustees or managers can be added to the document, and these individuals are allowed to have access to and use the Title II firearms. This gives the owner the ability to add and remove people at their own discretion, thus protecting their loved ones from prosecution.

Death or Incapacity of the Individual Owner

A serious issue arises when an individual owner of these Title II firearms passes away. If the person has a will, then it may or may not specifically devise the firearms. If the person does not have a will, then the firearms will pass intestate, which means state law will determine where the property of the decedent (deceased individual owner) goes. Whenever there is a transfer of a Title II firearm, a Bureau of Alcohol Form 5 must be filled out and submitted, similar to other Bureau of Alcohol forms. The only difference is there is no $200 tax stamp for a transfer from an estate to a beneficiary. Nonetheless, the form must still be submitted and approved by the Bureau of Alcohol before a transfer is to take place. Otherwise, any transfer will be a violation of the National Firearms Act.

If the decedent has a will and it specifically dictates to whom the firearms pass, or if the will has a residuary clause that says all personal property goes to a certain person, then the personal representative of the estate will take the firearms and distribute them accordingly. This is a problem because if the personal representative does not know the law or does not understand that there are strict regulations regarding these types of firearms, then the person receiving the items will be committing a felony if the proper forms are not filled out.

If the decedent passes away intestate, meaning without a will, then the property will be distributed according to the state statute. This generally means that the next of kin will receive all the property. The same issues arise here as in the context of having a will. The personal representative may not know the rules regarding these Title II firearms or may not even know the items are regulated.

This is a serious issue because many estate planners and personal representatives, who are generally just a family member, do not understand the regulations regarding these types of firearms or the grave penalties involved with a violation. It is easy to see how a personal representative may see a rifle and give it to a decedent’s son pursuant to the will or intestate rules and not know to check and see if the rifle is fully automatic or short-barreled. The son receiving it might not even know the firearm is regulated and may take the item, thus violating the National Firearms Act. This is why it is important to use a gun trust that will specifically lay out all the rules concerning these items and give specific instructions on how to pass these expensive and highly-regulated firearms.

Besides the risk of fines, jail time, and felony convictions, there is another devastating penalty involved with an illegal transfer, which is destruction of the item. Unregistered Title II items are supposed to immediately be given to law enforcement to be destroyed. This means that $20,000+ machine guns could be destroyed. None of the items regulated by the National Firearms Act are cheap, and no one wants to see their heirlooms destroyed. These items, once unregistered by means of an illegal transfer, cannot be retroactively re-registered and must be destroyed. Thus, once they become illegal, they stay illegal.

Succession Planning Requires Teamwork

by Jeffrey M. Verdon, Esquire

Jeffrey Verdon is Managing Partner of Jeffrey M. Verdon Law Group, LLP. He has an LL.M. in Taxation from Boston University and practices law in the areas of taxation and comprehensive estate planning. He specializes in estate, trust and income tax planning, and asset and lifestyle protection planning for high net-worth clients across the US. He is also a highly sought-after speaker in the areas of taxation and estate planning, lecturing aboard cruise ships and at top Investment Conferences internationally.

To see this article in its original form, please click here. Thanks, Jeff, for sharing this Client Alert with Thursday Report readers!

“Teamwork makes the dream work, but a vision becomes a nightmare when the leader has a big dream and a bad team.”

– American Clergyman John C. Maxwell

Paul can’t believe it’s been forty years since the night he died.

The last thing he remembered was blowing out the candles on his 20th birthday cake – then nothing. One minute, he was fine. The next minute, he was dead.

Fortunately, his death was short-lived. Paul’s nurse practitioner aunt performed CPR, and by the time the ambulance came, he was breathing on his own. Unfortunately, his prognosis was not good. Paul needed life-saving, highly experimental surgery that hadn’t been invented yet. After making hundreds of calls, Paul’s aunt found an enterprising doctor who quickly developed a special tool to help save him. This launched Paul on his life’s mission to get specialized medical devices into the hands of doctors around the world. Today, his company – one that has directly saved the lives of tens of thousands of people – is worth millions.

Because of Paul’s near-death experience, he understands the importance of business succession planning. He doesn’t want his inevitable death to also be the death of his business.

Years ago, Paul hired a key employee who is now poised to buy the company when he dies. To facilitate the transaction, Paul had his financial and tax people perform a fair-market valuation of the business, he had his lawyer draft buy-sell paperwork, and he had his life insurance agent put a life insurance policy in place to finance the terms of the agreement. Paul felt like he was making some smart moves.

But he neglected something – communication. Paul failed to insist his lawyer, his life insurance agent, his financial planner, and his tax advisor coordinate with each other. This might not seem like a big deal – after all, these professionals are paid good money to answer all the “what ifs” we could never think of on our own.

But “what if” our professional advisors aren’t answering the same “what ifs?”

Without communication and coordination among his professionals, Paul’s plan might not take into account hundreds of tiny little details that could cause the failure of the business succession plan. Former Laker’s coach Phil Jackson said, “The strength of the team is each individual member. The strength of each member is the team.” In succession planning, this statement could not ring more true.

Take the recent case of Broeferdorf v. Bachelor, No. 15-2117 (U.S.D.C.E.D.P.A. Sept. 14, 2015), as a perfect example. In this case, Amy Bosich, the owner and founder of Flying Nurses International, executed a right of first refusal buy-sell agreement with her longtime employee, Robert Bachelor, funding his potential right to buy the company with a life insurance policy, which he owned and could control. Unfortunately, this was not a one-way buy-sell agreement, and the insurance policy terms allowed Bachelor to unilaterally change the beneficiary of the policy to himself without informing Bosich. To complicate matters, the buy-sell agreement gave Bachelor the right to refuse to exercise his option to buy the company. In the end, this is exactly what Bachelor did, declining to buy FNI and cashing in the $1M life insurance policy for himself. Boisch’s executor sued under a number of different legal theories, but there is one, inescapable fact: failure of the team members to coordinate Bosich’s succession plan resulted in a failed succession.

That would be one of Paul’s worst fears.

Paul schedules a group meeting with all of his professional advisors. He asks each of them to explain to each other what they’ve contributed to his business succession plan, and then he voices concerns about whether it will all work together. Each professional is understandably proud of their individual work and defensive about Paul’s sudden case of “what ifs,” but as they all discuss the details of the plan, they slowly discover that it actually might contain some potentially fatal holes. None of these defects would have been detected by the individual professionals, but together, they were able to get a 360 degree view of the plan and detect where problems might arise.

Energized with a renewed urgency, Paul asks his professional advisors to coordinate a comprehensive strategy to ensure the success of his business succession objectives. As the plan takes shape, each of his advisors’ respective strengths enhances its viability. Score one for teamwork.

Our law firm works with professional advisors and their clients to develop comprehensive business succession plans and obtain that important 360 degree view. After all, teamwork really does make the dream work. Put us to work for your dreams so they don’t die when you do.

What if You Forgot to Put Something in an Agreement

that was Obviously Needed?

by Alan Gassman

The “Parties Will Cooperate to Make this Agreement Enforceable” Clause

Oftentimes, an agreement is read years after it was written, and one or more parties realize that there are legal requirements not fulfilled by the language of the agreement. This can easily be repaired by a short amendment.

While parties to any agreement have an obligation to act in good faith, what happens if an agreement that was fully negotiated and would otherwise be enforceable is unenforceable by reason of there not being two witnesses to a signature, or the agreement invokes long-term lease rights, or if it is not clear whether a signature was real or forged?

Consider the following clause, or something similar thereto, for your future agreements:

(f) Further Assurances. Each party shall executive any reasonable additional documents or instruments which are provided to the party by another party or parties and which are reasonably necessary to (i) carry out or facilitate the understanding represented by this Agreement or (ii) more clearly establish the rights of one or more parties under this Agreement, provided that any such additional documents, instruments, or amendment hereto will not deprive any party hereto of substantive legal or economic rights that were not intended to be limited or reduced under this Agreement. This will include resigning of this Agreement if there is any question as to the genuineness or validity of any signature, a need for witnesses and notarization, or to add a provision that is necessary to make some or all of the obligations set forth herein enforceable pursuant to applicable law. Any dispute with respect to whether this provision should be applicable shall be resolved by mediation if possible, or arbitration if necessary, pursuant to the terms of Section (o) below, or may be determined by a court of competent jurisdiction if there is any reason that a mediation or arbitration is not conducted.

Please also do not forget that an agreement can be stricken entirely if any one component of it is inadvertently illegal. Consider a severability clause for this:

(n) Severability. If any one or more of the provisions contained in this Agreement for any reason are held to be invalid, illegal, or unenforceable in any respect, such invalidity, illegality, or unenforceability shall not affect any other provision hereof and this Agreement shall be construed as if such invalid, illegal, or unenforceable provision had never been contained herein.

Richard Connolly’s World

Tax Changes You Should Be Aware Of

Insurance advisor Richard Connolly of Ward & Connolly in Columbus, Ohio often shares with us pertinent articles found in well-known publications such as The Wall Street Journal, Barron’s, and The New York Times. Each week, we will feature some of Richard’s recommendations with links to the articles.

This week, the first article of interest is “Americans: Pay Your Taxes – Or Lose Your Passport” by Laura Saunders. This article was featured in The Wall Street Journal on November 20, 2015.

Richard’s description is as follows:

Congress is poised to enact a law denying or revoking passports for U.S. citizens who haven’t paid their taxes.

Under a new law expected to take effect in January, the State Department will block Americans with “seriously delinquent” tax debt from receiving new passports and will be allowed to rescind existing passports of people who fall into that category. The list of affected taxpayers will be compiled by the Internal Revenue Service using a threshold of $50,000 of unpaid federal taxes, including penalties and interest, which would be adjusted for inflation.

Please click here to read this article in its entirety.

The second article of interest this week is “IRS Urged to Focus Audits on Wealthiest” by Richard Rubin. This article was featured in the Wall Street Journal on November 22, 2015.

Richard’s description is as follows:

The Internal Revenue Service spends too much time and effort auditing people who make $200,000 to $400,000 and too little going after the very wealthiest Americans, according to an inspector general’s report.

In response, the IRS said it is re-examining its decision to consider $200,000 a “high income” for auditing purposes and look at indexing that threshold to inflation. In an era of declining budgets, the move could lead to employees of the tax agency who specialize in the complex returns of the rich to focus on the super-wealthy instead.

Please click here to read this article in its entirety.

Thoughtful Corner

Top 25 Holiday Gift List

by Linda Chamberlain

Gift giving is fun for me! When I do have time to go shopping, I’m on the lookout for items my family or friends may enjoy. Ideas for gifts come from all different directions. I find listening closely to the person helps me identify gifts that will be useful and often become items they love.

I have personally used or have given all of these gifts to someone who has loved them! I have organized the gifts under headings to help you sort through them easily and perhaps find just the perfect gift.

Tech and Gadgets: Open-It

I can’t remember when I first found the “Open-It,” but I sure am glad I did. It seems like so many packages today are hard to open. One of the things I’ve noticed is that my hand strength is not what it used to be. The Open-It tool prevents any pain in my hand and cuts through fairly thick plastic, cardboard, etc.

Self-Improvement Gift Ideas: Clarins Restorative Wake-Up Lotion

I’m not sure what the active ingredient is in this lotion, but it definitely wakes up your skin in the morning and brings some light to your face. It’s easy to apply, absorbs quickly, and is the perfect moisturizer for under your tinted moisturizer or foundation.

Comforting Holiday Gifts for Seniors: Anti-Fatigue Kitchen Mat

This anti-fatigue kitchen mat from Frontgate has helped tremendously in decreasing the pain from standing and often eliminates the pain from standing all together. The mat is attractive in the kitchen and provides nice padding to stand on, therefore giving your back a break and less chance for pain to develop.

Gifts for Health and Wellness: Chill Pal

This is an awesome gift for the exercise person in your life. I have given this to many of my friends and family. It is perfect in the heat! You can make the Chill Pal cloth wet with cold water, snap the extra water out, and wrap it around your neck to bring you immediate coolness.

Gifts for Foodies: Killer Brownie

Dorothy Lane Market baked goods are amazing. One of my favorites is their Killer Brownies, which you can order and have delivered whenever you would like. As far as I know, these Killer Brownies have never killed anyone, but there may be a few fights in the house over who is going to get to eat the last one! You can choose the Killer Brownie you might like the best: the original chocolate caramel, peanut butter, cream cheese, Blonde Ambition, Brookie Killer, German Chocolate, PB&J, and Not a Nutter, or, better yet, try them all!

Linda has 20 more holiday gift ideas for you. Click here to find out what they are!

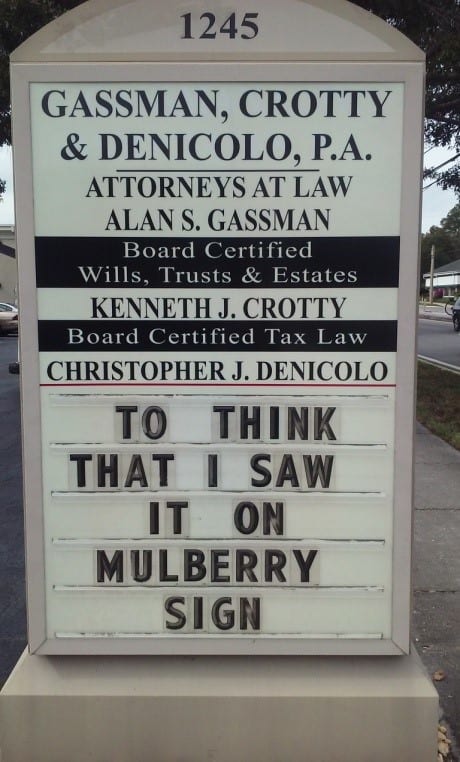

Humor! (or Lack Thereof!)

Sign Saying of the Week

******************************************************

********************************************

Did you ever have the feeling you had déjà vu, but it turned out you didn’t?

If this has happened to you before, it’s one thing, but if it is just a feeling and you are not sure whether or not it has happened to you before, then it’s vu ajed.

Have you ever seen the words vu ajed?

If so, you may need to have your Estate Planning updated.

Upcoming Seminars and Webinars

Calendar of Events

LIVE WEBINAR:

Nuclear physicist and Renaissance octogenarian Bill Kahn will join Alan Gassman for a free webinar on the topic of CREATIVE BUSINESS SECURITY – PROTECTING YOUR COMPUTER DATA FROM INTERNET CRIMINALS.

Company espionage is big business, and it’s not just limited to biggies. When a new business is in its early stages or before it has its operational system laid out in concrete, establishing the right security concepts can carry through as it grows. It minimizes unwanted exposure and unneeded expense of later changing how it operates. Preventing vulnerability to hackers, for example, would be one consideration. Making sure cell and office phones can’t be bugged and keeping competitors and governments from spying on the operation should also be an upfront consideration.

A business doesn’t have to be the NSA to make all of these things a reality. Conventional methods of information security, no matter how effective they profess to be, just end up with an organization being the eventual loser. Every day, you hear of a new intrusion. This webinar will look at the problem from a non-conventional perspective to obtain a more secure system.

Questions to be answered during this presentation include:

- Why don’t conventional security measures work for small to medium sized businesses?

- Who makes a company less secure?

- What steps can be taken to make companies more secure?

- How vulnerable are you and your company to spying from competitors and others?

There will be two opportunities to attend this presentation.

Date: Wednesday, December 9, 2015

Location: Online webinar

Additional Information: To register for the 12:30 PM webinar, please click here. To register for the 5:00 PM webinar, please click here. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE WEBINAR:

Alan Gassman will present a free, 30-minute webinar on the topic of PLANNING TO PROTECT MEDICAL PRACTICE ENTITIES AND INCOME.

There will be two opportunities to attend this presentation.

Date: Tuesday, December 15, 2015 | 12:30 PM or 5 PM

Location: Online webinar:

Additional Information: To register for the 12:30 PM webinar, please click here. To register for the 5:00 PM webinar, please click here. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE WEBINAR:

Bill Kahn will join Alan Gassman for a free webinar on the topic of THE SUGAR DADDY HUSTLE.

The classic “Sugar Daddy” situation is usually a win-win for both the male and the female involved. Both understand the situation and are willing participants. But for an older man who has undergone a traumatic life experience, is lonely, and may have somewhat diminished mental capacity, there are certain types of women who will use this to their advantage and make him their unknowing “Sugar Daddy.”

These women have researched the legal aspects of their operation and identified loop holes in the law which they can exploit. They take over the man’s life, make decisions, allow his health to deteriorate, and place him in financial tenuous situations for their own benefit. Within the USA, it amounts to a con of over $3 billion annually.

This webinar will discuss what proactive preventive steps to take when an emotional episode has occurred in an elderly person’s life. If a con has already begun, we’ll look at the signs delineating financial and non-financial abuse. Once in progress, there are steps which should be taken to minimize the impact.

Questions to be answered during this presentation include:

- For elderly men, what is the difference between the conventional Sugar Daddy and the Sugar Daddy Hustle?

- Why are older men more susceptible to being scammed?

- Are there preventive steps which should be taken when a man has recently undergone a traumatic life experience?

- How can you recognize a con?

- What should be done after a scam has begun?

There will be two opportunities to attend this presentation.

Date: Wednesday, December 16, 2015

Location: Online webinar

Additional Information: To register for the 12:30 PM webinar, please click here. To register for the 5:00 PM webinar, please click here. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE ORLANDO PRESENTATION:

REPRESENTING THE PHYSICIAN: THE ONLY CONSTANT IS CHANGE

Alan Gassman will present two talks at the 2016 Annual Florida Bar Health Law and Tax Section Representing the Physician seminar. His topics include:

- A Brief Introduction to the Current State of the Physician’s World (with Lester Perling)

- Creditor Protection for the Medical Practice

Other speakers at this event include Jerome Hesch, Michael O’Leary, Colleen Flynn, Jeff Howard, Darryl Richards, and others.

To download the brochure, or for a complete schedule, please click here.

Date: January 8, 2016 | Mr. Gassman will speak at 8:15 AM and 10:50 AM

Location: Rosen Plaza Hotel | 9700 International Drive, Orlando, FL, 32819

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE KEY WEST PRESENTATION:

MER INTERNAL MEDICINE FOR PRIMARY CARE PROGRAM

Alan Gassman will present four, one-hour, Medical Education Resources, Inc. talks for cardiologists and other doctors who dare attend this outstanding 4-day conference. Join us at Hemingway’s for a whiskey & soda and a ring of the bell. Beach Boys not invited.

Mr. Gassman’s topics will include:

- The 10 Biggest Mistakes that Physicians Make in Their Investment and Business Planning (January 30th: 10:10 AM – 11:10 AM)

- Lawsuits 101: How They Work, What to Expect, and What Your Lawyer and Insurance Carrier May Not Tell You (January 30th: 11:10 AM – 12:10 PM)

- 50 Ways to Leave Your Overhead (January 31st: 8:00 AM – 9:00 AM)

- Essential Creditor Protection and Retirement Planning Considerations (January 31st: 9:00 AM – 10:00 AM)

Date: January 28 – 31, 2016 | Mr. Gassman will speak on Saturday, January 30, from 10:10 AM to 12:10 PM and Sunday, January 31 from 8:00 AM to 10:00 AM

Location: Casa Marina Resort | 1500 Reynolds Street, Key West, FL, 33040

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE COMPLIMENTARY MAUI MASTERMIND WEBINAR:

Alan Gassman will present a free, 45-minute webinar on the topic of ESTATE PLANNING BASICS FOR BUSINESS OWNERS.

This webinar will be specially made for and presented in partnership with Maui Mastermind. There will be two opportunities to attend this presentation.

Date: Wednesday, February 17, 2016 | 12:30 PM or 5 PM

Location: Online webinar:

Additional Information: To register for this presentation or for more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE COMPLIMENTARY MAUI MASTERMIND WEBINAR:

Alan Gassman will present a free, 45-minute webinar on the topic of ASSET PROTECTION BASICS FOR BUSINESS OWNERS.

This webinar will be specially made for and presented in partnership with Maui Mastermind. There will be two opportunities to attend this presentation.

Date: Wednesday, March 16, 2016 | 12:30 PM or 5 PM

Location: Online webinar:

Additional Information: To register for this presentation or for more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE BOSTON PRESENTATION:

INTERACTIVE LEGAL ESTATE & ELDER PLANNING SUMMIT: SUBSTANCE, PROFITS, AND PRACTICE

Alan Gassman will be presenting at the InterActive Estate & Elder Planning Summit on a topic to be determined.

Other speakers include Jonathan Blattmachr, Michael Graham, Pope Francis, Mother Theresa, Thomas Jefferson, and others.

Date: April 20-22, 2016 | Mr. Gassman’s presentation time is TBD.

Location: Courtyard Marriott Boston Downtown | 275 Tremont Street, Boston, MA 02116

Additional Information: For more information, please visit http://ilsummit.com/ or contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE NAPLES PRESENTATION:

3RD ANNUAL AVE MARIA SCHOOL OF LAW ESTATE PLANNING CONFERENCE

This one-day conference will take place in Naples, Florida on Friday, May 6, 2016.

On Thursday, May 5, there will be a special dinner with Jonathan Blattmachr. Jonathan will also present at the conference on Friday. Be sure to bring an extra pair of socks because the first pair will get knocked off by Jonathan’s talk!

Alan’s Friday morning presentation will be entitled COFFEE WITH ALAN: AN INTRODUCTION TO SELECT ESTATE PLANNING AND ASSET PROTECTION STRATEGIES. During this session, Alan will offer an overview of the topics that will be presented throughout the Estate Planning Conference. Attendees new to these specific estate planning areas will find the presentation useful and helpful.

Alan will also moderate the Luncheon Speaker Panel with Jonathan Blattmachr, Stacy Eastland, and Lee-ford Tritt. The panel will cover the topic of WHAT WE WISH WE KNEW WHEN WE STARTED PRACTICING LAW – NON-TAX AND PRACTICAL ADVICE FOR ESTATE PLANNERS YOUNG AND OLD.

Don’t miss it!

Date: May 6, 2016

Location: Ritz Carlton Golf Resort | 2600 Tiburon Drive, Naples, FL, 34109

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE COMPLIMENTARY MAUI MASTERMIND WEBINAR:

Alan Gassman will present a free, 45-minute webinar on the topic of EQUITY STRIPPING AND OTHER ADVANCED ASSET PROTECTION IDEAS.

This webinar will be specially made for and presented in partnership with Maui Mastermind. There will be two opportunities to attend this presentation.

Date: Wednesday, May 11, 2016 | 12:30 PM or 5 PM

Location: Online webinar:

Additional Information: To register for this presentation or for more information, please contact Alan Gassman at agassman@gassmanpa.com.

Notable Events by Others

LIVE ORLANDO PRESENTATION:

50TH ANNUAL HECKERLING INSTITUTE ON ESTATE PLANNING

Date: January 11 – January 15, 2016

Come celebrate the 50th Year Anniversary (and 32 years of Alan Gassman not speaking at this conference) with us and our many friends (or at least they pretend to like us) at this important annual estate planning event.

Please visit the InterActive Legal booth to see the new Alan Gassman Florida Channel and get a free book of your choice by being one of the first to sign up for this new, monthly, interactive, computer-based library featuring several of Alan’s books.

Special thanks to Michael Graham of InterActive Legal for risking their entire operation on the success of this channel.

Location: Orlando World Center Marriott Resort & Convention Center | 8701 World Center Drive, Orlando, FL 32821

Additional Information: Registration for the 50th Annual Heckerling Institute on Estate Planning opened on August 3, 2015. For more information, please visit http://www.law.miami.edu/heckerling/.

**********************************************************

LIVE ST. PETERSBURG PRESENTATION:

ALL CHILDREN’S HOSPITAL FOUNDATION 18TH ANNUAL ESTATE, TAX, LEGAL & FINANCIAL PLANNING SEMINAR

We are pleased to announce that Jonathan Blatttmachr, Howard Zaritsky, Lee-Ford Tritt, Lauren Detzel, Michael Markham, and others will be speaking at the 2016 All Children’s Hospital Estate, Tax, Legal & Financial Planning Seminar.

Lauren Detzel will be speaking on Family Law and Tax Planning for Divorce, Michael Markham will be speaking on Bankruptcy and Creditor Protection/Fraudulent Transfers in the Context of Estate Planning, Howard Zaritsky will talk about Income and Estate Tax Planning Techniques in View of Recent Developments, and Lee-Ford Tritt will speak on Gun Trusts and Same Sex Marriage Consideration Highlights. Do not miss this important conference.

We thank Lydia Bailey and Lori Johnson for their incredible dedication (and patience with certain members of the Board of Advisors.) All Children’s Hospital is affiliated with Johns Hopkins.

Date: Wednesday, February 10, 2016

Location: Live Event at the All Children’s Hospital St. Petersburg Campus; Live webcasts in Tampa, Fort Myers, Belleair, New Port Richey, Lakeland, and Sarasota

Additional Information: Please contact Lydia Bennett Bailey at lydia.bailey@allkids.org for more information.

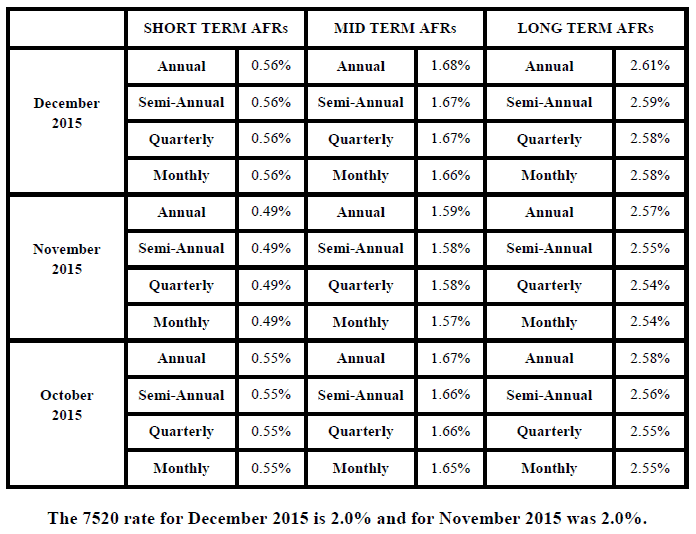

Applicable Federal Rates

Below we have this month, last month’s, and the preceding month’s Applicable Federal Rates, because for a sale you can use the lowest of the 3.