The Thursday Report – 10.29.15 – The Best Edition Ever

Lawsuits Involving Physician Non-Compete Clauses Must be Decided on a Case-by-Case Basis

The IRA Aggregation Rule and Pro-Rata Taxation of After-Tax IRA Dollars by Michael Kitces

A Life Insurance Interview with Barry Flagg and Alan Gassman, Part I

The 5 Biggest Obstacles to Build a Professional Practice by David Finkel

Richard Connolly’s World – Family Dynamics and Estate Planning

Thoughtful Corner – Trips and Tricks for a Safe Halloween

Humor! (or Lack Thereof!)

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Stephanie at stephanie@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

Lawsuits Involving Physician Non-Compete Clauses

Must be Decided on a Case-by-Case Basis

by Alan Gassman, Alyssa Eberle, and Travis Arango

The recent Florida Second District court case of AmSurg New Port Richey FL, Inc. v. Vangara involved a contractual obligation by the physician to not compete with the ambulatory surgery center (ASC) of which he was an investor. While physician non-compete provisions are common in Florida, the area of law surrounding them is not uniform. Indeed, the Court in this instance applied Tennessee law, as per the contract between the parties involved. The fact-specific inquiry of whether or not the non-compete is enforceable does not establish precedent for many jurisdictions, and therefore, the lawsuits must be decided on a case-by-case basis.

In the Vangara case, the company brought action against the physician for breach of a non-compete provision after the company learned that the physician was operating a competing ambulatory surgery business. The Court applied Tennessee law and held that the non-compete provision was enforceable because it only prohibited the physician from engaging in a competing business venture, rather than preventing him from engaging in the practice of medicine.[1]

Vangara involved the application of a non-compete clause contained in the parties’ joint venture contract which was governed by the laws of Tennessee. In 2007, Dr. Vangara and his business associates entered into a joint venture with AmSurg. AmSurg paid Dr. Vangara and his associates over $2.4 million in exchange for part ownership in this joint venture. An agreement was signed, which included a provision entitled “Ownership and Investment Restrictions,” which provides in pertinent part:

8.2 Ownership and Investment Restrictions. No Owner nor any Affiliate of any Owner shall have any…ownership interest in, or manage, lease, develop or otherwise have any financial interest in any business or entity competing or planning to compete with the LLC (including but not limited to, any ambulatory surgery center or any physician office in which surgical procedures are performed and for which facility fees or tray fees are charged)…

The foregoing shall not prohibit any Owner, nor any Affiliate of an Owner, from…practicing medicine or performing surgical procedures at any facility…The parties acknowledge and agree that this Section 8.2 does not require physician owners to perform surgical procedures at the Center or to refer patients to the Center, and imposes no restrictions on where such procedures are performed or where referrals are made.

Each Owner acknowledges and agrees that the enforcement of the provisions of this Section 8.2 against him or her would not prevent such person from engaging in his or her profession, the practice of medicine.[2]

In 2010, AmSurg discovered that Dr. Vangara was operating a competing ambulatory surgery center and sent numerous cease and desist letters. When Dr. Vangara continued, AmSurg filed suit against him for breach of contract, among other claims.

Since the contract containing the non-compete clause provided that it is to be governed by the laws of Tennessee, the Florida District Court of Appeals applied Tennessee law to their analysis. The Florida court relied on the Tennessee Supreme Court case of Murfreesboro Medical Clinic, P.A. v. Udom to determine if the non-compete provision was invalid and unenforceable.[3]

In Murfreesboro, a medical clinic entered into an employment contract with a physician, which contained a non-compete clause. The clause provided that: “upon any termination of this Agreement…, the Employee agrees not to engage in the practice of medicine within a twenty-five (25) mile radius…for a period of eighteen (18) months following” termination of his employment.[4]

Later, the medical clinic elected not to renew the physician’s contract and enforced the non-compete clause, even prohibiting the physician from working at a medical center that did not compete for patients with the clinic.[5]

The Supreme Court of Tennessee noted that such non-compete clauses are to be strictly construed in favor of the employee and set forth four factors that are to be utilized in determining whether the non-compete is reasonable:

(1) the consideration supporting the covenant; (2) the threatened danger to the employer in the absence of the covenant; (3) the economic hardship imposed on the employee by the covenant; and (4) whether the covenant is inimical to the public interest.[6]

After surveying those factors and other important public policy considerations, the Tennessee Supreme Court held that “except for restrictions specifically provided for by statute, covenants not to compete are unenforceable against physicians.”[7]

However, the Florida District Court rejected the analysis in Murfreesboro, holding that it cannot be read “so broadly as to invalidate the non-compete clause entered into by the parties here.”[8] The main issue, the Court noted, was the relationship of a physician to his or her patients. Pursuant to Murfreesboro, a non-compete which restricts a physician from practicing medicine is unenforceable except in limited circumstances. The non-compete clause in this instance did not prevent Dr. Vangara from engaging in the practice of medicine. In fact, the Court noted, the provision specifically states that it does “not prevent such person from engaging in his or her profession, the practice of medicine.”[9] It only prohibits him from engagement in a business venture that competes directly against AmSurg. Therefore, the Florida court did not apply the holding in Murfreesboro.

Even though the Florida Court in AmSurg applied Tennessee law and precedent, it is instructive on how courts will analyze non-compete provisions in Florida. Florida statutes specifically permit non-compete provisions, and therefore, if a case factually analogous to AmSurg appeared in Florida courts, the enforcement of this type of non-compete would be even stronger.

Some commentators have been mislead into assuming liquidated damages provisions should be included in employment agreements along with non-competes, but they are entirely different and should not be confused. In Humana Medical Plan v. Jacobson, the court held that a liquidated damages provision was invalid against public policy.[10] The provision stated:

In the event that any Member disenrolls from [Humana’s] health plan to be treated by you…under some other prepaid financial arrangement other than [Humana’s] health plan, then you shall pay to [Humana] the amount of $700 for each such Member who is treated by you…You hereby agree to waive any claim that this amount is a penalty.[11]

The court stated that this clause was added as a deterrent to prevent the doctor from changing HMO affiliations and thus is void under public policy. The court went on to say “this clause needlessly hindered the continuation of his existing and successful doctor/patient relationships by driving a financial wedge between the doctor and his patients.”

The courts have therefore made it very clear that if there is a provision in an employment agreement that would prevent a physician from practicing medicine, the provision is not valid. It is thus important that non-compete provisions comply with public policy as well as with applicable state law.

**************************************************

[1] 159 So. 3d 260 (Fla. 2nd DCA 2015).

[2] Id.

[3] 166 S.W. 3d 674 (Tenn. 2005).

[4] Id at 676.

[5] Id at 677.

[6] Id at 678.

[7] Id at 684.

[8] 159 So. 3d 260, 263 (Fla. 2nd DCA 2015).

[9] Id.

[10] Humana Medical Plan, Inc. v. Jacobson, 614 So. 2d 520 (1992).

[11] Id.

The IRA Aggregation Rule and Pro-Rata Taxation

of After-Tax IRA Dollars

by Michael E. Kitces

Michael E. Kitces, MSFS, MTAX, CFP®, CLU, ChFC, RHU, REBC, CASL, is a nationally recognized speaker and sought-after commentator on financial planning issues. He also writes extensively on a broad range of advanced financial planning topics. He is the co-author of books such as The Advisor’s Guide to Annuities and Tools & Techniques of Retirement Income Planning. He is currently a Director of Planning Research and a Partner at Pinnacle Advisory Group, Inc.

The following article was originally published on the blog Nerd’s Eye View: Commentary on Financial Planning News and Developments by Michael E. Kitces on October 14, 2015. Excerpts from the article are re-produced below.

To see the article in its entirety, please click here.

The IRA aggregation rule was created to limit the ability of taxpayers to take advantage of ‘abusive’ IRA tax strategies by requiring that all IRAs are aggregated together to determine the tax consequences of a distribution from any of them.

The primary impact of the IRA aggregation rule is to determine how much of an IRA’s non-deductible contributions are treated as an after-tax return of principal when a taxable distribution occurs, whether as a withdrawal or a Roth conversion, and by forcing all accounts to be aggregated together, the rule severely limits many individuals from taking advantage of the so-called “backdoor Roth contribution” strategy.

However, the IRA aggregation rule reaches much further than just the taxability of after-tax contributions in existing IRAs. Thanks to the recent Bobrow case, it now also applies to the limitation of no more than one 60-day rollover in any 12-month period. Though on the plus side, the IRA aggregation rules apply to required minimum distribution (RMD) obligations as well, allowing a distribution from any IRA to satisfy the RMD rules for all IRA accounts!

Fortunately, though, the IRA aggregation rules do not apply when calculating substantially equal periodic payments (SEPP) under Section 72(t), reducing the danger that a withdrawal from one IRA could constitute a “modification” of the ongoing 72(t) distributions from another that would trigger a retroactive penalty. However, even in the case of SEPPs, the IRA aggregation rules will still apply in determining how much of a 72(t) payment constitutes a tax-free return on non-deductible contributions!

What is the IRA Aggregation Rule?

The IRA Aggregation Rule, under IRC Section 408(d)(2), stipulates that when determining the tax consequences of an IRA distribution – particularly the “pro-rata” rule under IRC Section 72(e)(8) and also the early withdrawal penalty under IRC Section 72(t)(1) – the value of all IRA accounts will be aggregated together for the purpose of any tax calculations.

Notably, this IRA aggregation rule under IRC Section 408(d)(2) is explicitly only for IRA accounts; employer retirement plans, like a 401(k), 403(b), or profit-sharing plan, are not included in applying these IRA aggregation rules. In addition, under Treasury Regulation 1.408-8, Q&A-9, an inherited IRA is not aggregated together with an individual’s own IRAs, nor is a Roth IRA. Since the IRA rules are applied individually (even as a married couple, the tax consequences are determined individually before being reported on a joint tax return), an individual’s IRA is never aggregated with a spouse’s own IRA accounts.

Given that the treatment of a traditional IRA is that any distributions are pre-tax funds and 100% fully taxable anyway, the IRA aggregation rule is often a moot point. As when a distribution is already 100% taxable, there’s no pro-rata formula to apply, and if applicable at all, the 10% early withdrawal penalty would apply to the entire account anyway.

However, as soon as an IRA has any non-deductible (i.e. after-tax) contributions included, the IRA aggregation rule is immediately relevant.

The IRA Aggregation Rule and Pro-Rata Distributions of Non-Deductible (After-Tax) IRA Contributions

When an IRA has received any non-deductible contributions, the distribution of those dollars is received tax-free as a return of (after-tax) contributions. The amount of any non-deductible contributions that have been made over time is tracked on IRS Form 8606.

The caveat, as noted earlier, is that when a distribution occurs from an IRA that includes non-deductible contributions, the calculation to determine how much of the distribution will be a return of principal must be done on a pro-rata basis under IRC Section 72(e)(8). (Unlike a Roth IRA, where under IRC Section 408A(d)(4)(B) distributions are presumed to come explicitly from after-tax contributions first.)

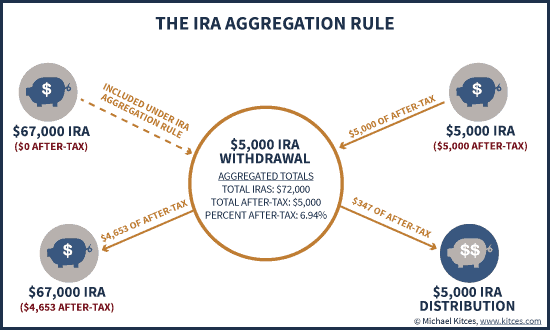

Example 1a. Charlie has a $72,000 IRA that includes $5,000 of non-deductible contributions made years ago and tracked as such on Form 8606. If Charlie decides to take a $5,000 withdrawal, though, he can’t just take out the $5,000 of after-tax contributions on a tax-free basis (the way he could receive back his after-tax contributions from a Roth IRA); instead, the pro-rata rule applies. Since Charlie’s account is $5,000/$72,000 = 6.94% after-tax, his $5,000 withdrawal is deemed to be only $347 of after-tax funds (6.9% of the $5,000) and the other $4,653 is taxable. In turn, the remaining $4,653 of after-tax funds remains behind as part of the $67,000 that is still in his IRA account.

Example 1b. Continuing the prior example, assume instead that Charlie had an existing $67,000 IRA that was all pre-tax funds and had more recently made a $5,000 non-deductible contribution to a brand new IRA #2. But Charlie has decided that he needs to use some of the money, so he now wants to distribute the $5,000 non-deductible IRA, hoping to recover the funds tax-free.

Unfortunately, though, even if Charlie withdraws just $5,000 from just IRA #2 that had just after-tax funds in it, the tax consequences are still the same as the preceding example – Charlie’s total IRA accounts are $72,000, his total after-tax funds are $5,000, which means the $5,000 withdrawal will be 6.94% return of after-tax funds with the remainder taxable. Thus, Charlie will end up reporting $4,653 of his withdrawal as taxable, even though he solely converted IRA #2 that originally had only after-tax contributions!

Ultimately, example 1b and the associated chart above show how the IRA aggregation rule plays out when multiple IRAs are involved. Even if a distribution comes from an account that was otherwise 100% funded with non-deductible after-tax funds, it still ends up being partially taxable if/when any other IRAs are aggregated into the calculation! And notably, the end result of this strategy in the example above is that the remaining $4,653 of after-tax funds not treated as being part of the withdrawal from IRA #2 have effectively be transmuted into after-tax contributions associated with IRA #1 (even though the contributions were never made to that account in the first place!)

To read the remaining sections of this article, including The IRA Aggregation Rule and Roth Conversion Strategies; Bobrow v. Commissioner, The Once-Per-Year IRA Rollover Rule, and the IRA Aggregation Rule; The IRA Aggregation Rule and Satisfying Required Minimum Distribution (RMD) Obligations; and When the IRA Aggregation Rule Does Not Apply – 72(t) Substantially Equal Periodic Payments (SEPP), please click here to view the article on Nerd’s Eye View.

A Life Insurance Interview with Barry Flagg and Alan Gassman, Part I

Barry Flagg and Alan Gassman recently appeared on a podcast interview on the subject of their article, “Ten Questions to Ask About a Client’s Life Insurance and Planning: What Every Estate Planning or Tax Planning Advisor Should Know.” The interview was conducted by experienced life insurance executive Randy Zipse, and the transcript is as follows:

Randy Zipse: Really, Alan, what was your motivation for the “10 Questions article?”

Alan Gassman: As a tax and estate planning lawyer, whenever I sit down with a client or I sit down with a trustee and I talk about a life insurance policy and I ask them what it is and what they think it is, what I hear them say is never what it actually is. There are almost always a lot of misconceptions, a lot of misunderstandings, and a lot of assumptions that, quite frankly, even the most conscientious life insurance agent or advisor is going to have a hard time laying out straight and making sure that people really understand what the product is, what it does, what it can be expected to do, and what it doesn’t do.

I see such a challenge for your industry in this area, but I also see opportunities in which good agents and conscientious practitioners can make sure that these things are understood and structure policies to be as good as they can be.

I thought it was a really great opportunity to write this article with Barry and learn from Barry, while also brainstorming with Barry as to what the standards of this industry should be and how you would bring a tax lawyer or a trustee up to speed on what we need to know so that our clients can be well-served in this area.

Randy Zipse: Can you talk a little bit about Question One in your article?

Alan Gassman: When I meet with life insurance agents, oftentimes, I’m very impressed with their acumen. I’m very impressed with their training. They commonly have Master’s degrees in finance. A lot of them have actuarial backgrounds like Barry, but then others, quite candidly, have a high school diploma, and then they took the 40-hour state course.

So my question back to you, Randy, and also Barry, is how can a tax and estate planning professional know that the person we are dealing with is going to actually understand his or her own product and the needs of our clients? Because sometimes they seem to really be confused over what the terms of the products are, what the guarantees mean, what illustrated versus guaranteed means, and that type of thing. As a lawyer, I have a fiduciary duty to every single client, and a trustee has a fiduciary duty to every single client, which is much, much higher and much different than the suitability standard that often applies to life insurance agents. Whether the clients possibly need this product, and is this product not the worst one available – that’s a lot different than a fiduciary standard. Barry and I know from experience that lawyers are going to refer clients to agents and agencies who act like fiduciaries.

Randy Zipse: Can you talk a little bit about how an individual life insurance policy ought to be owned and some of the things you look at in the article?

Alan Gassman: That is a very good question. When I started practicing law in the 1980s, almost every life insurance policy for an affluent family went into an irrevocable life insurance trust to avoid federal estate tax. Typically, the husband would buy a life insurance policy. He would make the wife the trustee of a trust that was irrevocable. The wife could get what she needed for health, education, and maintenance, and then, when the husband died, that would not be part of his estate. Back then, we had a $600,000.00 estate tax exemption.

Now, we have a $5,430,000.00 estate tax exemption, and if the client is not going to use their entire $5,430,000.00 exemption on assets when they die, the inclination is to allow the life insurance to fund a credit shelter trust or even to rely upon the portability allowance, which I’m sure most of our listeners understand. So life insurance trusts are used much less often, but I would really think twice about not using an irrevocable life insurance trust.

One reason is that when you die and leave the life insurance to a credit shelter trust or your children, part of your estate tax exemption gets used up, so there’s less portability allowance going to the surviving spouse. That needs to really be considered because you don’t want to have the surviving spouse come up to you and say, “Hey, why did you cost me $1,000,000 of my portability allowance when you could have done an irrevocable life insurance trust?” Secondly, these irrevocable life insurance trusts are creditor protected.

Now, in many states like Florida, where I practice, and New York and others, the cash value of a life policy will be creditor protected, but not in all states. For example, in Colorado, it’s limited to $100,000, so that would be another reason to use an irrevocable life insurance trust.

What you typically don’t want to do is have the life insurance policy owned by the person who will be the surviving spouse, primarily because, if I die with a life insurance policy, and I leave it to a trust on my death for my wife, her creditors can’t reach it, and it’s not going to be subject to federal estate tax when she dies. On the other hand, if she owns the policy, her creditors can reach the death benefit in most states, and it can’t go into a life insurance trust. It has to go into her estate when I die, so there are a lot of considerations there.

Another consideration is that people are not using split-dollar enough because they just don’t understand it. It got too darn complicated. In a nut shell, you can make a low interest loan at the applicable federal rate that applies to the life expectancy of the client and advance it to the trust. You don’t have to be repaid until the insured dies, and that’s a great economic deal that most advisors, quite frankly, just don’t understand because it got so complicated. So Barry how would you help me on this?

Barry Flagg: I’m not sure I can add much more to the above answer than compliments. You know, we were working on this question, and I was a victim of the thinking that you were talking about earlier that too many people thought that with the IRS codifying split-dollar regulations and the exemption going up to $5,000,000 plus…so I talked to a number of tax advisors, and there was a lot less conversation around it, and then we talked about what you just described, and I thought, “Wow, what a great idea to go talk to tax advisors about something that, for whatever reason, just kind of fell off their radar screen.” I thought that was great thinking.

Alan Gassman: Thanks, Barry. These concepts would certainly be a very good communications tool for an insurance agent. Many of my colleagues in the tax law area are not looking at these issues. A nudge in the right direction should be very much appreciated.

Stay tuned for more with Alan Gassman and Barry Flagg in subsequent editions of The Thursday Report.

The 5 Biggest Obstacles to Build a Professional Practice

by David Finkel

David Finkel is the Wall Street Journal bestselling author of SCALE: Seven Proven Principles to Grow Your Business and Get Your Life Back, which can be viewed by clicking here. As the CEO of Maui Mastermind, he has worked with 100,000+ business coaching clients and community members to buy, build, and sell over $5 billion worth of businesses.

Whether you are building a medical practice, accounting, or law firm, engineering or consulting practice, or financial services firm, here are concrete insights to sidestep the five biggest obstacles that trip up most business owners who run professional service firms.

Obstacle #1: Growing beyond the personal production of the owner (partners) in the professional practice.

8 of 10 professional practices never grow beyond the personal production of the owner of the practice. This means that with the exception of a few support staff, these businesses are limited to the personal sales and production capacity of just the prime owners of the business.

At my business coaching company Maui Mastermind, we call this the “Self-Employment Trap.” This is where you, the owner of the business, are so consumed by your day-to-day production for the business that you don’t have the time or space to step back and focus on growing your professional practice as a business. In essence, you have built a self-employed job, not a business.

Take the case of Patricia, a successful doctor. For years, Patricia was the main point of treatment for all her patients. She had staff who leveraged her, but they did just that – circled her and helped her produce more.

To scale, Patricia needed to bring in other team members who could both treat and sell (which, in her case, was doing the initial diagnostic evaluation.) During our two years working together, she did this growing significantly. Best of all, she lowered the practice’s reliance on her and gained over 300 hours of freed-up time per year in the process.

Yet this isn’t how most professional practices do things. Typically, the owner is too scared or convinced he or she can’t bring in other talent to replicate the core service offering that the owner stays stuck as the core producer for the business.

Click here to continue reading this article on inc.com. You can also follow David on Twitter: @DavidFinkel.

Richard Connolly’s World

Family Dynamics and Estate Planning

Insurance advisor Richard Connolly of Ward & Connolly in Columbus, Ohio often shares with us pertinent articles found in well-known publications such as The Wall Street Journal, Barron’s, and The New York Times. Each week, we will feature some of Richard’s recommendations with links to the articles.

This week, the first article of interest is “Family Feud! 6 Stories of Problematic Estate Planning” by Kristin Appenbrink. This article appeared on Forbes.com on February 19, 2015.

Richard’s description is as follows:

We won’t sugarcoat it: Estate planning can be tricky business.

Without a document detailing how you want your estate divided and distributed, your assets could end up in the hands of a relative you haven’t spoken to in years, or your teenager could have access to a fat bank account before he or she has even the first clue about how to manage money wisely.

To illustrate just how important it is to stay on top of your estate planning game, this article asks six legal pros from across the country to recount their clients’ most egregious estate planning mistakes and share advice for how you can sidestep the same land mines.

The six mistakes discussed in this article are as follows:

- Naming an Executor Who Doesn’t Play Fair

- Failing to Maintain a Valid Will

- Making Heirs Duke it Out Over Coveted Items

- Neglecting to Update Beneficiaries Following Big Life Changes

- Forgetting About Valuable Personal Effects

- Gifting Money to Minors with No Rules

Please click here to read this article in its entirety.

The second article of interest this week is “Sibling Rivalry Complicates Estate Planning” by Veronica Dagher. This article was featured in The Wall Street Journal on September 9, 2015.

Richard’s description is as follows:

When a parent dies, siblings may battle for years over their inheritance.

Inheritances can bring out the worst in quarrelsome family members, especially when the inheritance distribution is seen as unfair. Fortunately, there are ways for estate planners to prepare for that.

This article details how many sibling battles can be avoided, using the estate of guitarist Jimi Hendrix as an example.

Please click here to read this article in its entirety.

Thoughtful Corner

Tips and Tricks for a Safe Halloween

Going out trick-or-treating this weekend? The CDC (Centers for Disease Control and Prevention) published the following to help keep trick-or-treaters and their families safe:

S – Swords, knives, and other costume accessories should be short, soft, and flexible.

A – Avoid trick-or-treating alone. Kids should walk in groups or with a trusted adult.

F – Fasten reflective tape to costumes and bags to help drivers see you.

E – Examine all treats for choking hazards and tampering before eating them.

H – Hold a flashlight while trick-or-treating to help you see and to help others see you.

A – Always test make-up in small areas first to prevent possible skin and eye irritation.

L – Look both ways before crossing streets. Use crosswalks whenever possible.

L – Lower your risk for serious eye injury by avoiding decorative costume contact lenses.

O – Only walk on sidewalks when possible. If not, stay on the far edge of the road. Face traffic.

W – Wear well-fitting masks, costumes, and shoes to avoid blocked vision, trips, and falls.

E – Eat only factory-wrapped treats. Avoid homemade treats made by strangers.

E – Enter homes only if with a trusted adult. Only visit well-lit houses.

N – Never walk near lit candles or luminaries. Wear flame-resistant costumes.

If you are expecting trick-or-treaters and their families at your house, be sure walking areas, stairs, and pathways to your front door are well-lit and free of obstacles that could cause someone to fall. Jack o’ lanterns, luminaries, and other decorations should be kept away from doorsteps, walkways, landings, and curtains. Never leave anything with an open flame unattended, and keep such items out of reach of pets and small children. It is best to keep pets away from trick-or-treaters and the frequently-opening front door, but make sure your pet has the proper identification before Halloween, just in case an escape does occur.

If you are planning to be out driving on Halloween night, take the following safety tips into consideration:

- Slow down and be alert in residential neighborhoods. Children may move in unpredictable ways.

- Enter and exit driveways and alleys slowly and carefully.

- Don’t immediately pass stopped drivers. They may be dropping off children.

- Anticipate heavy pedestrian traffic in residential areas. Take extra time to look for kids at intersections and on curbs.

- Turn your headlights on earlier in the day to spot children from greater distances. This will also help the children see you.

- Trick-or-treating often occurs between 5:30 PM and 9:30 PM. Be especially alert during those hours.

You can download a Halloween Safety Fact Sheet from the US Consumer Product Safety Commission by clicking here.

Humor! (or Lack Thereof!)

Sign Saying of the Week

**************************************************

Upcoming Seminars and Webinars

Calendar of Events

LIVE MANHATTAN PRESENTATION:

INTERACTIVE ESTATE AND ELDER PLANNING LEGAL SUMMIT

Alan Gassman will be speaking on SCIENTIFIC MARKETING FOR THE ESTATE PLANNER – HOW TO DO MORE OF WHAT YOU LOVE TO DO AND LESS OF THE OTHER WHILE BETTER SERVING CLIENTS, COLLEAGUES, AND YOUR COMMUNITY.

Other speakers include Jonathan Blattmachr, Austin Bramwell, Natalie Choate, Mitchell Gans, and Gideon Rothschild.

Date: November 4 – 6, 2015 | Alan Gassman will be speaking on November 5

Location: New York Hilton Midtown Manhattan | 1335 Avenue of the Americas, New York, NY 10019

Additional Information: Please contact Alan Gassman at agassman@gassmanpa.com for more information or visit http://ilsummit.com/ to register.

**********************************************************

LIVE PRESENTATION

Alan Gassman will present a talk at the November meeting of the Suncoast Estate Planning Council on the topic of PORTABILITY UNDER NEW REGULATIONS AND ALICE’S LOOKING GLASS.

Date: Thursday, November 12, 2015 | 8:00 AM – 9:00 AM

Location: All Children’s Hospital | 501 6th Avenue South, St. Petersburg, FL, 33701

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com or Byron Smith at bsmith@gsscpa.com.

**********************************************************

LIVE WEBINAR:

Alan Gassman will present a free webinar on the topic of ASSET PROTECTION CHECKLIST ITEMS YOU HAVE NOT THOUGHT ABOUT.

There will be two opportunities to attend this presentation.

Date: Tuesday, November 17, 2015

Location: Online webinar

Additional Information: To register for the 12:30 PM webinar, please click here. To register for the 5:00 PM webinar, please click here. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE WEBINAR:

Bill Kahn will join Alan Gassman for a free webinar on the topic of CREATIVE BUSINESS SECURITY.

Company espionage is big business, and it’s not just limited to biggies. When a new business is in its early stages or before it has its operational system laid out in concrete, establishing the right security concepts can carry through as it grows. It minimizes unwanted exposure and unneeded expense of later changing how it operates. Preventing vulnerability to hackers, for example, would be one consideration. Making sure cell and office phones can’t be bugged and keeping competitors and governments from spying on the operation should also be an upfront consideration.

A business doesn’t have to be the NSA to make all of these things a reality. Conventional methods of information security, no matter how effective they profess to be, just end up with an organization being the eventual loser. Every day, you hear of a new intrusion. This webinar will look at the problem from a non-conventional perspective to obtain a more secure system.

Questions to be answered during this presentation include:

- Why don’t conventional security measures work for small to medium sized businesses?

- Who makes a company less secure?

- What steps can be taken to make companies more secure?

- How vulnerable are you and your company to spying from competitors and others?

There will be two opportunities to attend this presentation.

Date: Wednesday, November 18, 2015

Location: Online webinar

Additional Information: To register for the 12:30 PM webinar, please click here. To register for the 5:00 PM webinar, please click here. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE WEBINAR:

Bill Kahn will join Alan Gassman for a free webinar on the topic of THE SUGAR DADDY HUSTLE.

The classic “Sugar Daddy” situation is usually a win-win for both the male and the female involved. Both understand the situation and are willing participants. But for an older man who has undergone a traumatic life experience, is lonely, and may have somewhat diminished mental capacity, there are certain types of women who will use this to their advantage and make him their unknowing “Sugar Daddy.”

These women have researched the legal aspects of their operation and identified loop holes in the law which they can exploit. They take over the man’s life, make decisions, allow his health to deteriorate, and place him in financial tenuous situations for their own benefit. Within the USA, it amounts to a con of over $3 billion annually.

This webinar will discuss what proactive preventive steps to take when an emotional episode has occurred in an elderly person’s life. If a con has already begun, we’ll look at the signs delineating financial and non-financial abuse. Once in progress, there are steps which should be taken to minimize the impact.

Questions to be answered during this presentation include:

- For elderly men, what is the difference between the conventional Sugar Daddy and the Sugar Daddy Hustle?

- Why are older men more susceptible to being scammed?

- Are there preventive steps which should be taken when a man has recently undergone a traumatic life experience?

- How can you recognize a con?

- What should be done after a scam has begun?

There will be two opportunities to attend this presentation.

Date: Wednesday, December 9, 2015

Location: Online webinar

Additional Information: To register for the 12:30 PM webinar, please click here. To register for the 5:00 PM webinar, please click here. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE WEBINAR:

Bill Kahn will join Alan Gassman for a free webinar on the topic of WHY OUR GOVERNMENT REJECTS PUBLIC IDEAS AND KEEPS PEOPLE IN THE DARK ABOUT SERIOUS ISSUES.

In the area of rejecting ideas, consider this country has won more Nobel prizes than any other country, yet getting new ideas into the government from the general public is almost impossible. Yes, pulling the gems from the pile and evaluating them can be a problem. Unfortunately, it really doesn’t matter whether the potential ideas save lives, money, or time. The government generally ignores them.

Questions to be answered during this presentation include:

- Why are ideas often ignored by politicians and government agencies?

- What drives the motivations of politicians and government agencies?

- Why does the government try to keep the public in the dark about certain subjects?

- Does the government classify things that shouldn’t be marked as classified? Is that against the law?

There will be two opportunities to attend this presentation.

Date: Wednesday, January 6, 2016

Location: Online webinar

Additional Information: To register for the 12:30 PM webinar, please click here. To register for the 5:00 PM webinar, please click here. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE ORLANDO PRESENTATION:

REPRESENTING THE PHYSICIAN: THE ONLY CONSTANT IS CHANGE

Alan Gassman will present two talks at the 2016 Representing the Physician seminar. His topics include:

- A Brief Introduction to the Current State of the Physician’s World (with Lester Perling)

- Creditor Protection for the Medical Practice

Other speakers at this event include Jerome Hesch, Michael O’Leary, Colleen Flynn, Jeff Howard, Darryl Richards, and others.

To download the brochure, or for a complete schedule, please click here.

Date: January 8, 2016 | Mr. Gassman will speak at 8:15 AM and 10:50 AM

Location: Rosen Plaza Hotel | 9700 International Drive, Orlando, FL, 32819

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE KEY WEST PRESENTATION:

MER INTERNAL MEDICINE FOR PRIMARY CARE PROGRAM

Alan Gassman will present four, one-hour, Medical Education Resources, Inc. talks for cardiologists and other doctors who dare attend this outstanding 4-day conference. Join us at Hemingway’s for a whiskey & soda and a ring of the bell. Beach Boys not invited.

Mr. Gassman’s topics will include:

- The 10 Biggest Mistakes that Physicians Make in Their Investment and Business Planning (January 30th: 10:10 AM – 11:10 AM)

- Lawsuits 101: How They Work, What to Expect, and What Your Lawyer and Insurance Carrier May Not Tell You (January 30th: 11:10 AM – 12:10 PM)

- 50 Ways to Leave Your Overhead (January 31st: 8:00 AM – 9:00 AM)

- Essential Creditor Protection and Retirement Planning Considerations (January 31st: 9:00 AM – 10:00 AM)

Date: January 28 – 31, 2016 | Mr. Gassman will speak on Saturday, January 30, from 10:10 AM to 12:10 PM and Sunday, January 31 from 8:00 AM to 10:00 AM

Location: Casa Marina Resort | 1500 Reynolds Street, Key West, FL, 33040

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE NAPLES PRESENTATION:

3RD ANNUAL AVE MARIA SCHOOL OF LAW ESTATE PLANNING CONFERENCE

This one-day conference will take place in Naples, Florida on Friday, May 6, 2016.

On Thursday, May 5, there will be a special dinner with Jonathan Blattmachr. Jonathan will also present at the conference on Friday.

Alan’s Friday morning presentation will be entitled COFFEE WITH ALAN: AN INTRODUCTION TO SELECT ESTATE PLANNING AND ASSET PROTECTION STRATEGIES. During this session, Alan will offer an overview of the topics that will be presented throughout the Estate Planning Conference. Attendees new to these specific estate planning areas will find the presentation useful and helpful.

Alan will also moderate the Luncheon Speaker Panel with Jonathan Blattmachr, Stacy Eastland, and Lee-ford Tritt. The panel will cover the topic of WHAT WE WISH WE KNEW WHEN WE STARTED PRACTICING LAW – NON-TAX AND PRACTICAL ADVICE FOR ESTATE PLANNERS YOUNG AND OLD.

Don’t miss it!

Date: May 6, 2016

Location: Ritz Carlton Golf Resort | 2600 Tiburon Drive, Naples, FL, 34109

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com.

Notable Events by Others

LIVE ST. PETERSBURG PRESENTATION:

ST. PETERSBURG COLLEGE FOUNDATION PRESENTS THE WOZNIAK PROJECT

Apple co-founder Steve Wozniak will be the first featured speaker in the new St. Petersburg College Foundation Distinguished Speakers series.

Wozniak is a Silicon Valley icon and philanthropist who helped shape the computing industry with his design of Apple’s first line of products. In 1976, he and Steve Jobs founded Apple Computer, Inc. In 1985, for his achievements with Apple, Wozniak was awarded the National Medal of Technology, the highest honor bestowed on America’s leading technological innovators. He was inducted into the Inventors Hall of Fame in 2000.

Join Steve Wozniak and the Foundation for a lively, interactive discussion. Charitable proceeds will benefit the St. Petersburg College Foundation. Tickets range from $85 to $95.

Thanks to the Bank of Tampa, Merrill Lynch Wealth Management, Raymond James, and the CPA firm of Gregory Sharer and Stuart for being sponsors of this event.

Date: Monday, November 2, 2015 | 7:00 PM

Location: The Palladium Theater | 253 Fifth Avenue North, St. Petersburg, FL 33701

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE ORLANDO PRESENTATION:

50TH ANNUAL HECKERLING INSTITUTE ON ESTATE PLANNING

Date: January 11 – January 15, 2016

Come celebrate the 50th Year Anniversary (and 32 years of Alan Gassman not speaking at this conference) with us and our many friends (or at least they pretend to like us) at this important annual estate planning event.

Location: Orlando World Center Marriott Resort & Convention Center | 8701 World Center Drive, Orlando, FL 32821

Additional Information: Registration for the 50th Annual Heckerling Institute on Estate Planning opened on August 3, 2015. For more information, please visit http://www.law.miami.edu/heckerling/.

**********************************************************

LIVE ST. PETERSBURG PRESENTATION:

ALL CHILDREN’S HOSPITAL FOUNDATION 18TH ANNUAL ESTATE, TAX, LEGAL & FINANCIAL PLANNING SEMINAR

We are pleased to announce that Jonathan Blatttmachr, Howard Zaritsky, Lee-Ford Tritt, Lauren Detzel, Michael Markham, and others will be speaking at the 2016 All Children’s Hospital Estate, Tax, Legal & Financial Planning Seminar.

Lauren Detzel will be speaking on Family Law and Tax Planning for Divorce, Michael Markham will be speaking on Bankruptcy and Creditor Protection/Fraudulent Transfers in the Context of Estate Planning, Howard Zaritsky will talk about Income and Estate Tax Planning Techniques in View of Recent Developments, and Lee-Ford Tritt will speak on Gun Trusts and Same Sex Marriage Consideration Highlights. Do not miss this important conference.

We thank Lydia Bailey and Lori Johnson for their incredible dedication (and patience with certain members of the Board of Advisors.) All Children’s Hospital is affiliated with Johns Hopkins.

Date: Wednesday, February 10, 2016

Location: Live Event at the All Children’s Hospital St. Petersburg Campus; Live webcasts in Tampa, Fort Myers, Belleair, New Port Richey, Lakeland, and Sarasota

Additional Information: Please contact Lydia Bennett Bailey at lydia.bailey@allkids.org for more information.

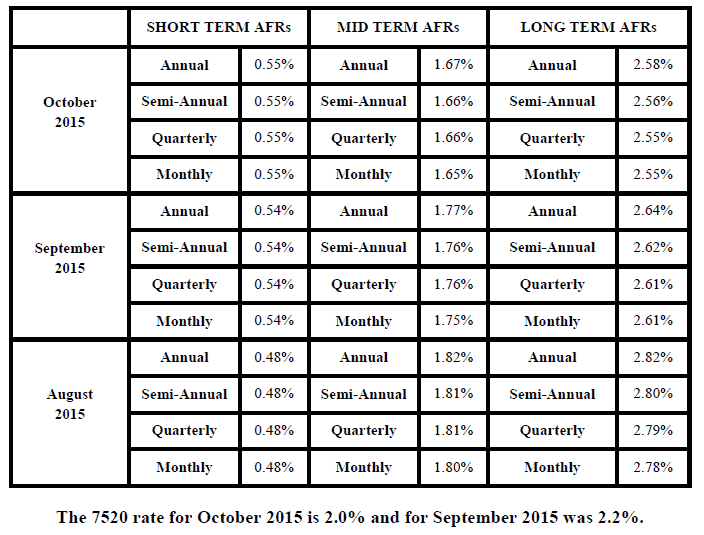

Applicable Federal Rates

Below we have this month, last month’s, and the preceding month’s Applicable Federal Rates, because for a sale you can use the lowest of the 3.