The Thursday Report – 08.06.15 – New York Taxes, FINRA & Mollaxes

New York Taxes Disregarded LLC Owning A Non-Resident’s Real Estate on Death

FINRAs to the Left, FINRAs to the Right

Disclaimer of Trust Assets to a Charity

Richard Connolly’s World – Avoiding Post-Death Financial Woes

Thoughtful Corner – Improving Your Mode of Thinking – Three Important Suggestions That Work

Look No Further for Professional Acceleration

Humor! (or Lack Thereof!)

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Stephanie at stephanie@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

New York Taxes Disregarded LLC Owning a

Non-Resident’s Real Estate on Death

Our friends and prolific writers Jonathan Gopman, Michael Sneeringer, and Eric Olsen wrote a pertinent review of the opinion provided by the New York State Department of Taxation and Finance regarding a membership interest in an SMLLC that owned a condominium for Steve Leimberg’s Estate Planning Newsletter.

Below are excerpts of their article. For the entire article, you can click here.

Executive Summary:

The New York State Department of Taxation and Finance (the “Department”) recently opined that a membership interest in a single-member LLC (“SMLLC”) owning a New York condominium is real property subject to New York State “estate tax.” This conclusion is based upon and applies to SMLLCs that are “disregarded” for Federal income tax purposes.

Facts:

In Advisory Opinion TSB-A-15(1)M, the Department responded to a New York resident (“Petitioner”) who contemplated contributing his New York condominium to a disregarded SMLLC and then moving to another state. The Petitioner intended to remain the sole owner of the SMLLC for the remainder of his life and to reside outside of New York until his death. The Petitioner asked whether the SMLLC is “intangible property” for estate tax purposes and would therefore not be treated as real property for New York State estate tax purposes. The Department, in considering the SMLLC’s sole ownership, reasoned that the assets and activities of a disregarded SMLLC should be treated as the assets and activities of the SMLLC’s sole member/owner. Accordingly, the condominium held by the SMLLC would be treated as real property held by the Petitioner for New York State estate tax purposes.

Comment:

Analysis

New York State imposes estate tax on the transfer by the estate of a nonresident decedent of real property and tangible personal property located in New York.[1] In general, the transfer of a New York condominium by the estate of a nonresident decedent is subject to estate tax.[2] New York real property may be held by a corporation or partnership; however, the interest in such entity (i.e., the corporate stock or partnership interest) constitutes intangible property.[3] New York does not impose estate tax on intangible property held by nonresidents, even if such property is located in New York.[4] Accordingly, the New York State estate tax is not imposed on the transfer by the estate of a nonresident decedent of an interest in a corporation or partnership that holds New York real estate.

Under U.S. Treasury Regulations, the tax classification of a business entity is determined by its number of owners and by an election, if any, made by the entity. A business entity with only one owner is classified as either a disregarded entity or a corporation.[5] As a default, a SMLLC is disregarded as an entity separate from its sole member/owner and the tax attributes of the SMLLC are imputed to its sole member/owner.[6] Alternatively, a SMLLC may file IRS Form 8832 (Entity Classification Election) to be classified as “an association and taxable as a corporation.”[7] An LLC with two or more members (i.e., owners) is classified as either a partnership or a corporation. As a default, a multimember LLC is treated as a partnership and its tax attributes pass through to its members.[8] Alternatively, a multimember LLC may file Form 8832 to be classified as a corporation.[9]

The key take-away point is that applicable state law creates legal interests and property rights for federal tax purposes, while the federal revenue acts designate what interests or rights, so created, shall be taxed.[10] Although the check-the-box regulations authorize the proposed entities to be ignored for federal income tax purposes, nothing in the Code or regulations authorizes or mandates that those entities should be ignored for purposes of the federal estate, gift and generation-skipping transfer taxes.[11] Thus, a person with similar circumstances as the taxpayers in the Opinions, albeit one with an iron stomach, could take on the Department using the rationale articulated in Pierre, so long as New York continues to have N.Y. LLC Law § 601 on its books.

Possible Solutions Without Litigation

As noted above, one should be able to rely upon the decision in Pierre despite the Opinions issued by the Department. However, to avoid future protracted litigation, clients will demand an alternative. One way to avoid litigation is to have a partnership own the underlying condominium, whether a traditional partnership structuring with perhaps one or more limited partners and a general partner, or through the creation of an LLC making an election to be taxed as a partnership.

Partnerships and multiple-member LLCs have their own set of separate issues, such as dealing with other partners/members and filing a partnership income tax return annually. Especially in the case of owning a single condominium unit, why would anybody want to put up with such a headache? Additionally, while one could follow the Opinions and opt to simply create a SMLLC and make the election to have it taxed as a corporation, this would entail its own sort of problems due to the basis step-up issues involved with corporations.

Query whether the Opinions would differ if the taxpayer formed an LLC to serve as a 1% general partner of a limited partnership where the condominium transferee owned all of the limited partnership interests as the 99% partner? While the partnership is deemed not to exist under Federal law for income tax purposes, this result differs under the check-the-box regulations. What would be the result if the taxpayer’s grantor trust is the 1% general partner? These variations still create an existing partnership for state law purposes.

Conclusion

In Advisory Opinion (TSB-A-15(1)M May 29, 2015), the Department narrowly addressed a specific estate tax inquiry as it related to the facts presented by the Petitioner. Decisions regarding entity classification may have significant federal and state tax implications and filing requirements. Accordingly, taxpayers should make such decisions in consultation with their professional advisors.

Cite As:

LISI Estate Planning Newsletter #2330, (August 4, 2015) at http://www.leimbergservices.com. Copyright 2015 Leimberg Information Services, Inc. (LISI).

*************************************************

[1] N.Y. Tax Law § 960(a).

[2] N.Y. Real Prop. Law § 339-g.

[3] N.Y. Tax Law § 951-a(c).

[4] N.Y. Partnership Law § 51; Estate of Havemeyer, 17 N.Y. 2d 216 (1966).

[5] Treas. Reg. § 301.7701-2(a).

[6] Treas. Reg. § 301.7701-3(b)(1)(ii).

[7] Treas. Reg. § 301.7701-3(c)(1)(i).

[8] Treas. Reg. § 301.7701-3(b)(1)(i).

[9] Treas. Reg. § 301.7701-3(c)(1)(i).

[10] See e.g., Knight v. Comr., 115 T.C. 506 (2000); U.S. v. Bess, 357 U.S. 51 (1958); Morgan v. Comr., 309 U.S. 78 (1940); Aquilino v. U.S., 363 U.S. 509 (1960); Aldrich v. U.S., 346 F.2d 37 (1965); McGehee v. Comr., 260 F.2d 818 (1958); and TAM 199930013.

[11] Gopman, “Estate Planning with S Stock: the “Spreeze” Transaction,” 27 Est. Gft. & Tr. J. 155 (May 9, 2002).

FINRAs to the Left, FINRAs to the Right

by Alyssa Eberle, J.D.

Elderly Americans can call 1-844-57-HELPS (or 1-844-574-3577) for free advice.

FINRA is the congressionally ordained financial industry “self regulatory” agency that oversees investment licensee conduct, sets standard of practice protocols, and is otherwise considered to be the governing bodies in these areas. FINRA has launched a number of programs to help consumers, although many believe that FINRA should more heavily regulate investment advisors as opposed to reaching out directly to consumers who may be being harmed by advisors and product choices that consumers are guided to that are not subject to fiduciary duty or disclosures.

While it is mostly for elderly Americans who are age 65 or older, anyone can use this hotline. More about the situation is as follows:

Lawyers and financial advisors are becoming more exposed to cases in which heirs are facing hurdles in trying to gain access to a deceased loved one’s brokerage account. In some cases, heirs are not even permitted to see account statements.[1] This may cause problems, for example, when children with rights to the estate are attempting to access their deceased parent’s assets. While brokerage firms are under strict legal guidelines with regard to what and with whom information is shared, firms respond slowly to those that do meet the requirements and do not readily provide information to family members upon the death of an account holder.

Another issue that elderly investors face is the suitability of recommendations from advisors, some communications and sales practices could prove to be abusive and fraudulent.

In order to provide a solution to this problem, FINRA established the FINRA Securities Helpline for Seniors called HELPS. HELPS is a toll-free number that senior investors can call to get assistance from FINRA or raise concerns regarding brokerage accounts and other investments.

If a senior investor is struggling with questions about their brokerage account, FINRA’s hotline can help with: (1) achieving a better understanding of how to review investment portfolios and account statements; (2) raising concerns about the handling of a brokerage account; and (3) getting information about investor tools and resources from FINRA, including BrokerCheck®.[2]

Susan Axelrod, FINRA’s Executive Vice President for Regulatory Operations, stated the following regarding the helpline:

Protecting senior investors has been an important priority for FINRA for several years. Our goal in setting up this Helpline is to build on these efforts and provide an additional resource to senior investors. FINRA’s Helpline means that older investors are only a phone call away from getting help with questions or concerns they may have regarding their investments. FINRA staff will point seniors to educational tools that can help them better understand investing, savings, and investment products, as well as resources like BrokerCheck® that can provide valuable information about securities firms and financial professionals.[3]

It is important to address senior investor needs expeditiously, as they lack outside income and could have potential health complications and decreased mental capacity, which require immediate attention to their assets. It is important for brokerage firms to take into consideration the age and life stage of the senior investor, and whether or not their heirs will require additional help in the future.

FINRA is hoping that HELPS provides assistance to senior investors as well as their heirs. Time will tell if HELPS coupled with the collaboration of estate planning attorneys will provide access to the deceased’s brokerage accounts without clogging the probate court system.

************************************************

[1] Matthias Rieker, The Hassle of Inheriting a Brokerage Account, The Wall Street Journal, July 10, 2015.

[2] FINRA Securities Helpline for Seniors – HELPS, available at www.finra.org/investors/finra-securities-helpline-seniors.

[3] FINRA Launches Toll-Free FINRA Securities Helpline for Seniors, April 20, 2015.

Disclaimer of Trust Assets to a Charity

by Kenneth J. Crotty, J.D., LL.M. and Alan S. Gassman, J.D., LL.M.

Have you considered allowing the disclaimer of trust assets to a charity where the grantor would like to see a donation but is not sure whether the beneficiary will agree or whether it may be best to pay the charity from income to receive an income tax deduction after the client’s death?

The following is a sample letter that you may want to share with a client considering this approach. The language was developed by us to facilitate having trusts held for children and descendants be subject to disclaimer provisions that would allow the primary beneficiary (child) to direct the trustee to have a portion of the trust assets pass to one or more specific charities or to a donor advised fund designated by the client in his or her estate planning documents.

Dear [Client]:

[CPA] asked about whether Mother, could use a disclaimer provision in her revocable trust to enable Daughter and Son to disclaim part of what would be their inheritance under the trusts being left by Mother, with the result that such disclaimed assets would pass to charity.

To accomplish this, on Mother’s death, there might be a clause that would read as follows:

I would like to have up to $______________ transferred as a charitable devise to the __________ CHARITY FUND, but would like for the decision with respect to such devise to be made by my children, SON and DAUGHTER.

Therefore, to the extent that one or both of my children, SON or DAUGHTER, request the Trustees of any trust established for their primary benefit under this Trust Agreement make a disclaimer of assets otherwise passing into trust for such child of up to one-half of the amount listed above per child (1/2 of the amount stated in the paragraph above), the amounts and/or assets so disclaimed shall pass to the _______________ CHARITY FUND. Such disclaimer must be made within 180 days of my date of death.

To illustrate how this would work, let’s say that the charity is the Foundation To Support Thursday Reports, and that the maximum amount is $500,000.

After Mother’s death, Daughter might decide to disclaim $100,000, and Son might decide to disclaim $250,000. They will have nine months after Mother’s death to make this decision.

As the result of the disclaimers, $100,000 that would have gone into a trust for Daughter would go to the Notable Charity, and $250,000 that would have gone into a trust for Son would go to the Notable Charity.

Estate tax saved as the result of this would be expected to be 40% of $350,000, which is $140,000.

The following clause, or language like it, would also be included.

To the extent that the disclaimer to charity by one child exceeds the disclaimer to charity by the other child, then the larger amount of estate tax attributable to the smaller or lack of disclaimer attributable to the one child will be charged against the share of that child.

By means of example, assume that the client (i) had authorized $500,000 to be devised as a charitable devise; (ii) DAUGHTER decided to disclaim $100,000; and (iii) SON decided to disclaim $250,000. Further assume that as a result of the disclaimers, and assuming a 40% estate tax rate, disclaiming $350,000 saved $140,000 in estate tax ($100,000 + $250,000 = $350,000; $350,000 x 40% = $140,000). Based on these assumptions, SON would have disclaimed $150,000 more than DAUGHTER. The extra estate tax savings as a result of such disclaimer would be $60,000 ($250,000 – $100,000 = $150,000; $150,000 x 40% = $60,000). As a result, the separate share established for the benefit of DAUGHTER would be reduced by $60,000.

If Mother would like to give each child more flexibility as to what specific charity or charities their disclaimed amounts would go to, then she might name the Pinellas Community Foundation or the Community Foundation of Tampa Bay. These foundations are charities that basically receive dispositions, and then transfer the monies as requested by the family. Many local donors use the Community Foundation to get a tax deduction now, while having control over the investments and timing of the actual delivery of the intended funds to charity.

Fidelity, Schwab, and other firms have similar donor advised charitable fund arrangements whereby they hold investments based upon the direction of a trustee or individual and can make distributions to charity when instructed to do so. The transfers of money to these funds will qualify for an income tax charitable deduction at the time of funding, notwithstanding that the actual end game charities may not receive distributions until years after the initial funding of the charitable account.

Best personal regards,

John Q. Thursday-Report

Richard Connolly’s World

Avoiding Post-Death Financial Woes

Insurance advisor Richard Connolly of Ward & Connolly in Columbus, Ohio often shares with us pertinent articles found in well-known publications such as The Wall Street Journal, Barron’s, and The New York Times. Each week, we will feature some of Richard’s recommendations with links to the articles.

This week, the first article of interest is “Money Advice for Wives Whose Husbands Die Suddenly” by Kerry Hannon. This article was featured on Forbes.com on June 19, 2015.

Richard’s description is as follows:

One third of women who become widows are younger than 65, according to the Women’s Institute for a Secure Retirement. The financial issues they’ll immediately confront go far beyond losing an income.

In the weeks following a husband’s death, a widow will be forced to make dozens of decisions, so she’ll need to get a grip on finances as quickly as possible. This article illustrates how to accomplish that, based on research and interviews with two ace financial planners.

Please click here to read this article in its entirety.

The second article of interest this week is entitled “Death, Taxes, and Your IRA. Ouch.” By Jonathan Clements. This article was featured in The Wall Street Journal on June 11, 2015.

Richard’s description is as follows:

Your death could be more taxing than you imagine.

Thanks to 2015’s $5.43 million federal estate-tax exclusion, perhaps just one out of 600 deaths this year will trigger federal estate taxes. Yet many heirs will face steep tax bills, partly because some states levy their own estate tax, but mostly because of the income taxes due on inherited retirement accounts.

All this is bad news for many Americans. For the typical household approaching retirement age, retirement accounts are the second-largest asset they own, after their home…

What should these investors do? This article highlights three key strategies that many folks ought to consider and two others that could make sense for some families.

Please click here to read this article in its entirety.

Thoughtful Corner

Problem Solving and Making a Decision

Introductory Quotes to Live By

“Concentrate on a fantastic future!”

It is very easy to get caught up in things from the past that may disappoint or be of concern, but what good does that do you? We live to make the most of the now and the future. Exciting and feasible goals and taking the proper steps to achieve them will bring a much better peace of mind. Can clients be nudged that way in the conference room? Absolutely!

“The problem is never the problem. The problem is that you don’t know how to think about the problem.”

“Problems analysis” is a process that many people are completely unaware of. The “problem” itself is usually not the real issue. The way the person looks at the situation is the problem.

If you take a few minutes to write down the obstacles that have caused the problem and possible solutions to each obstacle, you will often be amazed at how quickly the problem can be solved.

Discussing this brief written analysis with someone uninvolved with the situation will often provide a quick solution. Remember, your problem may just be an expense if it can be removed by spending some money.

Making a Decision

Narrow Down the Choices, Evaluate the Options, and Get On With it!

No great achievement ever occurred without a decision being made. Use the Ben Franklin Fork in the Road or Decision to Be Made Chart and make a list of all of the things that you have not decided and the detriment suffered as a result.

Alternatively, start an experiment – READY, FIRE, AIM – what did you hit? How did it go? You could also ask an Ouija board, flip a coin, whatever it takes to get on with it.

We, as advisors and planners, help clients make important decisions. Let’s not forget that the opportunities they have may justify risks and actions that they can afford to handle. We can encourage this with appropriate analysis of exposure and how to best protect from risk.

Yes, it is our job to warn them of risks and help reduce problems ahead, but let’s not get carried away. If the client has the passion and the wherewithal to make an intelligent choice, then let’s do what we can to help them.

No great achievement has occurred without risk and ambition; doing nothing in the face of an important decision is often the wrong move.

As Yogi Berra said, “When you come to the fork in the road, take it.” What can we do to help clients understand that inaction can be very harmful in a number of ways?

No guts, no glory!

Problem Solving Without Clutter

Are you giving your brain the opportunity to problem solve, invent, and enjoy social situations, or are you cluttering it with social media and texting as a matter of habit?

There are thousands of things to think about when you have time. Most highly successful individuals prioritize their thinking, and, in quiet moments, whether while driving, fishing, or standing in line for a coffee, are able to think through solutions to problems, mentally rehearse for meetings, conversations, or presentations, and can elect to originate or replay enjoyable, calming, or otherwise useful daydreaming sequences.

When standing in line for 10 minutes for a coffee, are you scouring through emails, looking at Facebook, and generally providing an active conscious clutter out of habit or the desire to be sociable, or are you solving client problems (that you can bill for!), enjoying a cool fantasy, or mentally rehearsing for an upcoming event?

When you have a big event coming up, you will want to consider making sure that you have first thought through the following:

- Materials needed

- Knowledge needed

- Agenda

- Goals for the meeting or event

- Mental rehearsal time – thinking through what you are going to say and how you are going to answer any questions

- Who to discuss the above with

The above has been excerpted from the Professional Acceleration Workshop Workbook, which can be purchased by clicking here.

Look No Further for Professional Acceleration

Are you interested in learning strategies for business relationships and techniques commonly used by successful professionals? Check out the Ave Maria School of Law Professional Acceleration Workshop on August 22, 2015, with Alan S. Gassman. This is an eight-hour version of the five-hour program given at the University of Florida on May 30, 2015.

This workshop is open to all 3rd year law students, alumni, and experienced professionals who wish to enhance their professional and personal lives.

The interactive workshop will engage participants in conversations about personal goal setting, handling practical challenges and eliminating obstacles, client interactions, finding a work-life balance, and, most importantly, lunch is included. The workshop is also approved for CLE credit!

Registration for professionals is $35.00, and $20.00 for students or alumni of Ave Marie School of Law. Thursday Report readers may also register for $100.00, and receive a bucket of Kentucky Fried Chicken, two pints of mashed potatoes, and an extra stick of butter in exchange for their donation and a testimonial, which must be provided before the program in case you do not like it. To register, contact Donna Heiser at dheiser@avemarialaw.edu or via phone at 239-687-5405 or Alan Gassman at agassman@gassmanpa.com or via phone at 727-442-1200.

Humor! (or Lack Thereof!)

Sign Saying of the Week

********************************************

Upcoming Seminars and Webinars

Calendar of Events

LIVE WEBINAR:

Alan Gassman and Christopher Denicolo will present a live, free, 30-minute webinar on the topic of CREDITOR PROTECTION PLANNING FOR PHYSICIANS AND MEDICAL PRACTICES. There will be two opportunities to attend this presentation.

Date: Wednesday, August 12, 2015 | 12:30 PM – 1:00 PM and 5:00 PM – 5:30 PM

Location: Online webinar

Additional Information: To register for the 12:30 webinar, please click here. To register for the 5:00 webinar, please click here. For additional information, please email agassman@gassmanpa.com.

**********************************************************

LIVE BRADENTON PRESENTATION:

Alan Gassman will speak at the Coastal Orthopedics Physician Education Seminar on the topics of CREDITOR PROTECTION AND THE 10 BIGGEST MISTAKES DOCTORS CAN MAKE: WHAT THEY DIDN’T TEACH YOU IN MEDICAL SCHOOL.

This 50 minute informative talk with extensive materials will cover essential aspects and trip-ups that doctors often encounter in the area of personal and practice entity asset protection. It will also discuss tax and investment planning, advisor selection, health law, compliance, and other areas of interest for physicians.

Each attendee will receive a complimentary copy of Mr. Gassman’s book, Creditor Protection for Florida Physicians and other valuable materials.

Coastal Orthopedics, Sports Medicine, and Pain Management is a comprehensive orthopedic practice which has been taking care of patients in Manatee and Sarasota Counties for 40 years. They have sub-specialized, fellowship-trained physicians as well as in-house diagnostics, therapy, and an outpatient surgery center to provide comprehensive, efficient orthopedic care.

Date: Thursday, August 13, 2015 | 6:00 PM

Location: Coastal Orthopedics and Sports Medicine | 6015 Pointe West Boulevard, Bradenton, FL, 34209

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE WEBINAR:

Alan Gassman and Lester Perling will present a live, free, 30-minute webinar on the topic of MEDICAL LAW UPDATE – FEDERAL AND FLORIDA DEVELOPMENTS THAT MEDICAL PRACTICES AND ADVISORS NEED TO BE AWARE OF. There will be two opportunities to attend this presentation.

Date: Tuesday, August 18, 2015 | 12:30 PM – 1:00 PM and 5:00 PM – 5:30 PM

Location: Live webinar

Additional Information: To register for the 12:30 webinar, please click here. To register for the 5:00 webinar, please click here. For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE PORT RICHEY PRESENTATION:

Alan Gassman will be speaking with Barry Flagg at the North Suncoast Chapter FICPA meeting on a topic to be determined.

Date: Wednesday, August 19, 2015 | 4:30 PM – 6:15 PM

Location: Chili’s | 9600 US 19 North, Port Richey, FL, 34668

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE AVE MARIA SCHOOL OF LAW PROFESSIONAL ACCELERATION WORKSHOP:

Alan Gassman will present a full day workshop for third year law students, alumni, and professionals at Ave Maria School of Law. This program is designed for individuals who wish to enhance their practice and personal lives.

Cost of attendance is $35.00. If you are a student or alumni of Ave Maria School of Law, the cost of attendance is $20.00.

Delicious lunch, snacks and amazing conversations included!

Date: Saturday, August 22, 2015 | 9:00 AM – 5:00 PM

I was fortunate to attend the Law Practice and Professional Development Workshop conducted by Alan Gassman, Esq. in Clearwater, Florida on August 3, 2014. The Workshop covered a wide range of topics from Goal Setting and Gratitude to as practical a topic as law office logistics. Alan’s approach was intimate, self-revelatory and highly instructive. I have been practicing law for 20 years and have never attended a program as broad ranging, practical and encouraging. The depth of Alan’s thought and experience is obvious in the materials and in the ease with which he led the discussions. This was not a dull lecture but a highly engaging workshop that was over before you expected it to be.

Daniel Medina, B.C.S

Board Certified in Wills, Trusts and Estates

Medina Law Group, P.A.

Course materials are available on Amazon.com for $1.99 and can be found by clicking here.

Location: Thomas Moore Commons, Ave Maria School of Law, 1025 Commons Circle, Naples, FL 34119

Additional Information: To download the official invitation to this event, please click here. To RSVP and for more information, please contact Donna Heiser at dheiser@avemarialaw.edu or via phone at 239-687-5405 or Alan Gassman at agassman@gassmanpa.com or via phone at 727-442-1200.

**********************************************************

LIVE SARASOTA PRESENTATION:

Alan Gassman will speak at the Southwest Florida Estate Planning Council meeting on September 8th on the topic of EVERYTHING YOU ALWAYS WANTED TO KNOW ABOUT CREDITOR PROTECTION AND DIDN’T EVEN THINK TO ASK.

Date: Tuesday, September 8, 2015 | 3:30 PM – 5:30 PM with dinner to follow

Location: Sarasota, Florida

Additional Information: For additional information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE BLOOMBERG BNA WEBINAR (CONTACT US FOR A 25% DISCOUNT):

Alan Gassman and Al King, co-founder, co-chair, and co-CEO of South Dakota Trust Company, LLC, will present a Bloomberg BNA Webinar entitled WHAT IS SO SPECIAL ABOUT SOUTH DAKOTA? DOMESTIC ASSET PROTECTION TRUST LAW AND PRACTICES.

South Dakota’s legislature has attempted to take the best from each of the states that have the most favorable estate and trust laws to provide a fresh platform for examining and maximizing tax and non-asset protection objectives. This webinar will provide a practical and interesting discussion of both South Dakota and practical domestic asset protection law strategies. It will cover the legal aspects, present checklists and sample trust clauses, and provide creative and practical planning techniques that can be used by practitioners and their clients.

Date: Wednesday, September 9, 2015 | 12:00 PM – 1:00 PM

Location: Online webinar

Additional Information: To register for this webinar, please click here. For additional information, please email Alan Gassman at agassman@gassmanpa.com

**********************************************************

LIVE WEBINAR:

Molly Carey Smith and Alan Gassman will present a free webinar on the topic of THE 10 BIGGEST MISTAKES THAT SUCCESSFUL PARENTS (AND GRANDPARENTS) MAKE WITH RESPECT TO COLLEGE AND RELATED DECISIONS FOR HIGH SCHOOL STUDENTS.

Date: Saturday, September 12, 2015 | 9:30 AM

Location: Online Webinar

Additional Information: To register for this webinar, please click here. For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE SOUTH BEND PRESENTATION:

41ST ANNUAL NOTRE DAME TAX AND ESTATE PLANNING INSTITUTE

Rebecca Ryan, Bill Boersma, Daen Wombwell, Michael Halloran, and Alan Gassman will be presenting a talk at the Notre Dame Tax & Estate Planning Institute on the topic of UNDERSTANDING ILLUSTRATIONS, DESIGN OPPORTUNITIES, AND FINANCIAL EVALUATION OF WHOLE LIFE, UNIVERSAL, VARIABLE, AND EQUITY INDEXED LIFE INSURANCE.

Date: September 17 – 18, 2015 | Alan Gassman will speak on Thursday, September 17 | 11:30 AM – 12:30 AM

Location: Century Center | 120 South Saint Joseph Street, South Bend, IN 46601

Additional Information: Click here to download the 2015 program brochure. For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE FORT LAUDERDALE PRESENTATION:

Ken Crotty will be presenting a 1-hour talk on PLANNING FOR THE SALE OF A PROFESSIONAL PRACTICE – TAX, LIABILITY, NON-COMPETITION COVENANT, AND PRACTICAL PLANNING at the Florida Institute of CPAs Annual Accounting Show.

Date: Friday, September 18, 2015 | 3:30 PM – 4:20 PM

Location: Broward County Convention Center | 1950 Eisenhower Blvd, Fort Lauderdale, FL 33316

Additional Information: For additional information, please email Ken Crotty at ken@gassmanpa.com or CPE Conference Manager Diane K. Major at majord@ficpa.org.

**********************************************************

LIVE WEBINAR:

Alan Gassman, Christopher Denicolo, and Kenneth Crotty will present a 50-minute webinar entitled CREATIVE PLANNING FOR FLORIDA REAL ESTATE. This presentation will be free and worth every dollar!

There will be two opportunities to attend this presentation. This webinar will qualify for CLE and CPE credit.

Date: Wednesday, September 23, 2015 | 12:30 PM or 5:00 PM

Location: Online webinar

Additional Information: To register for the 12:30 webinar, please click here. To register for the 5:00 webinar, please click here. For more information, please email agassman@gassmanpa.com.

**********************************************************

LIVE WEBINAR:

Alan Gassman will present a free, 30-minute webinar on the topic of THE 10 BIGGEST LEGAL MISTAKES MOST BUSINESS OWNERS AND INVESTORS MAKE (AND HOW YOU CAN AVOID MAKING THEM.)

There will be two opportunities to attend this presentation.

Date: Thursday, September 24, 2015 | 12:30 PM or 5:00 PM

Location: Online webinar.

Additional Information: To register for the 12:30 webinar, please click here. To register for the 5:00 webinar, please click here. For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE BLOOMBERG BNA WEBINAR (CONTACT US FOR A 25% DISCOUNT):

Alan Gassman and Lee-Ford Tritt will present a webinar on the topic of WHETHER TO MARRY AND WHAT TO CONSIDER: A TAX AND ESTATE PLANNER’S GUIDE TO COUNSELING SAME-SEX COUPLES WHO MAY TIE THE KNOT for Bloomberg BNA.

Following the decision of the United States Supreme Court in Obergefell v. Hodges, same-sex couples now enjoy the same legal and tax benefits as opposite-sex couples. These benefits include marriage, divorce, adoption and child custody, separation agreements, Qualified Domestic Relations Orders (QDROs), marital property, survivorship spousal death benefits, inheritance through intestacy, priority rights in guardianship proceedings, and contract rights.

This program will discuss relationship and marital agreements, tax issues, reasons to marry or not marry, and a number of unique circumstances that can apply to same-sex couples as well as to opposite-sex couples.

Date: Wednesday, September 30, 2015 | 12:00 PM – 1:00 PM

Location: Online webinar

Additional Information: For more information, please contact Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE WEBINAR:

Steven B. Gorin and Alan Gassman will present a free webinar on the topic of INCOME TAX EXIT STRATEGIES. There will be two opportunities to attend this presentation.

Date: Thursday, October 1, 2015 | 12:30 PM and 5:00 PM

Location: Online webinar

Additional Information: To register for the 12:30 PM webinar, please click here. To register for the 5:00 PM webinar, please click here. For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE WEBINAR:

Molly Carey Smith and Alan Gassman will present a free webinar on the topic of FAILURE TO LAUNCH: 20-SOMETHINGS WITHOUT A SOLID CAREER PATH – WHAT PARENTS (AND OTHERS) NEED TO KNOW.

Date: Saturday, October 3, 2015 | 9:30 AM

Location: Online webinar

Additional Information: Please click here to register for this webinar. For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE CLEARWATER PRESENTATION:

Christopher Denicolo will be speaking at the Pinellas County Estate Planning Council meeting on the topic of PLANNING WITH IRAs AND QUALIFIED PLANS.

Date: Monday, October 5, 2015

Location: To Be Determined

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com or Christopher Denicolo at christopher@gassmanpa.com.

**********************************************************

LIVE WEBINAR:

Alan Gassman, Ken Crotty, and Christopher Denicolo will present a webinar on the topic of WHAT EVERY NEW JERSEY ATTORNEY SHOULD KNOW ABOUT FLORIDA ESTATE PLANNING. This webinar will qualify for 2 New Jersey CLE credits.

Most advisors with Florida clients are unaware of the unique rules and planning considerations that affect Florida estate, tax, and business planning. Unlike some other states, Florida’s laws regarding limited liability companies, powers of attorney, taxation, homestead, creditor exemptions, trusts and estates, and documentary stamp taxes are not simply versions of a Uniform Act. They have been crafted by the Florida legislature to apply to various specific issues in an often counterintuitive manner.

This presentation will have the following objectives:

- Unique aspects of the Florida Trust and Probate Codes

- Creditor protection considerations and Florida’s statutory creditor exemptions

- The Florida Power of Attorney Act

- Traps and tricks associated with Florida’s Homestead Law and Elective Share

- Documentary stamp taxes, sales taxes, rent taxes, property taxes, and how to avoid them

- Business and tax law anomalies and planning opportunities

Date: Thursday, October 8, 2015 | 12:00 PM – 1:40 PM

Location: Online Webinar

Additional Information: For more information, please email Alan Gassman at agassman@gassmanpa.com or Eileen O’Connor at eoconnor@njsba.com.

**********************************************************

LIVE WEBINAR:

Alan Gassman will present a free, 30 minute webinar on the topic of ESTATE AND ESTATE TAX PLANNING – CONVENTIONAL AND ADVANCED PLANNING TECHNIQUES TO MINIMIZE TAXES AND EFFECTIVELY PASS ON YOUR WEALTH.

There will be two opportunities to attend this presentation.

Date: Wednesday, October 14, 2015 | 12:30 PM and 5:00 PM

Location: Online webinar.

Additional Information: To register for the 12:30 PM webinar, please click here. To register for the 5:00 PM webinar, please click here. For more information, please email Alan Gassman at agassman@gassmanpa.com.

**********************************************************

LIVE SARASOTA PRESENTATION:

2015 MOTE VASCULAR SURGERY FELLOWS – FACTS OF LIFE TALK SEMINAR FOR FIRST YEAR SURGEONS

Alan Gassman will be speaking on the topic of ESTATE, MEDICAL PRACTICE, RETIREMENT, TAX, INSURANCE, AND BUY/SELL PLANNING – THE EARLIER YOU START, THE SOONER YOU WILL BE SECURE.

Date: Saturday, October 24th, 2015

Location: To Be Determined

Additional Information: Please contact Alan Gassman at agassman@gassmanpa.com for more information.

**********************************************************

LIVE MANHATTAN PRESENTATION:

INTERACTIVE ESTATE AND ELDER PLANNING LEGAL SUMMIT

Alan Gassman will be speaking on Scientific Marketing For The Estate Planner – How to do more of what you love to do, and less of the other, while better serving clients, colleagues, and your community.

Other speakers include Jonathan Blattmachr, Austin Bramwell, Natalie Choate, Mitchell Gans, and Gideon Rothschild.

Date: November 4 – 6, 2015 | Alan Gassman will be speaking on November 5 | Time TBA

Location: New York Hilton Midtown Manhattan | 1335 Avenue of the Americas, New York, NY 10019

Additional Information: Please contact Alan Gassman at agassman@gassmanpa.com for more information or visit http://ilsummit.com/ to register.

Notable Events by Others

LIVE TAMPA EVENT:

TAMPA THEATRE 14TH ANNUAL WINEFEST

Bust out your sweet dance moves and come have a “killer time” with Napoleon, Pedro, Kip, and Lafawnduh at Tampa Theatre’s 14th annual WineFest, Napoleon Wineamite. This year’s event features snacks and samples from local independent restaurants, sips from the finest wineries, and evening of rare, top-rated wines and – for the first time this year – a “Movie Under the Stars” screening of this year’s theme, Napoleon Dynamite.

While the theme may be silly, the purpose is most serious. Now in its 14th year, the annual WineFest is Tampa Theatre’s biggest fundraising event of the year, benefitting the historic movie palace’s artistic and educational programs, as well as its ongoing preservation and restoration.

Date: September 10 – 17, 2015

Location: Tampa Theatre | 711 N. Franklin Street, Tampa, FL 33602

Additional Information: Tickets are on sale now at www.tampatheatre.org/winefest. Sponsorship opportunities are also available. Please contact Maggie Ciadella at maggie@tampatheatre.org for more information about sponsorship or the event.

**********************************************************

LIVE ORLANDO PRESENTATION:

50TH ANNUAL HECKERLING INSTITUTE ON ESTATE PLANNING

Date: January 11 – January 15, 2016

Come celebrate the 50th Year Anniversary (and 32 years of Alan Gassman not speaking at this conference) with us and our many friends (or at least they pretend to like us) at this important annual estate planning event.

Location: Orlando World Center Marriott Resort & Convention Center | 8701 World Center Drive, Orlando, FL 32821

Additional Information: Registration for the 50th Annual Heckerling Institute on Estate Planning will open on August 3, 2015. For more information, please visit http://www.law.miami.edu/heckerling/.

**********************************************************

LIVE ST. PETERSBURG PRESENTATION:

ALL CHILDREN’S HOSPITAL FOUNDATION 18TH ANNUAL ESTATE, TAX, LEGAL & FINANCIAL PLANNING SEMINAR

We are pleased to announce that Jonathan Blatttmachr, Howard Zaritsky, Lee-Ford Tritt, Lauren Detzel, Michael Markham, and others will be speaking at the 2016 All Children’s Hospital Estate, Tax, Legal & Financial Planning Seminar.

Lauren Detzel will be speaking on Family Law and Tax Planning for Divorce, Michael Markham will be speaking on Bankruptcy and Creditor Protection/Fraudulent Transfers in the Context of Estate Planning, Howard Zaritsky will talk about Income and Estate Tax Planning Techniques in View of Recent Developments, and Lee-Ford Tritt will speak on Gun Trusts and Same Sex Marriage Consideration Highlights. Do not miss this important conference.

We thank Lydia Bailey and Lori Johnson for their incredible dedication (and patience with certain members of the Board of Advisors.) All Children’s Hospital is affiliated with Johns Hopkins.

Date: Wednesday, February 10, 2016

Location: Live Event at the All Children’s Hospital St. Petersburg Campus; Live webcasts in Tampa, Fort Myers, Belleair, New Port Richey, Lakeland, and Sarasota

Additional Information: Please contact Lydia Bennett Bailey at lydia.bailey@allkids.org for more information.

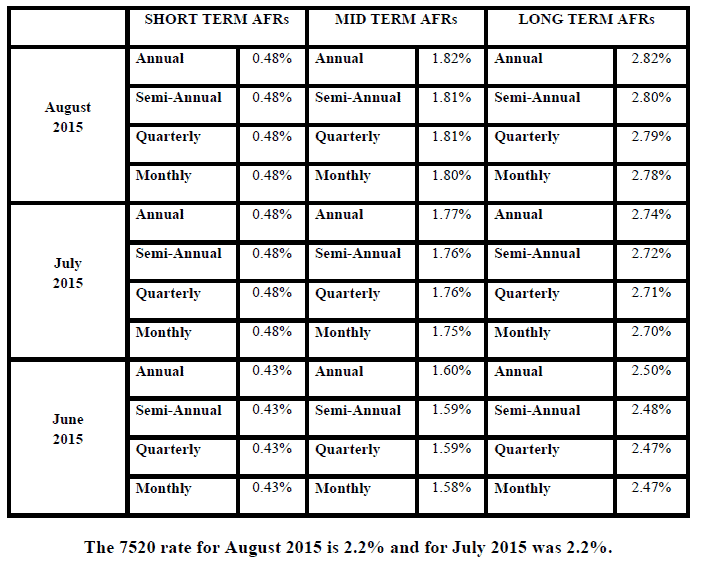

Applicable Federal Rates

Below we have this month, last month’s, and the preceding month’s Applicable Federal Rates, because for a sale you can use the lowest of the 3.