The Thursday Report – 10.1.15 – Charting Genetics

Marital Asset Preservation Systems (MAPS) by Alan Gassman

Physical Remains of a Decedent – Assets of the Estate or Subject to the Direction of a Personal Representative?

Coming Soon to a Conference Near You: Alan Gassman Live Presentations

Richard Connolly’s World – Six Financial Considerations Concerning Prenups and Divorces

Thoughtful Corner – Proper Conduct After a Client Meeting

Humor! (or Lack Thereof!)

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Stephanie at stephanie@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

Quote of the Week

“I gave a presentation at Kennedy Space Center for about 4 days, probably about 6 hours a day of presentations. In those days, they used flip charts, and you gave them copies of your flip charts. I had hundreds and hundreds of charts.”

– Marvin Gassman

Marvin Gassman worked for NASA on the Gemini, Apollo, SkyLab, and Shuttle programs in the Engineering and Operations divisions from the mid1960s until his retirement in 2003. Charting tendencies are, apparently, genetic.

Marital Asset Preservation Systems (MAPS)

by Alan Gassman

While not as exciting as NASA and rocket ships, helping married couples make sure that marital assets stay in the family is often a paramount concern that is not discussed in estate and financial planning. Once discussed, the scope and nature of an estate planning project will change significantly as the result thereof. The opportunity to have more charts to explain the systems is only one spin-off benefit!

One of the primary purposes for utilizing the Marital Asset Preservation System (“MAPS”) is to ensure that married couples keep their marital assets in the family for generations to come. In general, conscientious estate and tax planners will do their very best to meticulously plan and preserve assets for a surviving spouse while also enabling the surviving spouse to leave assets to common descendants of the decedent, with the minimal amount of taxes and probate expenses.

However, there is one question that is routinely left out of the discussion between married couples and estate planners during the planning process:

Would you like some assurance that your marital assets will only pass to your common descendants upon the death of the survivor of you?

The answer to this question is usually a resounding “yes” and, as such, requires the surviving spouse to protect the martial assets by not allowing them to be left to a subsequent spouse or some other future significant other. That answer leaves the estate planner with some rather intricate issues and challenges, not to mention more work, and an added layer of complexity to design and implement the various trust systems and strategies to be used.

Once the clients have decided that this is the right strategy for them, the planner must explain that upon the death of one spouse, the surviving spouse may serve as Trustee or Co-Trustee of one or more irrevocable trusts, with the power to change the trusteeship within pre-agreed parameters. These irrevocable trusts may only allow the surviving spouse to have access to assets and monies as needed for the spouse to maintain the standard of living that has been enjoyed during the marriage and to provide support for common descendants.

There are several restrictions that can be placed on a surviving spouse, one of which is to allow them to only make distributions outside of the family based upon an annual allowance that might be used for charity, religious organization dues, and donations and gifts to friends based upon guidelines that can be set forth in the documents. There can also be limitations placed on how much compensation might be paid to third parties for services like housekeeping, nursing, private lessons, personal trainers, and otherwise. There can also be limited access for charity, church or synagogue donations, and other defined causes.

An Ability to Provide Limited Benefits and Compensation to a Subsequent Spouse

While it is commonly assumed that the “next spouse” might threaten to deprive descendants of marital wealth and might place the surviving spouse in jeopardy of losing assets that would be needed for his or her well-being, there is also the possibility that the subsequent spouse will contribute meaningfully both to the preservation and enhancement of marital assets and with respect to providing care and support for the surviving spouse. It could be both unfair and counterproductive for the surviving spouse to not be able to allow a subsequent spouse to contribute meaningfully to marital assets and to be compensated for providing necessary services, whether personal, nursing, or managerial, where this is clearly in the best interests of the surviving spouse and possibly one or more of the descendants of the original marriage.

For this reason, the authors also provide that the MAPS Agreement or system may be amended by one or more of the adult descendants of the original couple and/or an independent Trust Protector or other advisor to take into account appropriate circumstances and formal requests for changes.

The above normally fits well and naturally under a credit shelter/marital deduction trust arrangement that will typically be established on the death of a first dying spouse where federal estate tax is a possible concern, but quite often, a good many assets will be owned outright by the surviving spouse or jointly with right of survivorship. IRA and qualified retirement plans are typically best left to a surviving spouse to enable postponement of having to take taxable distributions.

The planner must therefore explain that those assets that are not naturally captured under a trust system on the first death of a spouse will need to be either: (1) contributed to a trust system by the surviving spouse, as encouraged or required by planning documents and possibly a Marital Asset Preservation System (MAPS) Agreement; or (2) have the surviving spouse contractually bound by a MAPS Agreement requiring them to maintain existing marital assets and any income derived from those assets for the surviving spouse’s life. Also direct that those assets be left for only common descendants upon the surviving spouse’s death.

The author commonly uses one or both of these alternatives. These techniques are often coupled with carefully drafted trust provisions, as well as an explanation in the trust document to ensure that every possible step is satisfied that the MAPS objectives are met.

One issue for couples having more than the $10,860,000 exemption level situation, or expectation thereof, is whether limitations placed on inherited assets would cause loss of the federal estate tax marital deduction and consequent income tax to be paid on the first death. Each individual presently only has a $5,430,000 estate and gift tax exemption amount, which must be considered. This issue is especially important when the surviving spouse is contractually bound to preserve and leave the assets for subsequent descendants, as opposed to receiving the assets as the sole owner without any legal entanglements.

Generally, there is no marital deduction allowed for dispositions that do not at least allow the surviving spouse to have all income from marital deduction trust property and to be the sole beneficiary of a trust holding such property for his or her lifetime. A marital deduction may also not be received for assets that are paid outright to a surviving spouse who has significant contractual limitations on what he or she is able to do with the property.

In states that do not recognize community property, most planners will use separate revocable trusts for affluent husbands and wives because of established customs and the complexities associated with using joint trusts. In such situations, it is possible to have the revocable trust of the surviving spouse become irrevocable upon the death of the first spouse. For purposes of federal estate and gift taxes, this event will be considered an incomplete gift because it provides the surviving spouse with the right to veto payments to any person other than the surviving spouse during their remaining lifetime and the power to appoint trust assets to common descendants of the married couple. Alternatively, in states that do recognize community property, joint trusts are becoming more prevalent.

An objective for many estate and tax planners, regardless of the state in which they live, is to have the first dying spouse’s death cause a step-up in the income tax basis to a fair market value for any and all family assets. This strategy should be utilized to the extent that the family would benefit from having an increased basis, which would essentially take any property that appreciated during the decedent’s lifetime and provide the surviving spouse with the ability to not recognize any gain on such property when they come into possession.

Many planners in non-community property states are using Joint Exempt Step-Up Trusts (“JEST”), which may enable clients to receive this stepped-up basis on all joint trust assets upon the death of the first dying spouse. When the first spouse dies, assets held by the joint trust are used to fund a credit shelter trust for the benefit of the surviving spouse and descendants. These assets now held by the credit shelter trust will receive a full step-up in basis and escape tax liability upon the surviving spouse’s death.

Life insurance can also be integrated into the arrangement by having the death benefit payable to an irrevocable trust, which may be a separate trust that owns the policy so as not to be subject to federal estate tax on the death of the first dying spouse.

Waiver of Marital Rights

Most states have statutes which provide a surviving spouse with a minimal outright disposition, most commonly known as the Elective Share. In addition, some states provide a surviving spouse with homestead inheritance and other rights which may be waived during the estate planning process while both spouses are living.

The estate planner will have to be very careful with respect to disclosing conflict of interest issues and evaluating whether one or both spouses should be required, or at least strongly urged, to seek independent legal counsel before being legally bound to have limited access and control to marital and inherited assets after the death of one spouse. In the event that a conflict of interest does arise, the estate planner should withdraw and require the spouses to retain separate counsel. Furthermore, because the planner represented both spouses, they are prohibited from representing either one of them against the other, even with informed consent.

ABA-Model Rule 1.7 addresses the rules for Current Client Conflicts of Interest. In essence, Rule 1.7(a) states that a lawyer shall not represent a client if representing one client will be directly adverse to another client. However, this Rule is not an absolute bar to representing a client when there is a conflict. Subsection (b) provides that a lawyer may represent a conflicted client if (1) they believe they can provide competent representation; (2) it is not prohibited by law; (3) it does not involve one client asserting a claim against another client, both of whom are represented by the lawyer; and (4) each client gives informed consent. In the context of marital inheritance, subsection (b)(3) will almost always bar the attorney from representing one client over another, even with informed consent.

Physical Remains of a Decedent – Assets of the Estate or Subject to the Direction of the Personal Representative?

by Chuck Rubin

One would think that the body of the decedent is an asset of the estate that might be subject to Probate Code guidelines on real and personal property. According to the Florida courts, however, this is not necessarily the case.

Notable trust writer and dedicated writer/blogger Chuck Rubin wrote an outstanding article on this subject, based upon the May 2014 Palm Beach Probate court case of Wilson v. Wilson, in which divorced parents fought over whether or not their son’s remains were divisible after the 23-year-old’s untimely death. The father wished for the remains to be declared property so he could bury a portion of the ashes in a family plot in Georgia. The mother wanted the entirety of the remains to stay near her West Palm Beach home.

A summary of Chuck’s take on this case and the practical applications thereof are as follows:

Executive Summary

An heir unsuccessfully asserts that the decedent’s cremated ashes are estate property that should be divided with the other property of the estate.

Facts:

A father of a deceased child sought to have the cremated ashes of his son divided equally with his former wife who was the mother of the deceased child. The mother objected to the division on religious grounds. Both the Florida probate court and the appellate court held for the mother.

Florida law recognizes there is a legitimate claim of entitlement by the next of kin to possession of the remains of a decedent for burial or other disposition. However, the scope of that entitlement, especially when the decedent made no expression of desire as to the disposition of his or her remains and there is a dispute among the kin, is not well-defined.

To get around this uncertainty and obtain half of the ashes, the father posited that his son’s ashes were “property” of the probate estate and should be disposed of in accordance with the disposition of all the decedent’s property. Since he and the mother were the beneficiaries of their son’s estate, the remains should be divided equally between them.

Florida Statutes §731.201(32) defines property for Probate Code purposes as “both real and personal property or any interest in it and anything that may be the subject of ownership.” So, at first glance, it appears that bodily remains may fit within this definition. However, the Florida Supreme Court has articulated that the next of kin have no property right in the remains of a decedent. Kirksey v. Jernigan, 45 So 2d 188 (Fla. 1950); State v. Powell, 497 So 2d 1188 (Fla. 1986); Crocker v. Pleasant, 778 So. 2d 978 (Fla. 2001). The appellate court indicated that this position has deep roots in the common law, quoting Sir William Blackstone’s Commentaries that heirs have no property interest in bodies or ashes of decedents.

Thus, the appellate court rejected the father’s attempt to divide the ashes based on the ashes being property of the probate estate subject to division. This is not to say that the probate court, in exercise of its discretion in the matter, was without authority to divide the ashes – just that it could not be compelled to do so based on a property rights argument.

Comment:

Similar results should apply in other states outside of Florida that follow the common law. While not a perfect solution, dispositive directions in the Last Will of decedents over disposition of remains can help reduce disputes over remains, especially in circumstances where a later dispute is possible, such as second marriage situations or when the children do not get along.

Charles Rubin is a Managing Partner with Gutter Chaves Josepher Rubin Forman Fleisher Miller, P.A. Chuck earned both his J.D. degree and his LL.M. in Taxation from the University of Florida. He is Florida Bar Board Certified in Taxation and was named the 2015 Lawyer of the Year by Best Lawyers in Taxation in the Miami metropolitan area. He has been running Rubin on Tax, a tax blog on developments relating to Federal and Florida tax, estate planning, probate, and business law, since 2005. The blog currently features over one thousand posts, and can be viewed by clicking here http://rubinontax.floridatax.com/.

Coming Soon to a Conference Near You

Alan Gassman Live Presentations

October 2015

October 24th – 2015 Mote Vascular Symposium

Alan Gassman will be speaking on the topic of Estate, Medical Practice, Retirement, Tax, Insurance, and Buy/Sell Planning – The Earlier You Start, the Sooner You Will Be Secure.

This presentation will take place at the Hyatt Regency in Sarasota, Florida.

November 2015

November 5th – Interactive Estate and Elder Planning Legal Summit

Alan Gassman will be speaking on the topic of Scientific Marketing for the Estate Planner – How to Do More of What You Love to Do and Less of the Other While Better Serving Clients, Colleagues, and Your Community.

This presentation will take place at the New York Hilton – Midtown Manhattan in New York City.

November 12th – Suncoast Estate Planning Council

Alan Gassman will be speaking on the topic of Portability Under New Regulations and Alice’s Looking Glass.

This presentation will take place at All Children’s Hospital in St. Petersburg, Florida.

January 2016

January 8th – Representing the Physician: The Only Constant is Change

Alan Gassman will present three talks at the Florida Bar sponsored Representing the Physician seminar. His topics will include:

- A Brief Introduction to the Current State of the Physician’s World (with Lester Perling)

- Creditor Protection for the Medical Practice

- Where Tax and Health Law Simply Don’t Work Together (with Lester Perling)

This event will take place at the Rosen Plaza Hotel in Orlando, Florida. More information about this program will be featured in next week’s Thursday Report.

January 30th and January 31st – MER Internal Medicine for Primary Care Program

Alan Gassman will present four, one-hour Medical Education Resources, Inc. talks for cardiologists and other doctors who attend this four-day conference. His topics will include:

- The 10 Biggest Mistakes that Physicians Make in Their Investment and Business Planning

- Lawsuits 101: How They Work, What to Expect, and What Your Lawyer and Insurance Carrier May Not Tell You

- 50 Ways to Leave Your Overhead

- Essential Creditor Protection and Retirement Planning Considerations

This presentation will take place at the Casa Marina Resort in Key West, Florida.

May 2016

May 6th – 3rd Annual Ave Maria School of Law Estate Planning Conference

Alan Gassman will be presenting a talk entitled Coffee with Alan: An Introduction to Select Estate Planning and Asset Protection Strategies. During this session, Alan will offer an overview of the topics that will be presented throughout the Estate Planning Conference.

Alan will also moderate the Luncheon Speaker Panel with Jonathan Blattmachr, Stacy Eastland, and Lee-ford Tritt. The panel will cover the topic of What We Wish We Knew When We Started Practicing Law – Non-Tax and Practical Advice for Estate Planners Young and Old.

This presentation will take place at the Ritz Carlton Golf Resort in Naples, Florida.

Attend all but one of the above presentations and receive 25 buckets of Kentucky Fried Chicken (thighs only!) and mashed potatoes, no gravy, delivered to your favorite mother-in-law the day before Thanksgiving, 2016. Attend all of the above presentations and receive a new mother-in-law!

Please note that we also speak at weddings and Bar Mitzvah’s!

Richard Connolly’s World

Six Financial Considerations Concerning

Prenups and Divorces

Insurance advisor Richard Connolly of Ward & Connolly in Columbus, Ohio often shares with us pertinent articles found in well-known publications such as The Wall Street Journal, Barron’s, and The New York Times. Each week, we will feature some of Richard’s recommendations with links to the articles.

This week, the first article of interest is “Talking Prenups with Clients: 6 Tips” by Kimberly Foss. This article was featured in Financial Planning on May 18, 2015.

Richard’s description is as follows:

Many clients walk down the aisle with the security of a prenuptial agreement. Because the foundation of our work with clients is to plan for an unknowable future and ensure that they are prepared financially for whatever life throws at them, it is almost always advisable to sign a prenup.

But pitching the prenup isn’t always easy. Many clients initially view it as unnecessary and, well, unromantic.

Six tips for working with clients to create a successful prenup are as follows:

- Get a head start – Six months before a wedding is standard.

- Manage the romantics – Think of a prenup as insurance, not something that will tarnish a relationship.

- Discuss both assets & liabilities – This is especially important for people with student loan or other large sums of debt.

- Allow for (some) flexibility – Marriages can change over time; a prenup should be able to adapt, too.

- Think beyond money – Prenups can also include financial goals, investment strategies, annual vacations, and social media clauses.

- Use star power – Is the prenup still a tough sell? Use celebrity examples. Everyone enjoys a good Hollywood story.

To explore each of these tips in detail, please click here to read this article in its entirety.

The second article of interest this week is “Divorce and Money: Six Costly Mistakes” by Veronica Dagher. This article was featured in The Wall Street Journal on May 15, 2015.

Richard’s description is as follows:

Divorce can be hazardous to your financial health. Splitting up is expensive, and your cost of living is likely to go up when it’s all over.

If you are considering seeking a divorce, plan carefully in advance so that you can make rational decisions at a time when emotions may be running high. Six common mistakes to avoid are as follows:

- Overlooking assets – It is crucial to know what your family’s assets and liabilities are.

- Keeping the house – A household that took two people to run may be far too expensive for just one.

- Underestimating expenses – It is key to get a firm handle on expenses beyond housing.

- Seeking revenge – Couples are better off approaching divorce as an opportunity to strike a favorable business deal rather than a chance to settle scores.

- Forgetting about taxes – Be careful not to divide assets in a way that looks fair but sticks one spouse with a larger tax bill.

- Thinking the work is done – There are other important financial matters that need attending to after the papers are signed.

To explore each of these mistakes in detail, please click here to read this article in its entirety.

Thoughtful Corner

Proper Conduct After a Client Meeting

Client meetings can result in a great deal of information being gathered and a number of follow-up items. Ideally, we would all take perfect notes or have a scribe in the room to take perfect notes for us, but this rarely occurs.

If you are working as best you can on communication skills, creative thinking, and explaining things during a conference, it is unlikely that you can also take notes that can be relied upon the next day or week as an appropriate summary of what happened and what you need to know moving forward.

Lawyers who have a long drive home are blessed with the ability to dictate their notes from meetings and client follow-up letters (more on those below!) on their way. If you do not have a long drive home, the following steps are an excellent way to ensure that all work for a client is remembered and completed.

Have your office staff scan all notes and materials reviewed during the meeting so that it is not possible for them to get lost thereafter.

Sit in the same room you met with the client(s) in and sit in the same seat, facing the same direction, and tape record an explanation of what was discussed. Have a paralegal who can manage the client’s follow-up in the room during this recording.

If there is time, dictate a letter to the client with the paralegal sitting there listening and looking at the notes taken during the meeting. This letter can concentrate what was discussed and what your staff is doing. By having the paralegal in the room with you, he/she can interrupt to ask for more detail and remind you to note certain things in the letter that need to be done or that the client needs to do.

Then, follow your notes and explain what was discussed and what needs to be done directly to the paralegal. The paralegal can ask questions, which can prompt you to make decisions and begin thinking about issues and next steps immediately following the meeting. This discussion can also help you to recall exactly what was discussed.

If there is limited time, record the same ideas as a memo to yourself or to the file of what is needed to remember and what is needed to later explain. The information can then be crafted into a letter when time permits.

If anything significant comes up before the work promised in the follow-up letter is done, you can call the client or send them a quick email to make a mid-course connection or to clarify understanding while the client is still very much into the process as well.

Studies (and my experience) have shown that the best memory of an event comes when you sit in the same place you were in when that event occurred, so it is best to do this as soon as possible after the meeting has concluded.

If you’re able to dictate a letter to the client right away, it’s fine to indicate specific things such as, “as part of the work we will be doing for you, we will draft a clause that does this, a clause that does that, and will also provide…” because this gives the client an explanation of what you are doing while also providing a roadmap and a reference document for your paralegals, lawyers, and other team members.

This letter essentially serves as your “fee agreement” because it defines what you are doing, what you are not doing, and anything else that you may have discussed about costs. It is the most important post-meeting product and becomes the focal point for the project. This letter is typically completed before any other work is started.

We review this follow-up letter when a client comes back for another meeting, when document packages go out, or when we need to remember what we were doing or not doing for the particular client. An incidental benefit of this review method is that you will have much better recall of what was discussed with the client if you have immediately repeated the most important parts and told their story to a staff member.

This, and illustrating and charting all data on one Excel document, will be a very valuable part of your work product for the client.

Humor! (or Lack Thereof!)

Sign Saying of the Week

**************************************************

A Poem

by Ron Ross

Romans conquered the world with swords, arrows, and spears,

The weapons they used filled their enemies with fears.

Their ships deployed “the raven,” a kind of giant claw,

They also invented siege towers, catapults, and attorneys at law.

Etruscans once ruled Italy. Know why they don’t remain?

Romans took their land using imminent domain.

When Hannibal and Carthage attacked, they were left with two cents.

The court seized their army, declaring their elephants a public nuisance.

Wonder why the Jews found Romans so abhorrent?

They sacked the Holy Temple, armed with only a search warrant.

But payback comes to everyone, just as a matter of course.

Rome wept when the Eastern Empire was granted a divorce.

**************************************************

In the News

by Ron Ross

Halloween is coming soon, and Presidential candidates are expected to be popular costume choices. Buy your Donald Trump or Bernie Sanders wigs now before they’re all gone!

******************

California announces that the 3,380 fires this year were caused by 3,379 different people who left the house without unplugging their iron.

In related news, two women discovered their husband was a bigamist when local news reported he accidentally burned down both of his homes by leaving the iron on.

******************

An elephant wandered away from the zoo and ended up in a nunnery where the sisters have taken a vow of silence. They literally cannot talk about the elephant in the room.

Upcoming Seminars and Webinars

Calendar of Events

LIVE WEBINAR:

Molly Carey Smith and Alan Gassman will present a free webinar on the topic of FAILURE TO LAUNCH: 20-SOMETHINGS WITHOUT A SOLID CAREER PATH – WHAT PARENTS (AND OTHERS) NEED TO KNOW.

Date: Saturday, October 3, 2015 | 9:30 AM

Location: Online webinar

Additional Information: Please click here to register for this webinar. For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE CLEARWATER PRESENTATION:

Christopher Denicolo will be speaking at the Pinellas County Estate Planning Council meeting on the topic of PLANNING WITH IRAs AND QUALIFIED PLANS.

Date: Monday, October 5, 2015

Location: To Be Determined

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com or Christopher Denicolo at christopher@gassmanpa.com.

**********************************************************

LIVE WEBINAR:

Alan Gassman, Ken Crotty, and Christopher Denicolo will present a webinar on the topic of WHAT EVERY NEW JERSEY ATTORNEY SHOULD KNOW ABOUT FLORIDA ESTATE PLANNING. This webinar will qualify for 2 New Jersey CLE credits.

Most advisors with Florida clients are unaware of the unique rules and planning considerations that affect Florida estate, tax, and business planning. Unlike some other states, Florida’s laws regarding limited liability companies, powers of attorney, taxation, homestead, creditor exemptions, trusts and estates, and documentary stamp taxes are not simply versions of a Uniform Act. They have been crafted by the Florida legislature to apply to various specific issues in an often counterintuitive manner.

This presentation will have the following objectives:

- Unique aspects of the Florida Trust and Probate Codes

- Creditor protection considerations and Florida’s statutory creditor exemptions

- The Florida Power of Attorney Act

- Traps and tricks associated with Florida’s Homestead Law and Elective Share

- Documentary stamp taxes, sales taxes, rent taxes, property taxes, and how to avoid them

- Business and tax law anomalies and planning opportunities

Date: Thursday, October 8, 2015 | 12:00 PM – 1:40 PM

Location: Online webinar

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com or Eileen O’Connor at eoconnor@njsba.com.

**********************************************************

LIVE WEBINAR:

Alan Gassman will present a free, 30 minute webinar on the topic of ESTATE AND ESTATE TAX PLANNING – CONVENTIONAL AND ADVANCED PLANNING TECHNIQUES TO MINIMIZE TAXES AND EFFECTIVELY PASS ON YOUR WEALTH.

There will be two opportunities to attend this presentation.

Date: Wednesday, October 14, 2015 | 12:30 PM and 5:00 PM

Location: Online webinar

Additional Information: To register for the 12:30 PM webinar, please click here. To register for the 5:00 PM webinar, please click here. For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE BLOOMBERG BNA WEBINAR (CONTACT US FOR A 25% DISCOUNT!):

Alan Gassman, Steve Roll, and Lauren E. Colandreo will present a webinar on the topic of STATE TRUST NEXUS SURVEY for Bloomberg BNA.

Date: Thursday, October 15, 2015 | 12:00 PM – 1:00 PM

Location: Online webinar

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE WEBINAR:

Jonathan Gopman, Jan Dash, and David Neufeld will join Alan Gassman for an informative webinar on THE NEW NEVIS TRUST LAW.

There will be two opportunities to attend this presentation.

Date: Wednesday, October 21, 2015 | 12:30 PM or 5:00 PM

Location: Online webinar

Additional Information: To register for the 12:30 PM webinar, please click here. To register for the 5:00 PM webinar, please click here. For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE SARASOTA PRESENTATION:

2015 MOTE VASCULAR SURGERY FELLOWS – FACTS OF LIFE TALK SEMINAR FOR FIRST YEAR SURGEONS

Alan Gassman will be speaking on the topic of ESTATE, MEDICAL PRACTICE, RETIREMENT, TAX, INSURANCE, AND BUY/SELL PLANNING – THE EARLIER YOU START, THE SOONER YOU WILL BE SECURE.

Date: Saturday, October 24th, 2015

Location: Hyatt Regency Sarasota | 1000 Boulevard of the Arts, Sarasota, FL, 34236

Additional Information: Please contact Alan Gassman at agassman@gassmanpa.com for more information.

**********************************************************

LIVE MANHATTAN PRESENTATION:

INTERACTIVE ESTATE AND ELDER PLANNING LEGAL SUMMIT

Alan Gassman will be speaking on SCIENTIFIC MARKETING FOR THE ESTATE PLANNER – HOW TO DO MORE OF WHAT YOU LOVE TO DO AND LESS OF THE OTHER WHILE BETTER SERVING CLIENTS, COLLEAGUES, AND YOUR COMMUNITY.

Other speakers include Jonathan Blattmachr, Austin Bramwell, Natalie Choate, Mitchell Gans, and Gideon Rothschild.

Date: November 4 – 6, 2015 | Alan Gassman will be speaking on November 5 | Time TBA

Location: New York Hilton Midtown Manhattan | 1335 Avenue of the Americas, New York, NY 10019

Additional Information: Please contact Alan Gassman at agassman@gassmanpa.com for more information or visit http://ilsummit.com/ to register.

**********************************************************

LIVE PRESENTATION

Alan Gassman will present a talk at the November meeting of the Suncoast Estate Planning Council on the topic of PORTABILITY UNDER NEW REGULATIONS AND ALICE’S LOOKING GLASS.

Date: Thursday, November 12, 2015 | 8:00 AM – 9:00 AM

Location: All Children’s Hospital | 501 6th Avenue South, St. Petersburg, FL, 33701

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com or Byron Smith at bsmith@gsscpa.com.

**********************************************************

LIVE ORLANDO PRESENTATION:

REPRESENTING THE PHYSICIAN: THE ONLY CONSTANT IS CHANGE

Alan Gassman will present three talks at the 2016 Representing the Physician seminar. His topics include:

- A Brief Introduction to the Current State of the Physician’s World (with Lester Perling)

- Creditor Protection for the Medical Practice

- Where Tax and Health Law Simply Don’t Work Together (with Lester Perling)

Other speakers at this event include Jerome Hesch, Michael O’Leary, Colleen Flynn, Jeff Howard, Darryl Richards, and others.

For a complete schedule, please click here.

Date: January 8, 2016 | Mr. Gassman will speak at 8:15 AM, 10:50 AM, and 4:25 PM

Location: Rosen Plaza Hotel | 9700 International Drive, Orlando, FL, 32819

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE KEY WEST PRESENTATION:

MER INTERNAL MEDICINE FOR PRIMARY CARE PROGRAM

Alan Gassman will present four, one-hour, Medical Education Resources, Inc. talks for cardiologists and other doctors who dare attend this outstanding 4-day conference. Join us at Hemingway’s for a whiskey & soda and a ring of the bell. Beach Boys not invited.

Mr. Gassman’s topics will include:

- The 10 Biggest Mistakes that Physicians Make in Their Investment and Business Planning

- Lawsuits 101: How They Work, What to Expect, and What Your Lawyer and Insurance Carrier May Not Tell You

- 50 Ways to Leave Your Overhead

- Essential Creditor Protection and Retirement Planning Considerations

Date: January 28 – 31, 2016 | Mr. Gassman will speak on Saturday, January 30 and Sunday, January 31 | Time TBA

Location: Casa Marina Resort | 1500 Reynolds Street, Key West, FL, 33040

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE NAPLES PRESENTATION:

3RD ANNUAL AVE MARIA SCHOOL OF LAW ESTATE PLANNING CONFERENCE

This one-day conference will take place in Naples, Florida on Friday, May 6, 2016.

On Thursday, May 5, there will be a special dinner with Jonathan Blattmachr. Jonathan will also present at the conference on Friday.

Alan’s Friday morning presentation will be entitled COFFEE WITH ALAN: AN INTRODUCTION TO SELECT ESTATE PLANNING AND ASSET PROTECTION STRATEGIES. During this session, Alan will offer an overview of the topics that will be presented throughout the Estate Planning Conference. Attendees new to these specific estate planning areas will find the presentation useful and helpful.

Alan will also moderate the Luncheon Speaker Panel with Jonathan Blattmachr, Stacy Eastland, and Lee-ford Tritt. The panel will cover the topic of WHAT WE WISH WE KNEW WHEN WE STARTED PRACTICING LAW – NON-TAX AND PRACTICAL ADVICE FOR ESTATE PLANNERS YOUNG AND OLD.

Don’t miss it!

Date: May 6, 2016

Location: Ritz Carlton Golf Resort | 2600 Tiburon Drive, Naples, FL, 34109

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com.

Notable Events by Others

LIVE ORLANDO PRESENTATION:

50TH ANNUAL HECKERLING INSTITUTE ON ESTATE PLANNING

Date: January 11 – January 15, 2016

Come celebrate the 50th Year Anniversary (and 32 years of Alan Gassman not speaking at this conference) with us and our many friends (or at least they pretend to like us) at this important annual estate planning event.

Location: Orlando World Center Marriott Resort & Convention Center | 8701 World Center Drive, Orlando, FL 32821

Additional Information: Registration for the 50th Annual Heckerling Institute on Estate Planning opened on August 3, 2015. For more information, please visit http://www.law.miami.edu/heckerling/.

**********************************************************

LIVE ST. PETERSBURG PRESENTATION:

ALL CHILDREN’S HOSPITAL FOUNDATION 18TH ANNUAL ESTATE, TAX, LEGAL & FINANCIAL PLANNING SEMINAR

We are pleased to announce that Jonathan Blatttmachr, Howard Zaritsky, Lee-Ford Tritt, Lauren Detzel, Michael Markham, and others will be speaking at the 2016 All Children’s Hospital Estate, Tax, Legal & Financial Planning Seminar.

Lauren Detzel will be speaking on Family Law and Tax Planning for Divorce, Michael Markham will be speaking on Bankruptcy and Creditor Protection/Fraudulent Transfers in the Context of Estate Planning, Howard Zaritsky will talk about Income and Estate Tax Planning Techniques in View of Recent Developments, and Lee-Ford Tritt will speak on Gun Trusts and Same Sex Marriage Consideration Highlights. Do not miss this important conference.

We thank Lydia Bailey and Lori Johnson for their incredible dedication (and patience with certain members of the Board of Advisors.) All Children’s Hospital is affiliated with Johns Hopkins.

Date: Wednesday, February 10, 2016

Location: Live Event at the All Children’s Hospital St. Petersburg Campus; Live webcasts in Tampa, Fort Myers, Belleair, New Port Richey, Lakeland, and Sarasota

Additional Information: Please contact Lydia Bennett Bailey at lydia.bailey@allkids.org for more information.

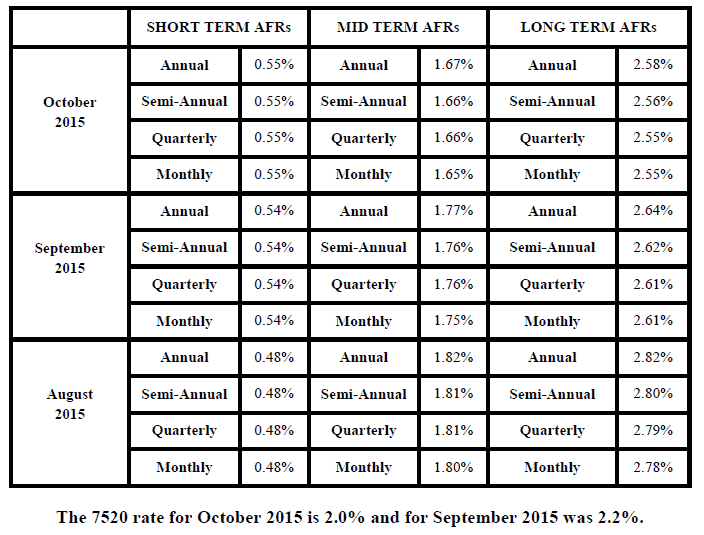

Applicable Federal Rates

Below we have this month, last month’s, and the preceding month’s Applicable Federal Rates, because for a sale you can use the lowest of the 3.