The $800,000 Mistake, Addicted Beneficiaries, and the Lawyer/Dolphin

5th Circuit Court of Appeals BP Opinion Issued Last Night

Why a Married Couple with $4,500,000 in Assets and $2,000,000 of Life Insurance Needs an Irrevocable Life Insurance Trust – Do Not Make an $800,000 Mistake

Our Article: Trust Planning for the Addicted Beneficiary – What the Mental Health Counselor Needs to Know About Trust Law with an Incentive Trust System designed by Alan Gassman and Mental Health Counselors (Not his mental health counselors!)

Dolphins in the News! – Part 1 – Rest In Peace Panama and Part 2 – Clearwater Marine Science Center Replaces Dolphin with Lawyer

Lawyers in History: The Impact of Law Practice on Their Lives and Careers – Mark Twain’s Father was a Lawyer

We welcome contributions for future Thursday Report topics. If you are interested in making a contribution as a guest writer, please email Janine Gunyan at Janine@gassmanpa.com.

This report and other Thursday Reports can be found on our website at www.gassmanlaw.com.

BP 5th Circuit Court Decision

The Fifth Circuit Court of Appeal released an Opinion just last night which is not good for the claims of professional service companies, farming, or construction entities. The Opinion holds that a preliminary injunction should be in place to prevent adjudication and payment of claims for farmers, professional service firms, and construction companies while the Court sorts out the apparent new requirement imposed in this opinion that financial statements must be on an accrual basis of accounting, meaning that profits and losses have to be measured based upon when earned and owed, not when cash is received or paid.

The Opinion also holds that revenue and expenses must be matched. This will increase the amount of some claims but decrease other claims. It will also prevent some claims from being calculated for individuals and businesses that have inadequate accounting records.

Please email us at agassman@gassmanpa.com for a copy of this shocking 67 page decision, which may be reviewed by the full Fifth Circuit Court of Appeals in New Orleans and, perhaps, the U.S. Supreme Court.

John Goldsmith of the Trenam Kemker law firm has promised us an analysis of this new case in the next day or two.

We will send it as soon as it is available.

Tampa BP Seminar Announcement: BP Calculations for CPAs – Tricks & Traps Seminar

On Wednesday, October 23, 2013 at 6:00 pm, Alan Gassman and John Goldsmith and Dean Kent of Trenam Kemker law firm will be presenting a seminar in Tampa at a presently secret location where both dolphins and Dick Cheney can attend and enjoy this informative program. Our feedback from the Clearwater BP Seminar was excellent. One participate even left her spouse as the result of this seminar.

Why a Married Couple with $4,500,000 in Assets and $2,000,000 of Life Insurance Needs an Irrevocable Life Insurance Trust – Do Not Make an $800,000 Mistake

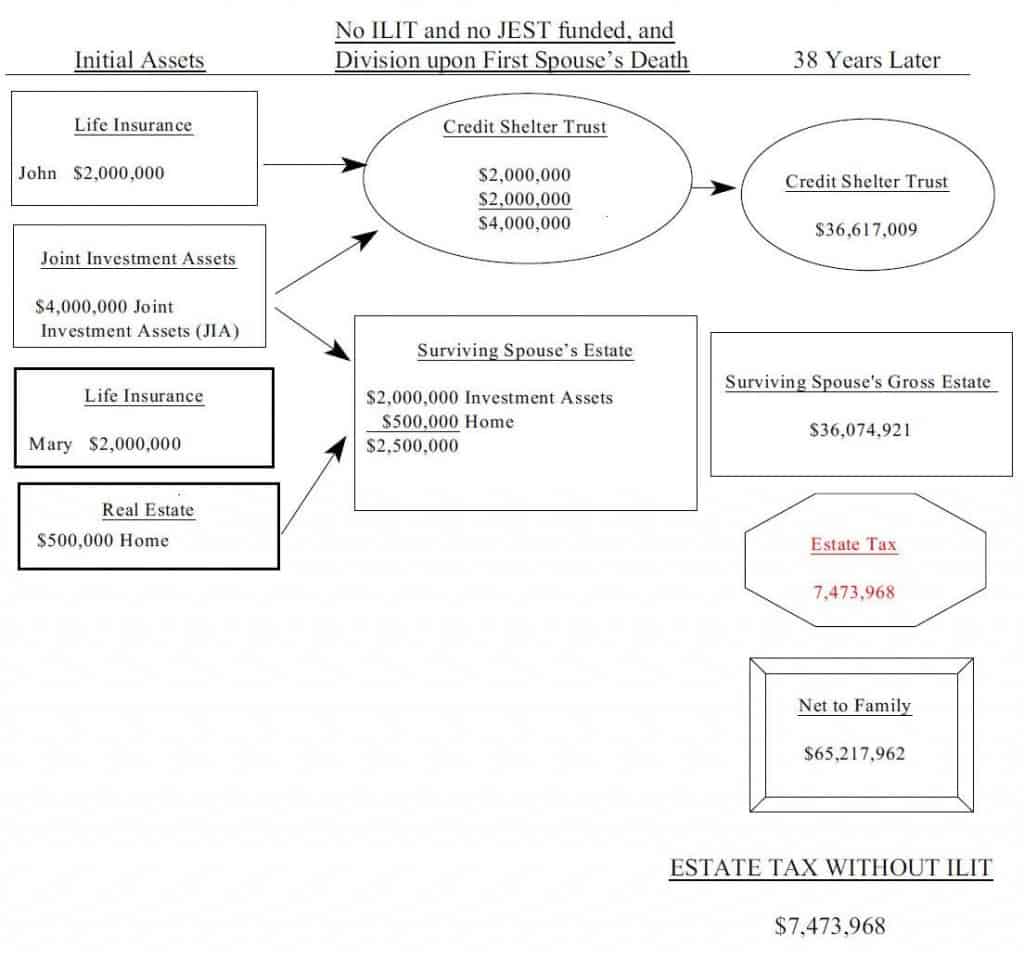

John and Mary are both 40 years old and have a $4,500,000 net worth, consisting of a $500,000 home and $4,000,000 of joint investment assets. They each have $2,000,000 worth of life insurance payable to their respective revocable trusts. The surviving spouse will save $80,000 per year after the first spouse dies in 2014.

If one of them dies and the proceeds from one life insurance policy and half of the joint investment assets pass into a credit shelter trust that will not be subject to estate tax on the second death, then the credit shelter trust will be funded with $4,000,000 worth of assets. The surviving spouse will have a $5,250,000 estate tax exemption that will grow with the Consumer Price Index, and another $1,250,000 portability allowance that will not grow with inflation.

If one of them dies the survivor will drop the life insurance on the survivor because the purpose of the life insurance is to help enhance the well-being of the surviving spouse.

The surviving spouse will therefore have an estate of $2,500,000 ($2,000,000 worth of investment assets + $500,000 home = $2,500,000) and $4,000,000 in a credit shelter trust, so it would not seem that a life insurance trust would have been necessary for the first dying spouse.

But what about the time value of money? If the surviving spouse lives to his or her life expectancy of 38 years, the investments grow at a compounded net rate of six percent (6%) (which is well under the 50-year average for an appropriately managed portfolio), the surviving spouse adds $80,000 a year in year 1 and thereafter an inflation-adjusted amount and this is added to the $2,000,000 of investments, and if the surviving spouse’s $5,250,000 allowance grows by three percent (3%) a year, then here are the results in 38 years:

1. The $4,000,000 credit shelter trust will have grown to $36,617,009 that will pass estate tax free.

2. The surviving spouse’s estate tax exemption will have grown to $16,140,000.

3. The $1,250,000 portability allowance will have stayed stationary (or would disappear if the surviving spouse remarried and the new spouse predeceases the surviving spouse and has used their entire estate tax exemption).

Assuming that the portability allowance remains, the estate tax on the surviving spouse’s $36,074,921 estate would be $7,473,968, assuming a forty percent (40%) estate tax.

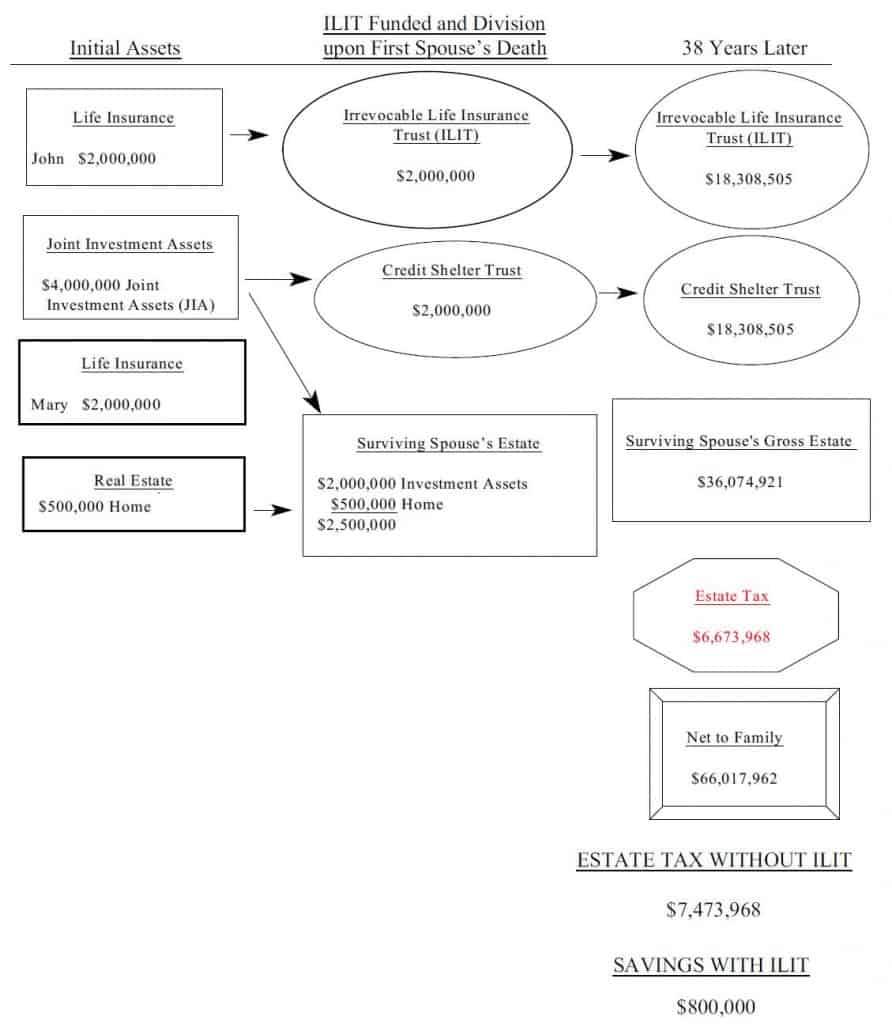

Let’s go back now and assume that the $2,000,000 life insurance policy on the first spouse’s death was in an irrevocable life insurance trust. As the result of this, the surviving spouse’s portability allowance would have been $3,250,000 instead of $1,250,000.

Assuming that the portability allowance remains, the estate tax on the surviving spouse’s $36,074,921 estate would be $6,673,968, assuming a forty percent (40%) estate tax.

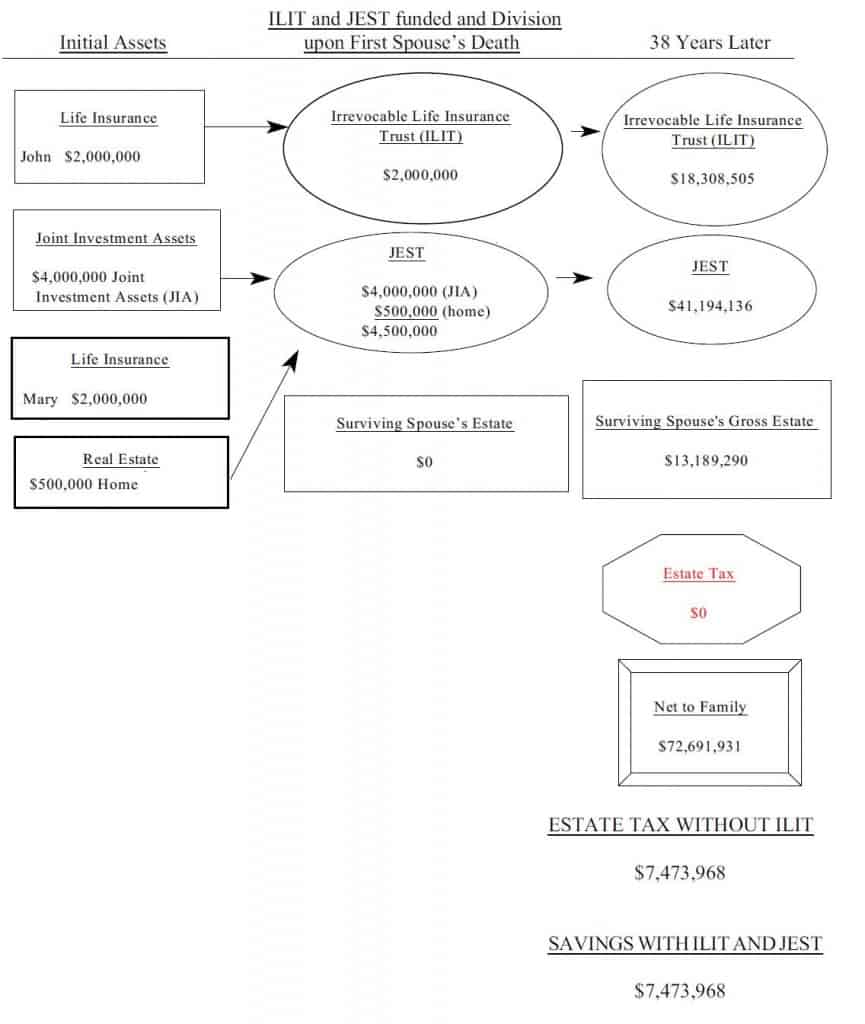

Going back to the first death, if the couple had had the entire $4,500,000 estate pass into a credit shelter trust on the first death (by reason of their living in a community property state and using a joint trust, or living in a non-community property state and using a JEST trust or other mechanism that allowed for having the entire $4,500,000 pass into a credit shelter trust on the first death and utilized an irrevocable life insurance trust on the first death, then the surviving spouse’s estate would be $13,189,290, and there would be no estate tax owed on the second death.

As a consequence of the above, planners should more strongly consider irrevocable life insurance trusts and full credit shelter trust funding strategies.

Our Article: Trust Planning for the Addicted Beneficiary – What the Mental Health Counselor Needs to Know About Trust Law with an Incentive Trust System designed by Alan Gassman and Mental Health Counselors (Not his mental health counselors!)

We have divided the article into 3 parts and part 1 is below:

Many successful families have one or more members who at some point deal with addictions to drugs, alcohol, or gambling. Illicit drug use continues to rise in the United States, and millions of Americans meet criteria for either dependence or abuse of alcohol or other substances (Substance Abuse and Mental Health Services Administration, 2011). Gambling addiction is thought to occur in a small percentage of the American population, yet these individuals are believed to account for a large percentage of the revenue acquired in parts of the gambling business (Dizikes, 2012). This information indicates that those with gambling addictions are spending significant monies to support their addictions. Along with the emotional distress addiction creates in families, there are also important issues concerning finances and inheritance.

The natural desire of parents to treat their children equally, with respect to their inheritance and the management of inheritance, however, is often outweighed by the problems associated with providing outright gifts to an addicted beneficiary-child. The issue of gifting to the “addicted beneficiary” is the primary focus of this article, but many of the issues and concepts are equally applicable to passing wealth to beneficiaries who function at a high level but whom display emotional and other psychological challenges such as impulsivity, anger and bi-polar issues.

Wealthy families often provide living accommodations, a stream of income, and gifts to an addicted individual, which tends to result in the individual receiving such benefits having little work experience, and may lead to diminished motivation or desire to work. The process of “enabling” the addicted family member often exacerbates the dependency problem, because the well-meaning support of family for the addicted loved one inhibits development of a sense of self esteem and pursuit of personal or professional goals. They do not dedicate the necessary time to ensure successful employment or develop meaningful relationships that are commonly helpful to working professionals, business owners, and gainfully employed individuals. Although in most circumstances the road to recovery will need to include firm boundaries and a discontinuation of the enabling process, many times parents are not willing to leave their children on their own, regardless of their age. Ultimately, the best case scenario for the addicted personality is treatment and continuing care that potentially involve such things as abstinence monitoring and community support (McKay et al., 2009). Research on individuals who remained abstinent over a period of three years were shown to have self-esteem levels comparable to college students, indicating that a sober life may increase goal-directed behavior (Christo & Sutton, 1994). Several treatment options are available, especially to those with available funds, but relapse is likely when treatment plans are not followed (National Institute on Drug Abuse, 2012). If the addicted family member is not willing to commit to follow the medically prescribed road to recovery, the best case scenario is to have the estate plan control the flow of money to the addicted person. Families and estate planners should bear in mind that money is often recognized as a trigger for relapse, and that many addicted individuals have not developed the life skills sufficient to handle money in a responsible manner. Although families may desire their loved one continue the status quo financially, addicted individuals should also receive counseling and advice regarding how to manage money while in recovery.

Commonly the family head wishes to continue the status quo of “enabling,” but must address the addicted family member specifically in their estate plan. The estate planner may therefore occupy a pivotal role in helping the family determine how to handle not only the inheritance of the addicted individual and his or her family, but also with respect to how to handle the addicted individual’s support and applicable issues while the family matriarch and/or patriarch is still alive and well.

The estate planner will often find that a significant degree of denial among one or both of the clients concerning the severity of the problem. They will deny their role in what has caused or is causing the problem, and what type of approach is best taken to help both the addicted person and the immediate family members realize the best outcome for the situation. In most cases the addiction has already created a significant amount of family strain, so some family members will have very strong ideas and opinions about the estate plan. In most family systems there are enablers and members who are more willing to discontinue support, both emotional and financial.

The problem with waiting to address the problem is the often unforeseen danger that as the family head ages, he or she becomes more exposed to pressure, both mentally and physically, from the addicted individual for money, attention, and inheritance rights. This can exacerbate conflicts already present, including relationships with siblings and other family members who are commonly resented and made fearful by the addicted individual.

The welfare of the addicted child’s spouse and/or significant other is also a common concern, which is made even more difficult as they will often have the same or a similar addiction, co-dependence, and a substantial investment in denial of the problem, as well as the children and/or stepchildren of the impaired individual and other family members, all of whom are gravely affected by the decisions ultimately made on how the inheritance will be handled.

Recovery of the addicted individual is the paramount objective. Unfortunately, however, family dynamics and the potential for a large inheritance process create a significant stressor for the addicted beneficiary and those around them. Financial support has the possibility of promoting their recovery process or destroying it. This article will provide some suggested structures and forms to address the inheritance of the impaired beneficiary with their best interests and the interests of their family in mind, and will also offer suggestions on how an estate planner may best interact with the family and allied health care professionals in the process.

Next week we will cover part 2 of this article, which will provide language and suggestions for structuring support guidelines and associated trust planning concepts.

Dolphins in the News!

Part 1 – Rest in Peace Panama the Dolphin

Beloved Clearwater Marine Aquarium (CMA) dolphin Panama died on September 25, 2013. Rescued from a Panama City beach on October 21, 2000, Panama found her permanent home at CMA in 2001. She was an Atlantic bottlenose dolphin and is widely recognized as the adoptive mother to Winter, the dolphin with the prosthetic tail and star of the feature film Dolphin Tale. Panama, who was believed to be deaf, also played a special role at the aquarium, encouraging hearing-impaired children to live their lives to the fullest.

Panama was the oldest dolphin at CMA. Though dolphins have an expected lifespan of about 25 years, Panama was estimated to be in her late 30s to early 40s at the time of her death. As such, it is expected that she died of natural causes. Panama has been entertaining families and guests to the CMA for over a decade, so she will surely be missed!

Panama was well loved by many people who watched her play games with rafts and with the other dolphins. The dolphins wrestle over rafts like dogs pull toys from each other. Go see this! Panama would have also probably played cards but they never gave her a waterproof deck.

Part 2 – Clearwater Marine Science Center Replaces Dolphin with Lawyer

Tax lawyer Linda Griffin, of Linda Suzzanne Griffin, P.A., is a long-time volunteer with the Clearwater Marine Aquarium and a member of the rescue and release agency’s dive team. After leaving her law practice for the day, Linda, an advocate for oceanic and environmental preservation, often heads over to the CMA to care for, rehabilitate, and work with the aquatic animals. Now, Linda has decided to take her volunteer status to the next level.

Linda has agreed to become a dolphin and will be putting her dolphin skills on display at the Clearwater Marine Science Center. She can swim through 9 hoops with a blind fold, and her hobbies include cleaning fish, snorkeling, and making clicking sounds in elevators. She will be swimming at the Clearwater Marine Science Center from 2 pm to 5 pm Monday – Thursday. Any charitable organization would be pleased to have Linda. Very few lawyers will work for fish.

She is finn-nominal.

Lawyers in History: The Impact of Law Practice on Their Lives and Careers – Mark Twain’s Father Was a Lawyer

Mark Twain: A Son of a Lawyer

American author and humorist Samuel Langhorne Clemens, better known under his pen name Mark Twain, was born in 1835. During his lifetime, he served as a printer’s apprentice, piloted a riverboat, and became known as the father of American literature. While Twain himself was not a lawyer, Twain’s father, John Marshall Clemens, became a licensed attorney at the age of 21. Named for the fourth Chief Justice of the United States, John Marshall Clemens went on to practice law in three states and serve as a county commissioner, county clerk of a probate court, acting attorney general, and county justice of the peace throughout his lengthy legal career.

It seems that his father’s knowledge of the legal field and business practices passed to his son, for most of Twain’s novels use humor to criticize the economy, government, and, quite often, lawyers. Through both his personal experience with and knowledge of the law, Twain has been praised as “the most faithful delineator of courts and lawyers that we have had among us,” in the 2003 Connecticut Law Review article, “Things are Seldom What They Seem: Judges and Lawyers in the Tales of Mark Twain,” by Lucia A. Silecchia.

For a fun article on Mark Twain’s Guide for Lawyers please click here.

Some of our favorite Mark Twain Jokes & Quotes are as follows:

“October. This is one of the peculiarly dangerous months to speculate in stocks. The others are July, January, September, April, November, May, March, June, December, August, and February.” – Pudd’nhead Wilson’s Calendar (1894)

“Suppose you were an idiot, and suppose you were a member of Congress, but then I repeat myself.” – Mark Twain, a Biography (1912)

“Patriot: The person who can holler the loudest without knowing what he is hollering about.” – More Maxims of Mark (1927)

“The political and commercial morals of the United States are not merely food for laughter, they are an entire banquet.” – Mark Twain in Eruption (1940)

“They all laid their heads together like as many lawyers when they are gettin’ ready to prove that a man’s heirs ain’t got any right to his property.” – Thomas Jefferson Snodgrass letter, Keokuk Saturday Post (Nov. 1, 1856)

BLOOMBERG BNA YEAR END PLANNING WEBINAR

Making the Most of Year-End Planning Opportunities with Checklists, Forms, and Client Letters

Date: Wednesday, October 30, 2013, from 12:30 pm to 2:00 pm

Presenters: Alan S. Gassman, Esq., Kenneth J. Crotty, Esquire, and Christopher J. Denicolo, Esquire

This new practical webinar from Bloomberg BNA, presented by Alan S. Gassman, Kenneth J. Crotty and Christopher J. Denicolo, concentrates on year-end planning techniques which practitioners need to consider for their clients. This includes techniques that are available to utilize the clients’ lifetime gift exemption, to structure clients’ planning to reduce or eliminate possible income tax exposure, and the potential pitfalls and traps that need to be considered. Practitioners should not miss this program.

During this live webinar, Gassman, Crotty and Denicolo will cover:

-Stepped-up basis planning – considering the use of a JEST trust, Alaska community property trusts, and similar techniques

-Income tax planning as a result of the higher income tax rates and the 3.8% Medicare tax

-Mechanizing office correspondence client interaction and drafting systems to facilitate annual gifting to make use of annual exclusions and lifetime gift tax exemptions

-Utilizing split gifts and common mistakes related to same

-Reforming irrevocable trusts to facilitate a stepped-up basis upon the Grantor’s death

-How asset growth and savings can make a currently non-estate taxable client subject to possible estate tax in years to come

-Designing valuation adjustment and assignment clauses to maximize the value of the gifts while using valuation discounts

-Application of the Step Transaction Doctrine to year-end gifts

-Utilizing LLCs or LLLPs when making gifts

-Establishing Dynasty Trusts for the benefit of spouses and descendants

-Using Intentionally Defective Grantor Trusts (IDGT)

-Forgiving loans or reducing debt and using Swap-Back SCINs to utilize the increased lifetime gift exemption

-Analysis of CCA 201330033, and how this may impact utilizing SCINs

-Accelerating income, and planning to “spray” income to trust beneficiaries in lieu of using Grantor Trusts

-Reconsidering the use of irrevocable life insurance trusts because of the 40% Rule

-Discussion of a planner’s checklist which can be reviewed by practitioners with their clients to help discover additional planning opportunities

Learning Objectives:

– Understanding the traps which may apply to year-end planning

– Facilitating a stepped-up income tax basis on assets on death to eliminate possible future capital gains

– Recognizing that planning for possible estate tax is important for currently non-estate taxable clients because of future assets growth and savings

– Structuring clients’ planning to plan for income tax avoidance

– Maximizing the use of clients’ increased lifetime gift exemption

– Implementing and annual gifting system that is easily communicated to clients

– Reviewing a checklist of important items to review with clients

Designed For: Any tax practitioner who wants to understand various strategies to utilize a client’s lifetime gift exemption before the end of the year, structure clients’ planning to reduce income tax exposure, and avoid adverse consequences.

EMAIL US AT agassman@gassmanpa.com FOR A TOP SECRET VERY VERY UNIQUE SPECIAL CODE FOR DISCOUNTS FOR ATTENDEES, OR FOR A SPECIAL RECIPE FOR MAKING TUNA FISH TASTE LIKE KENTUCKY FRIED CHICKEN WHEN EATEN BY DOLPHINS.

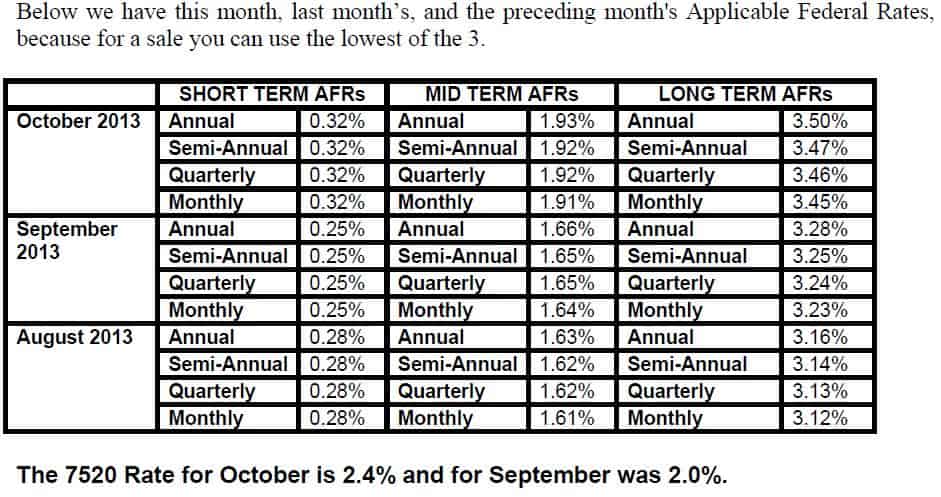

Applicable Federal Rates

Seminars and Webinars

LUNCH TALK – THE POWER OF POSITION MARKETING FOR ATTORNEYS

Date: Monday, October 7, 2013 | 12:30 p.m.

Location: Online webinar

Presenter: John Graden

Additional Information: To register please visit www.clearwaterbar.org

MEET & GREET COCKTAIL HOUR WITH DR. SRIKUMAR RAO

Noted author and nationally recognized speaker, Dr. Srikumar Rao will be joining us for a cocktail party on Wednesday, October 9, 2013 at 6 pm in the evening. We will begin with light hors d’ oeuvres followed by a talk by Dr. Rao on GOOD THING – BAD THING – WHO KNOWS? CHANGING YOUR IMMEDIATE AND LONG-TERM RESPONSES TO EVENTS AND CHALLENGES.

DATE: Wednesday, October 9, 2013

Location: Holiday Inn Express, U.S. 19 & Gulf-to-Bay Blvd, Clearwater, Florida

Additional Information: To register for the event please click here.

PLANNED GIVING CONSORTIUM LUNCHEON

Kenneth J. Crotty, Esq. and Christopher J. Denicolo, Esq. will be speaking at the Planned Giving Consortium Luncheon on the topic of FLORIDA LAW FOR THE ESTATE AND FINANCIAL PLANNER

Date: Thursday, October 10, 2013 | 12:00 – 1:00 p.m.

Location: Spartan Manor, 6121 Massachusetts Avenue, New Port Richey

Additional Information: For more information or to attend this event please email agassman@gassmanpa.com

INTERACTIVE HALF-DAY WORKSHOP WITH DR. SRIKUMAR RAO

On Saturday, October 12, 2013 we are co-hosting an interactive workshop with Dr. Srikumar Rao on the subject of ENHANCED EFFECTIVENESS AND ENJOYMENT OF YOUR PROFESSIONAL AND PERSONAL LIFE – 5 TOOLS YOU CAN START USING IMMEDIATELY.

Date: Saturday, October 12, 2013 | 1:00 – 6:00 pm with an optional 7:00 – 8:00 p.m. question and answer session.

Location: Holiday Inn Express, U.S. 19 & Gulf-to-Bay Blvd, Clearwater, Florida

Additional Information: To register for the event please click here.

NOTRE DAME TAX INSTITUTE

Jerry Hesch and Alan Gassman will be speaking on the topic of INTERESTING INTEREST QUESTIONS, PLANNING WITH LOW INTEREST LOANS, PRIVATE ANNUITIES, DEFECTIVE GRANTOR TRUSTS, AND PRIVATE AND COMMERCIAL ANNUITIES

Date: Wednesday, October 16 through Friday, October 18, 2013

Location: Notre Dame College, South Bend, Indiana

Additional Information: Professor Jerry Hesch’s Notre Dame Tax Institute will once again emphasize the importance of income tax planning and implications in addition to estate, estate tax, and related concepts. Also Paul and attorney Barry will be discussing stepped-up basis tools and techniques, including our JEST Trust.

We welcome questions, comments and suggestions for the presentation that we are assisting Jerry in preparing and presenting.

PINELLAS COUNTY ESTATE PLANNING COUNCIL HALF-DAY SEMINAR

Alan Gassman will be speaking on the topic of HOT TOPICS FOR ESTATE PLANNERS, including same sex marriage, estate tax planning software (with all attendees to receive a free beta version of our new software), and other important topics.

Sandra Diamond will speak on the new Florida laws that impact estate planning, amending of decanting existing irrevocable trusts, and other recent Florida law developments.

Barry Flagg will speak on insurance and estate planning.

Sean Casey of Fifth-Third Bank will give an economic update.

Date: Wednesday, October 23, 2013 | 8:00 am – 12:00 p.m. (60 MINUTE PRESENTATION) Breakfast and networking opportunities starting at 7:15 am.

Location: Ruth Eckerd Hall

Additional Information: To attend the meeting or to receive information on joining the Council please click here or email agassman@gassmanpa.com. To see a flyer of the event with more detailed information, please click here.

BP CALCULATIONS FOR CPAS: TRICKS & TRAPS SEMINAR WITH JOHN GOLDSMITH AND DEAN KENT

Date: Wednesday, October 23, 2013 | 6:00 p.m.

Location: a presently secret location in Tampa where both dolphins and Dick Cheney can attend and enjoy this informative program.

Additional Information:. Our feedback from the Clearwater BP Seminar was excellent. One participate even left her spouse as the result of this seminar

2013 MOTE VASCULAR SURGERY FELLOWS – FACTS OF LIFE TALK SEMINAR FOR FIRST YEAR SURGEONS

Alan Gassman will be speaking on the topic of ESTATE, MEDICAL PRACTICE, RETIREMENT, TAX, INSURANCE, AND BUY/SELL PLANNING – THE EARLIER YOU START THE SOONER YOU WILL BE SECURE

Date: October 25 – 27, 2013 | Alan Gassman is speaking on Sunday, October 27, 2013

Location: TBD

Additional Information: Please contact agassman@gassmanpa.com for additional information.

DECODING HEALTHCARE SYMPOSIUM IN TAMPA

Alan Gassman will be moderating the Decoding Healthcare Seminar hosted by Fifth Third Bank.

Speakers will include Jason Altmire, Senior Vice President of Public Policy, Government and Community Affairs, Florida Blue, Coretha Rushing, Chief Human Resources Officer, Equifax, Inc., Stephen Mason, CEO of BayCare Health System and Dr. Jay Wolfson, DrPH, JD, Associate Vice President of USF Health.

We sincerely thank Fifth-Third Bank, President Brian Lamb, Ryan Sloan and the Tampa Bay Business Journal for hosting this important public “town hall” discussion that will hopefully lead to improvement of our healthcare systems in the Tampa Bay area.

Date: Tuesday, October 29, 2013

Location: Grand Hyatt, 2900 Bayport Drive, Tampa, Florida

Additional Information: For more information on this event please email agassman@gassmanpa.com

Bloomberg BNA – Estate, Estate and Gift Tax, and Trust Year-End Planning Webinar

Date: October 30, 2013

Time: 12:30 – 1:30

Location: Online Webinar

Additional Information: This new practical webinar from Bloomberg BNA, presented by Alan S. Gassman, Kenneth J. Crotty and Christopher J. Denicolo, concentrates on year-end planning techniques which practitioners need to consider for their clients. This includes techniques that are available to utilize the clients’ lifetime gift exemption, to structure clients’ planning to reduce or eliminate possible income tax exposure, and the potential pitfalls and traps that need to be considered. Practitioners should not miss this program. For more information on this event, please email agassman@gassmanpa.com

NEW JERSEY INSTITUTE FOR CONTINUING LEGAL EDUCATION (ICLE) HEALTH LAW SYMPOSIUM – AN ALL DAY SEMINAR

Alan Gassman will be speaking on the topic of WHAT HEALTH LAWYERS NEED TO KNOW ABOUT FLORIDA LAW

Date: Friday, November 1, 2013 | 9am – 5pm (Mr. Gassman speaks from 1:10 pm until 2:10 p.m.)

Location: Seton Hall Law School, Newark, New Jersey

Additional Information: Seton Hall University in South Orange, New Jersey was founded in 1856, and they have remodeled since. Today, Seton Hall has over 10,000 students in its undergraduate, graduate and law school programs and is in close proximity to several Kentucky Fried Chicken locations.

NEW JERSEY INSTITUTE FOR CONTINUING LEGAL EDUCATION (ICLE)_SPECIAL 3 HOUR SESSION

Alan Gassman will be speaking on the topic of WHAT NEW JERSEY LAWYERS NEED TO KNOW ABOUT FLORIDA LAW – A 3 HOUR OVERVIEW BY ALAN S. GASSMAN

Date: Saturday, November 2, 2013

Location: Wilshire Grand Hotel, West Orange, New Jersey | 9am – 12pm

Additional Information: Please tell all of your friends, neighbors and enemies in New Jersey to come out to support this important presentation for the New Jersey Bar Association. We will include discussions of airboats, how to get an alligator off of your driveway, how to peel a navel orange and what collard greens and grits are. For additional information please email agassman@gassmanpa.com

SALT LAKE CITY ESTATE PLANNING COUNCIL’S FALL ONE DAY “TAX AND DEDUCTIBILITY OF YOUR SKI TRIP” INSTITUTE

Alan Gassman will be speaking on the topic of PRACTICAL ESTATE PLANNING, WITH A $5.25 MILLION EXEMPTION AMOUNT, ESTATE TAX PROJECTION PLANNING, AND WHY DENTISTS ARE DIFFERENT

Date: Thursday, November 7, 2013

Location: Hilton Downtown Salt Lake City, Utah

Additional Information: Please support this one day annual seminar conveniently located near skiing and tourism opportunities. If you would like to attend this event or receive the materials please email agassman@gassmanpa.com

MEDICAL EDUCATION RESOURCES CONTINUING EDUACTION PRIMARY CARE CONFERENCE

Alan Gassman will be speaking on the topic of LEGAL, TAX AND FINANCIAL BOOT CAMP FOR THE MEDICAL PRACTICE – A SPECIAL TAX, ESTATE PLANNING AND LAW CONFERENCE FOR PRIMARY CARE PHYSICIANS

Date: December 13, 2013 – 12:00 pm – 4:40 pm and December 14, 2013 8:00 am – 3:00 pm

Topics and Meeting Times:

Friday, December 13, 2013

- 12:00 – 1:00 pm – 2013 Tax Changes

- 1:00 – 2:00 pm – The 10 Biggest Mistakes that Physicians Make in their Investments and Business Planning

- 2:10 – 3:10 pm – Lawsuits 101

- 3:10 – 3:40 pm – Essential Estate Planning

- 3:40 – 4:40 pm – Deductions for Physicians

Saturday, December 14, 2013

- 8:00 – 9:00 am – Medical Practice Financial Management

- 9:00 – 10:00 am – Physician Compensation

- 10:10 – 11:10 am – Asset Entity Planning for Creditor Protection and Buy/Sell Arrangements

- 11:10 – 11:40 am – Tax Structures for Medical Practices

- 12:00 – 1:00 pm – 50 Ways to Leave Your Overhead

- 1:00 – 2:00 pm – Retirement Plan Options for Physicians

- 2:00 – 3:00 pm – Stark Naked or Well Prepared? (Please do not come to this session naked.)

Location: Grand Hyatt Tampa Bay, 2900 Bayport Drive, Tampa, Florida

Additional Information: For more information please visit www.MER.org Please note that the program qualifies for continuing education credit for physicians. Attendees will receive books and other comprehensive materials.

Discount Information: Clients of our firm will receive their choice of a $150 discount or the ability to bring one non-physical guest to this comprehensive program at a discounted rate.

THE FLORIDA BAR – REPRESENTING THE PHYSICIAN

Date: Friday, January 17, 2013

Location: The Peabody Hotel, Orlando, Florida

Additional Information: The annual Florida Bar conference entitled Representing the Physician is designed especially for health care, tax, and business lawyers, CPAs and physician office managers and physicians to cover practical legal, medical law, and tax planning matters that affect physicians and physician practices.

This year our 1 day seminar will be held in the Peabody Hotel near Walt Disney World, which is world famous for its daily “march of the ducks” through the lobby (wear easy to clean shoes) and maybe we will have peking duck for dinner.

A dinner for the Executive Committee of the Health Law Section of The Florida Bar and our speakers will be held on Thursday, January 16, 2013, whether formally or informally. Anyone who would like to attend (dutch treat or bring wooden shoes) will be welcomed. Your tax deductible hotel room to start a fantastic week near Disney, Universal, Sea World and most importantly Gatorland can include a room at the fantastic Peabody Hotel for a discounted rate per night, single occupancy.

1st ANNUAL ESTATE PLANNER’S DAY AT AVE MARIA SCHOOL OF LAW

Speakers: Speakers will include Professor Jerry Hesch, Jonathan Gopman, Alan Gassman and others.

Date: April 25, 2014

Location: Ave Maria School of Law, Naples, Florida

Sponsors: Ave Maria School of Law, Collier County Estate Planning Council and more to be announced.

Additional Information: For more information on this event please contact agassman@gassmanpa.com.

NOTABLE SEMINARS PRESENTED BY OTHERS:

48th ANNUAL HECKERLING INSTITUTE ON ESTATE PLANNING SEMINAR

Date: January 13 – 17, 2014

Location: Orlando World Center Marriott, Orlando, Florida

Sponsor: University of Miami School of Law

Additional Information: For more information please visit: http://www.law.miami.edu/heckerling/

16th ANNUAL ALL CHILDREN’S HOSPITAL ESTATE, TAX, LEGAL & FINANCIAL PLANNING SEMINAR

Date: Wednesday, February 12, 2014

Location: All Children’s Hospital Education and Conference Center, St. Petersburg, Florida with remote location live interactive viewings in Tampa, Sarasota, New Port Richey, Lakeland, and Bangkok, Thailand

Sponsor: All Children’s Hospital

THE UNIVERSITY OF FLORIDA TAX INSTITUTE

Date: February 19 – 21, 2014

Location: Grand Hyatt, Tampa, Florida

Sponsor: UF Law alumni and UF Graduate Tax Program

Additional Information: Here is what UF is saying about the program on its website: “The UF Tax Institute will provide tax practitioners and other leading tax, business and estate planning professionals with a program that covers the most current issues and planning ideas with a practical, informative, state-of-the-art approach. The Institute’s schedule will devote separate days or half days to individual income tax issues, entity tax issues and estate planning issues. Speakers and presentations will be announced as the program date nears to ensure coverage of the most timely and significant topics. UF Law alumni have formed the Florida Tax Education Foundation, Inc., a nonprofit corporation, to organize the conference.”

Thank you to our law clerks that assisted us in preparing this report.